Cisco 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

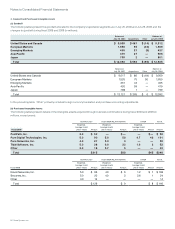

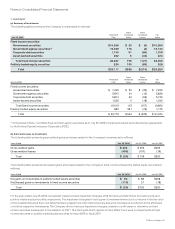

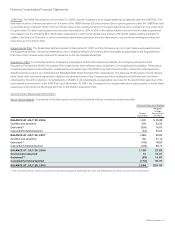

Interest expense and cash paid for interest are summarized as follows (in millions):

Years Ended July 25, 2009 July 26, 2008 July 28, 2007

Interest expense $ 346 $ 319 $ 377

Cash paid for interest $ 333 $ 366 $ 361

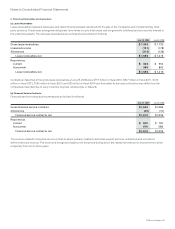

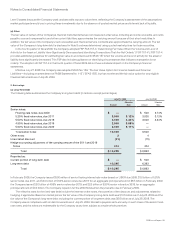

(b) Credit Facility

In August 2007, the Company entered into a credit agreement with certain institutional lenders providing for a $3.0 billion unsecured

revolving credit facility that is scheduled to expire on August 17, 2012. Due to the bankruptcy of one of the lenders during the first quarter of

fiscal 2009, the credit facility has been reduced to $2.9 billion.

Any advances under the credit agreement will accrue interest at rates that are equal to, based on certain conditions, either (i) the higher

of the Federal Funds rate plus 0.50% or Bank of America’s “prime rate” as announced from time to time, or (ii) LIBOR plus a margin that is

based on the Company’s senior debt credit ratings as published by Standard & Poor’s Ratings Services and Moody’s Investors Service, Inc.

The credit agreement requires that the Company comply with certain covenants including that it maintains an interest coverage ratio as

defined in the agreement.

As of July 25, 2009, the Company was in compliance with the required interest coverage ratio and the other covenants, and the

Company had not borrowed any funds under the credit facility. The Company may also, upon the agreement of either the then- existing

lenders or of additional lenders not currently parties to the agreement, increase the commitments under the credit facility by up to an

additional $2.0 billion and/or extend the expiration date of the credit facility up to August 15, 2014.

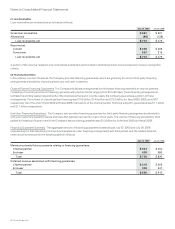

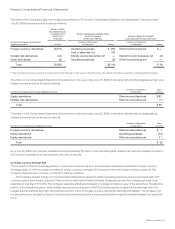

10. Derivative Instruments

(a) Summary of Derivative Instruments

The Company uses derivative instruments primarily to manage exposures to foreign currency exchange rate, interest rate, and equity price

risks. The Company’s primary objective in holding derivatives is to reduce the volatility of earnings and cash flows associated with changes

in foreign currency exchange rates, interest rates, and equity prices. The Company’s derivatives expose it to credit risk to the extent that

the counterparties may be unable to meet the terms of the agreement. The Company does, however, seek to mitigate such risks by limiting

its counterparties to major financial institutions. In addition, the potential risk of loss with any one counterparty resulting from this type of

credit risk is monitored. Management does not expect material losses as a result of defaults by counterparties.

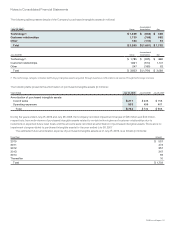

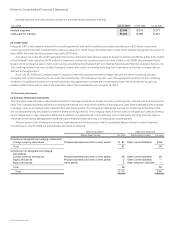

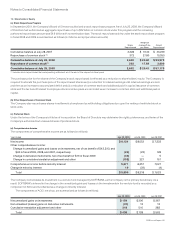

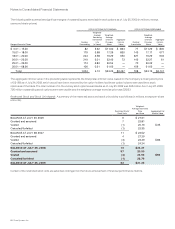

The fair values of the Company’s derivative instruments and the line items on the Consolidated Balance Sheet to which they were

recorded as of July 25, 2009 are summarized as follows (in millions):

DERIVATIVE ASSETS DERIVATIVE LIABILITIES

Balance Sheet Line Item Fair Value Balance Sheet Line Item Fair Value

Derivatives designated as hedging instruments:

Foreign currency derivatives Prepaid expenses and other current assets $ 87 Other current liabilities $ 36

Total 87 36

Derivatives not designated as hedging

instruments:

Foreign currency derivatives Prepaid expenses and other current assets 22 Other current liabilities 30

Equity derivatives Prepaid expenses and other current assets 2 Other current liabilities —

Equity derivatives Other assets 2 Other long-term liabilities —

Total 26 30

Total $ 113 $ 66

60 Cisco Systems, Inc.