Cisco 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

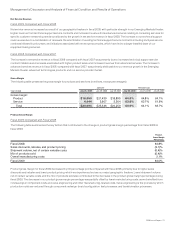

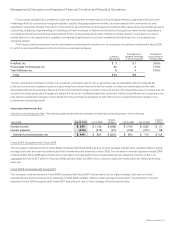

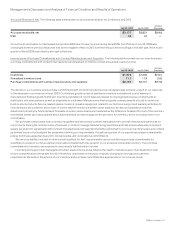

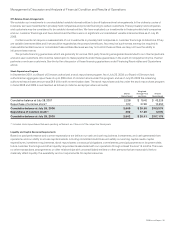

Accounts Receivable, Net The following table summarizes our accounts receivable, net (in millions), and DSO:

July 25, 2009 July 26, 2008

Increase

(Decrease)

Accounts receivable, net $3,177 $3,821 $(644)

DSO 34 34 —

Our accounts receivable, net decreased during fiscal 2009 due to lower revenue during fiscal 2009. Our DSO as of July 25, 2009 was

unchanged from the previous fiscal year end, as the negative effect on DSO from the timing of service billings in the later part of the fourth

quarter of fiscal 2009 was offset by stronger collections.

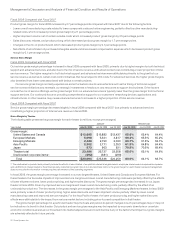

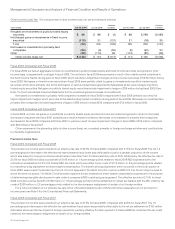

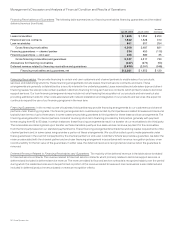

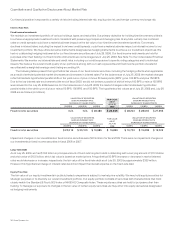

Inventories and Purchase Commitments with Contract Manufacturers and Suppliers The following table summarizes our inventories and

purchase commitments with contract manufacturers and suppliers (in millions, except annualized inventory turns):

July 25, 2009 July 26, 2008

Increase

(Decrease)

Inventories $1,074 $1,235 $(161)

Annualized inventory turns 11.7 11.9 (0.2)

Purchase commitments with contract manufacturers and suppliers $2,157 $2,727 $(570)

The decline in our inventory and purchase commitments with contract manufacturers and suppliers was primarily a result of our response

to the decrease in our revenue in fiscal 2009. Our finished goods consist of distributor inventory and deferred cost of sales and

manufactured finished goods. Distributor inventory and deferred cost of sales are related to unrecognized revenue on shipments to

distributors and retail partners as well as shipments to customers. Manufactured finished goods consist primarily of build-to-order and

build-to-stock products. Service-related spares consist of reusable equipment related to our technical support and warranty activities. All

inventories are accounted for at the lower of cost or market. Inventory is written down based on excess and obsolete inventories

determined primarily by future demand forecasts. Inventory write-downs are measured as the difference between the cost of the inventory

and market, based upon assumptions about future demand, and are charged to the provision for inventory, which is a component of our

cost of sales.

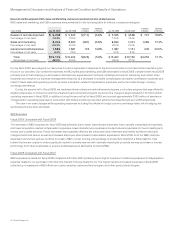

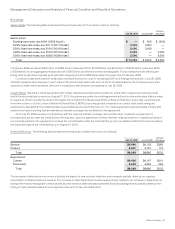

We purchase components from a variety of suppliers and use several contract manufacturers to provide manufacturing services for

our products. During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component

supply, we enter into agreements with contract manufacturers and suppliers that either allow them to procure inventory based upon criteria

as defined by us or that establish the parameters defining our requirements. A significant portion of our reported purchase commitments

arising from these agreements are firm, noncancelable, and unconditional commitments.

We record a liability, included in other current liabilities, for firm, noncancelable, and unconditional purchase commitments for

quantities in excess of our future demand forecasts consistent with the valuation of our excess and obsolete inventory. The purchase

commitments for inventory are expected to be primarily fulfilled within one year.

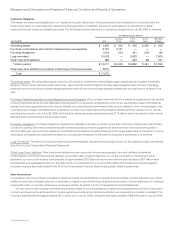

Inventory and supply chain management remain areas of focus as we balance the need to maintain supply chain flexibility to help

ensure competitive lead times with the risk of inventory obsolescence because of rapidly changing technology and customer

requirements. We believe the amount of our inventory and purchase commitments is appropriate for our revenue levels.

2009 Annual Report 31