Cisco 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

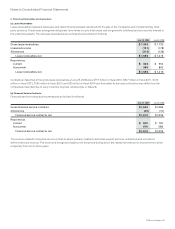

Notes to Consolidated Financial Statements

Fiscal 2007

• The Company acquired Arroyo Video Solutions, Inc. to enable carriers to accelerate the creation and distribution of network-delivered

entertainment, interactive media, and advertising services across the growing portfolio of televisions, personal computers, and mobile

handsets.

• The Company acquired IronPort Systems, Inc. to extend the Company’s security portfolio in email and messaging security solutions.

• The Company acquired Reactivity, Inc. to complement and extend the Company’s application networking services portfolio within

advanced technologies.

• The Company acquired WebEx Communications, Inc. (“WebEx”), a provider of on-demand collaboration applications. WebEx’s network-

based solution for delivering business-to-business collaboration extends the Company’s unified communications portfolio, particularly

within the small and medium-sized business (SMB) market.

The Consolidated Financial Statements include the operating results of each business from the date of acquisition. Pro forma results of

operations for the acquisitions completed during fiscal 2009, 2008, and 2007 have not been presented because the effects of the

acquisitions, individually or in the aggregate, were not material to the Company’s financial results.

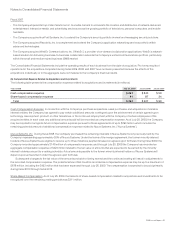

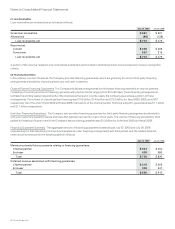

(b) Compensation Expense Related to Acquisitions and Investments

The following table presents the compensation expense related to acquisitions and investments (in millions):

Years Ended July 25, 2009 July 26, 2008 July 28, 2007

Cash compensation expense $ 291 $ 340 $ 59

Share-based compensation expense 91 87 34

Total $ 382 $ 427 $ 93

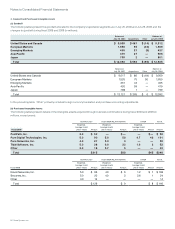

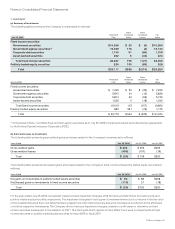

Cash Compensation Expense In connection with the Company’s purchase acquisitions, asset purchases, and acquisitions of variable

interest entities, the Company has agreed to pay certain additional amounts contingent upon the achievement of certain agreed-upon

technology, development, product, or other milestones, or the continued employment with the Company of certain employees of the

acquired entities. In each case, any additional amounts paid will be recorded as compensation expense. As of July 25, 2009, the Company

may be required to recognize future compensation expense pursuant to these agreements of up to $293 million, which includes the

remaining potential amount of additional compensation expense related to Nuova Systems, Inc. (“Nuova Systems”).

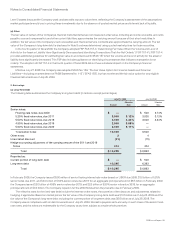

Nuova Systems, Inc. During fiscal 2008, the Company purchased the remaining interests in Nuova Systems not previously held by the

Company, representing approximately 20% of Nuova Systems. Under the terms of the merger agreement, the former minority interest

holders of Nuova Systems are eligible to receive up to three milestone payments based on agreed-upon formulas. During fiscal 2009, the

Company recorded approximately $146 million of compensation expense, and through July 25, 2009 the Company has recorded an

aggregate compensation expense of $423 million related to the fair value of amounts that are expected to be earned by the minority

interest holders pursuant to a vesting schedule. Actual amounts payable to the former minority interest holders of Nuova Systems will

depend upon achievement under the agreed-upon formulas.

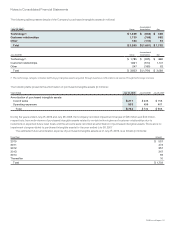

Subsequent changes to the fair value of the amounts probable of being earned and the continued vesting will result in adjustments to

the recorded compensation expense. The potential amount that could be recorded as compensation expense may be up to a maximum of

$678 million, including the $423 million that has been expensed through July 25, 2009. The compensation is expected to be paid primarily

during fiscal 2010 through fiscal 2012.

Share-Based Compensation As of July 25, 2009, the balance of share-based compensation related to acquisitions and investments to be

recognized over the remaining vesting periods was $211 million.

2009 Annual Report 49