Cisco 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

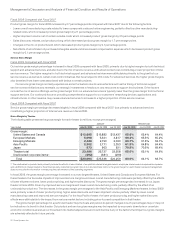

Fiscal 2008 Compared with Fiscal 2007

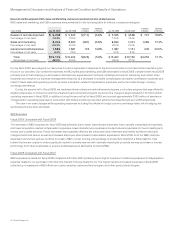

Product gross margin for fiscal 2008 increased by 0.7 percentage points compared with fiscal 2007 due to the following factors:

• Lower overall manufacturing costs related to lower component costs and value engineering, partially offset by other manufacturing-

related costs, which increased product gross margin by 2.1 percentage points.

• Higher shipment volume, net of certain variable costs, which increased product gross margin by 0.5 percentage points.

• Sales discounts, rebates, and product pricing, which decreased product gross margin by 1.7 percentage points.

• Changes in the mix of products sold, which decreased product gross margin by 0.1 percentage points.

• Net effects of amortization of purchased intangible assets and share-based compensation expense, which decreased product gross

margin by 0.1 percentage points.

Service Gross Margin

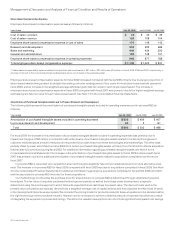

Fiscal 2009 Compared with Fiscal 2008

Our service gross margin percentage increased in fiscal 2009 compared with fiscal 2008, primarily due to higher margins for both technical

support and advanced services, and also due to the mix of service revenue, with advanced services constituting a lower proportion of total

service revenue. The higher margins for both technical support and advanced services were attributable primarily to the growth of our

service revenue as well as to certain cost-control initiatives that have helped to limit costs. For advanced services, the higher gross margins

also benefited from lower costs associated with delays in certain projects.

Our service gross margin normally experiences some fluctuations due to various factors such as the timing of technical support

service contract initiations and renewals, our strategic investments in headcount, and resources to support this business. Other factors

include the mix of service offerings, as the gross margin from our advanced services is typically lower than the gross margin from technical

support services. Our continued focus on providing comprehensive support to our customers’ networking devices, applications, and

infrastructures, or other reasons, may cause advanced services to increase to a higher proportion of total service revenue.

Fiscal 2008 Compared with Fiscal 2007

Service gross margin percentage decreased slightly in fiscal 2008 compared with fiscal 2007, due primarily to advanced services

constituting a higher proportion of total service revenue in fiscal 2008.

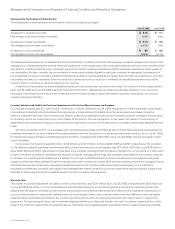

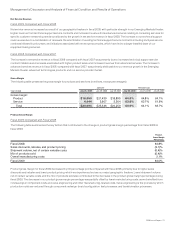

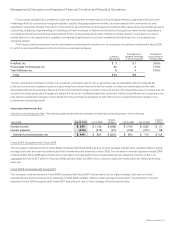

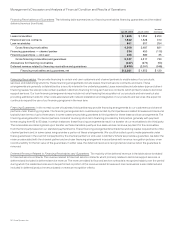

Gross Margin by Theater

The following table presents the gross margin for each theater (in millions, except percentages):

AMOUNT PERCENTAGE

Years Ended July 25, 2009 July 26, 2008 July 28, 2007 July 25, 2009 July 26, 2008 July 28, 2007

Gross margin:

United States and Canada $12,685 $13,882 $12,437 65.6% 65.4% 64.4%

European Markets 5,098 5,321 4,817 66.4% 65.5% 65.2%

Emerging Markets 2,428 2,790 2,030 60.7% 61.6% 62.7%

Asia Pacific 2,302 2,771 2,353 61.9% 64.8% 64.4%

Japan 973 963 921 70.9% 70.3% 69.4%

Theater total 23,486 25,727 22,558 65.0% 65.1% 64.6%

Unallocated corporate items(1) (392) (381) (299)

Total $23,094 $25,346 $22,259 63.9% 64.1% 63.7%

(1) The unallocated corporate items primarily include the effects of amortization of acquisition-related intangible assets, employee share-based compensation expense,

and a $28 million charge related to the enhanced early retirement program. We do not allocate these items to the gross margin for each theater because management

does not include the information in measuring the performance of the operating segments.

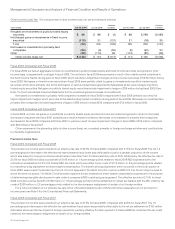

In fiscal 2009, the gross margin percentage increased in our two largest theaters, United States and Canada and European Markets. For

these theaters, the favorable impacts of improved service margins and lower overall manufacturing costs were partially offset by the effects

of lower shipment volume, lower product pricing, and higher sales discounts. The gross margin percentage also increased in our Japan

theater in fiscal 2009, driven by improved service margins and lower overall manufacturing costs, partially offset by the effect of an

unfavorable product mix. The decreases in the gross margin percentages for the Asia Pacific and Emerging Markets theaters in fiscal 2009

were primarily a result of lower product pricing, higher sales discounts, and lower shipment volume, partially offset by lower overall

manufacturing costs and improved service margins. For the Asia Pacific theater, the lower product pricing and higher sales discounts

effects were attributable to the impact from various market factors, including price-focused competition in that theater.

The gross margin percentage for a particular theater may fluctuate and period-to-period changes in such percentages may or may not

be indicative of a trend for that theater. Our product and service gross margins may be impacted by economic downturns or uncertain

economic conditions as well as our movement into market adjacencies and could decline if any of the factors that impact our gross margins

are adversely affected in future periods.

22 Cisco Systems, Inc.