Cisco 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

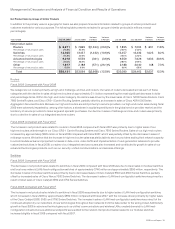

Critical Accounting Estimates

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the United

States requires us to make judgments, assumptions, and estimates that affect the amounts reported in the Consolidated Financial

Statements and accompanying notes. Note 2 to the Consolidated Financial Statements describes the significant accounting policies and

methods used in the preparation of the Consolidated Financial Statements. The accounting policies described below are significantly

affected by critical accounting estimates. Such accounting policies require significant judgments, assumptions, and estimates used in the

preparation of the Consolidated Financial Statements, and actual results could differ materially from the amounts reported based on these

policies. We ensured that our accounting-based judgments and estimates appropriately considered the macroeconomic environment.

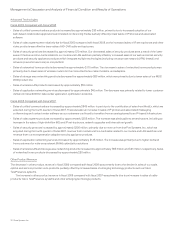

Revenue Recognition

Our products are generally integrated with software that is essential to the functionality of the equipment. Additionally, we provide

unspecified software upgrades and enhancements related to the equipment through our maintenance contracts for most of our products.

Accordingly, we account for revenue in accordance with Statement of Position No. 97-2, “Software Revenue Recognition,” and all related

interpretations. For sales of products where software is incidental to the equipment, or in hosting arrangements, we apply the provisions of

Staff Accounting Bulletin No. 104, “Revenue Recognition,” and all related interpretations. Revenue is recognized when all of the following

criteria have been met:

•When persuasive evidence of an arrangement exists. Contracts, Internet commerce agreements, and customer purchase orders are

generally used to determine the existence of an arrangement.

•Delivery has occurred. Shipping documents and customer acceptance, when applicable, are used to verify delivery.

•The fee is fixed or determinable. We assess whether the fee is fixed or determinable based on the payment terms associated with the

transaction and whether the sales price is subject to refund or adjustment.

•Collectibility is reasonably assured. We assess collectibility based primarily on the creditworthiness of the customer as determined by

credit checks and analysis, as well as the customer’s payment history.

In instances where final acceptance of the product, system, or solution is specified by the customer, revenue is deferred until all

acceptance criteria have been met. When a sale involves multiple elements, such as sales of products that include services, the entire fee

from the arrangement is allocated to each respective element based on its relative fair value and recognized when revenue recognition

criteria for each element are met. The amount of product and service revenue recognized in a given period is affected by our judgment as

to whether an arrangement includes multiple elements and, if so, whether vendor-specific objective evidence of fair value exists. Changes

to the elements in an arrangement and our ability to establish vendor-specific objective evidence for those elements could affect the timing

of the revenue recognition.

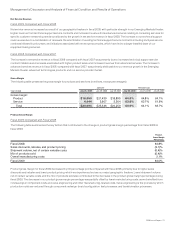

Revenue deferrals relate to the timing of revenue recognition for specific transactions based on financing arrangements, service,

support, and other factors. Financing arrangements may include sales-type, direct-financing, and operating leases, loans, and guarantees

of third-party financing. Our total deferred revenue for products was $2.9 billion and $2.7 billion as of July 25, 2009 and July 26, 2008,

respectively. Technical support services revenue is deferred and recognized ratably over the period during which the services are to be

performed, which typically is from one to three years. Advanced services revenue is recognized upon delivery or completion of

performance. Our total deferred revenue for services was $6.5 billion and $6.1 billion as of July 25, 2009 and July 26, 2008, respectively.

We make sales to distributors and retail partners and recognize revenue based on a sell-through method using information provided

by them. Our distributors and retail partners participate in various cooperative marketing and other programs, and we maintain estimated

accruals and allowances for these programs. If actual credits received by our distributors and retail partners under these programs were to

deviate significantly from our estimates, which are based on historical experience, our revenue could be adversely affected.

2009 Annual Report 11