Cisco 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

The Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements

regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities

Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). All statements other than statements of historical facts are statements

that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and

projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,”

“anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,”

variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that

refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of

future events or circumstances are forward-looking statements. Readers are cautioned that these forward-looking statements are only

predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, as well as

on the inside back cover of this Annual Report to Shareholders and under “Part I, Item 1A. Risk Factors,” and elsewhere in our Annual Report

on Form 10-K. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. We

undertake no obligation to revise or update any forward-looking statements for any reason.

Overview

We sell IP-based networking and other products and services related to the communications and IT industry. Our products and services

are designed to address a wide range of customers’ business needs, including improving productivity, reducing costs, and gaining a

competitive advantage. In addition, they are designed to help customers build their own network infrastructures that support tools and

applications that allow them to communicate with key stakeholders, including customers, prospects, business partners, suppliers, and

employees. We focus on delivering networking products and solutions that simplify and secure customers’ network infrastructures. We

conduct our business globally and are managed geographically in five segments: United States and Canada, European Markets, Emerging

Markets, Asia Pacific, and Japan. Our product offerings fall into the following categories: our core technologies, routing and switching;

advanced technologies; and other products. In addition to our product offerings, we provide a broad range of service offerings, including

technical support services and advanced services. Our customer base spans virtually all types of public and private agencies and

businesses, comprising enterprise businesses, service providers, commercial customers, and consumers.

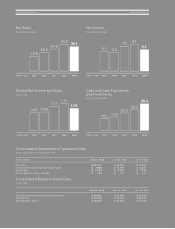

For fiscal 2009, our total net sales decreased by approximately 9% compared with fiscal 2008. Throughout the first half of fiscal 2009,

our results were impacted by a deterioration in the global macroeconomic environment. In the third quarter of fiscal 2009, certain of our

customers indicated to us that they had begun to notice some signs of economic stability, though at lower overall levels of economic

activity compared with the corresponding period in fiscal 2008. In the fourth quarter of fiscal 2009, we experienced our only quarterly

sequential increase in revenue during fiscal 2009, as our results for the fourth quarter returned to a more typical sequential pattern for us.

While the stabilization in our fourth quarter results was encouraging, we are unable to determine whether or not this possible improvement

in the global macroeconomic environment is sustainable.

Net income decreased by 24% in fiscal 2009 compared with fiscal 2008 primarily as a result of the decline in sales. Lower interest and

other income in fiscal 2009 compared with fiscal 2008 also contributed to the decrease in net income. These factors were partially offset by

lower operating expenses, attributable primarily to our initiatives to reduce operating expenses. Net income per diluted share decreased

by 20% in fiscal 2009 compared with fiscal 2008.

Strategy and Focus Areas

Our strategy in fiscal 2009 was centered on the increasing role of intelligent networks, collaboration and Web 2.0 technologies, the United

States and selected emerging countries, the network as the platform, and resource management and realignment. Our strategy draws in

part from our experience in managing through previous economic downturns. As we have done in the past, we will attempt to use the

economic downturn as an opportunity to expand our share of our customers’ information technology spending and to continue moving into

product markets similar, related, or adjacent to those in which we currently are active, which we refer to as market adjacencies. We have

expanded our movement into market adjacencies primarily through realignment of resources, while simultaneously reducing aggregate

expenses.

We refer to the evolutionary process by which adjacencies arise as market transitions. One example of a market in which a significant

market transition appears to be underway is the enterprise data center market. We believe the market is at an inflection point, as awareness

grows that intelligent networks are becoming the platform for productivity improvement and global competitiveness. We further believe

that disruption in the enterprise data center market will accelerate in the next 12 months, due to changing technology trends such as the

increasing adoption of virtualization and the rise in scalable processing. Virtualization is the process of aggregating the current siloed data

center resources into unified, shared resource pools that can be dynamically delivered to applications on demand thus providing the ability

to move content and applications between devices and the network.

8 Cisco Systems, Inc.