Cisco 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

This market transition is being brought about through the convergence of networking, computing, storage, and software technologies.

We are seeking to capitalize on this market transition through, among other things, our Cisco Unified Computing System and Cisco Nexus

product families, which are designed to integrate the previously siloed technologies in the enterprise data center with a unified

architecture.

The competitive landscape in our markets is changing, and we expect there will be a new class of very large, well-financed and

aggressive competitors, each bringing its own new class of products to address this new enterprise data center market. However, with

respect to this market, we believe the network will be the intersection of innovation through an open ecosystem and standards. We expect

to see acquisitions, industry consolidation, and new alliances among companies as they seek to serve the enterprise data center market.

As we enter this next market phase, we expect that we will strengthen certain strategic alliances, compete more with certain strategic

alliances and partners, and perhaps also encounter new competitors, in our attempt to deliver the best solutions for our customers.

Other market adjacencies on which we are focusing attention include those related to the increased role of video, collaboration, and

networked Web 2.0 technologies across our customer markets. The key market transitions relative to the convergence of video,

collaboration, and networked Web 2.0 technologies, which we believe will drive productivity and growth in network loads, appear to be

evolving even faster than we had anticipated earlier this year. Cisco TelePresence systems are one example of our product offerings that

have incorporated video, collaboration, and networked Web 2.0 technologies, as customers evolve their communications and business

models.

We believe that the architectural approach that has served us well in addressing the market adjacencies in the communications and

information technology industry will be adaptable to other markets. Examples of market adjacencies where we aim to apply this approach

are the consumer, electrical services infrastructure, and video market segments. For the consumer market, through collaboration with

technology partners, retailers, service providers, and content publishers, we are striving to create compelling consumer experiences and

make the network the platform for a variety of services in the home, as broadband development moves from a device-centric phase to a

network-centric model. In the electrical services infrastructure market, we are developing an architecture for managing energy in a highly

secure fashion on electrical grids at various steps from energy generation to consumption in homes and buildings. With regard to the video

market segment, we are focused on simplifying and expanding the creation, distribution, and use of end-to-end video solutions for

businesses and consumers.

Our approach of moving into market adjacencies has contributed to the growth we experienced in the past. During fiscal 2009, we

delivered several new products, and we are pleased with the breadth and depth of our innovation across almost all aspects of our business

and the impact that we believe this innovation will have on our long-term prospects. We believe that our strategy and our ability to innovate

and execute may enable us to improve our relative competitive position in difficult business conditions and may continue to provide us with

long-term growth opportunities.

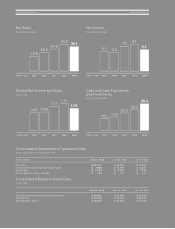

Revenue

We experienced a decline in net product sales across all of our geographic theaters during fiscal 2009 as net product sales declined by

12% compared with fiscal 2008. The United States and Canada theater experienced weakness in the service provider market, the

enterprise market excluding the public sector, and the commercial market. The decline in net product sales in our Emerging Markets

theater was driven by sales decreases in Russia, Brazil, and Mexico, partly due to lower shipments and the timing of revenue recognition.

The product sales decline in our Asia Pacific theater was driven primarily by sales declines in South Korea and India. Product sales also

declined across all of our customer markets. However, within the enterprise market, the public sector showed relative strength across most

of our geographic theaters.

In addition, the decrease in net product sales was reflected across all our product categories including routing, switching and

advanced technologies. Within the advanced technologies category certain product lines showed relative strength, such as unified

communications, which had a slight increase in sales in fiscal 2009, while sales of video systems were relatively flat. The decrease in our

sales of routing products in fiscal 2009 resulted from lower sales of all categories of routers, particularly high-end routers. The decrease in

switching revenue in fiscal 2009 reflected a decline in sales of both modular and fixed-configuration switches.

Net service revenue increased by approximately 8% compared with fiscal 2008, reflecting increased service revenue across our

geographic theaters. Our service and support strategy seeks to capitalize on increased globalization. We believe this strategy, along with

our architectural approach, has the potential to further differentiate us from competitors.

2009 Annual Report 9