Cisco 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

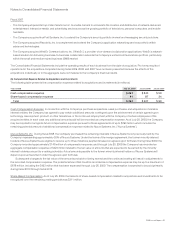

Notes to Consolidated Financial Statements

Level 2 fixed income securities are priced using quoted market prices for similar instruments, nonbinding market prices that are

corroborated by observable market data, or discounted cash flow techniques. The Company’s derivative instruments are primarily

classified as Level 2, as they are not actively traded and are valued using pricing models that use observable market inputs. Level 3 assets

include asset-backed securities and certain derivative assets, whose values are determined based on discounted cash flow models using

inputs that the Company could not corroborate with market data.

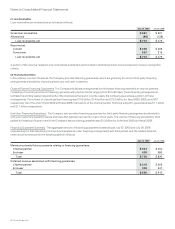

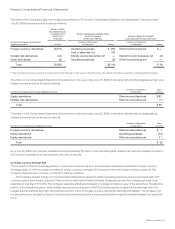

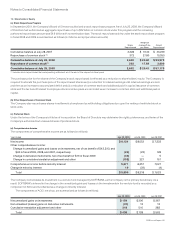

Assets and liabilities measured at fair value on a recurring basis were presented on the Company’s Consolidated Balance Sheet as of

July 25, 2009 as follows (in millions):

FAIR VALUE MEASUREMENTS USING

Quoted Prices in

Active Markets for

Identical

Instruments

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Balance

July 25, 2009

Assets:

Cash equivalents $ 4,514 $ 409 $ — $ 4,923

Investments 928 28,132 223 29,283

Prepaid expenses and other current assets — 109 4 113

Total $ 5,442 $ 28,650 $ 227 $ 34,319

Liabilities:

Other current liabilities $ — $ 66 $ — $ 66

Total $— $ 66 $— $ 66

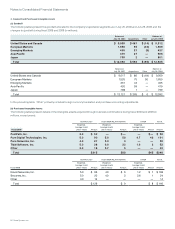

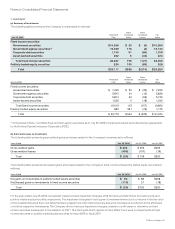

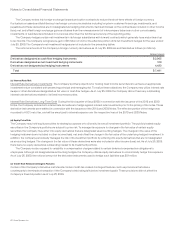

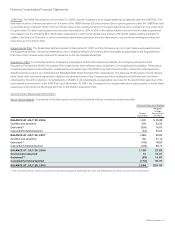

The following table presents a reconciliation for all assets measured at fair value on a recurring basis using significant unobservable inputs

(Level 3) for the year ended July 25, 2009 (in millions):

Asset-Backed

Securities

Derivative

Instruments Total

Beginning balance $— $— $—

Transfers in to Level 3 618 6 624

Total gains and losses (realized and unrealized):

Included in other income (loss), net (28) — (28)

Included in operating expenses — (2) (2)

Included in OCI (9) — (9)

Purchases, sales, and maturities (358) — (358)

Ending balance $ 223 $ 4 $ 227

Impairment charges in other income (loss), net attributable to assets still held as of July 25, 2009 $ (13) $ — $ (13)

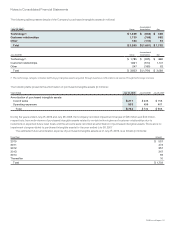

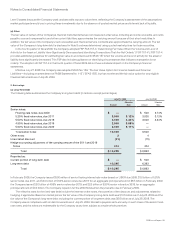

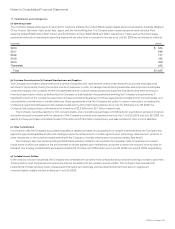

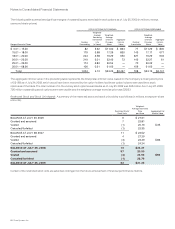

(c) Financial Assets Measured at Fair Value on a Nonrecurring Basis

The following table presents the Company’s financial assets that were measured at fair value on a nonrecurring basis and the

losses recorded to other income (loss), net on those assets (in millions):

FAIR VALUE MEASUREMENTS USING

Net Carrying

Value as of

July 25, 2009

Quoted Prices in

Active Markets

for Identical

Instruments

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total Losses

for the Year

Ended

July 25, 2009

Investments in privately held companies $ 69 $ — $ — $ 69 $ (78)

Losses on assets no longer held as of July 25, 2009 (9)

Total $ (87)

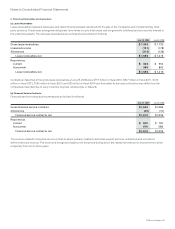

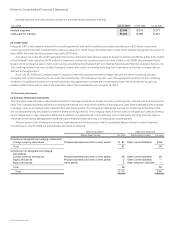

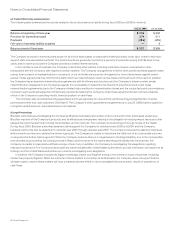

The assets in the preceding table were measured at fair value during the year ended July 25, 2009 due to events or circumstances the

Company identified that significantly impacted the fair value of these investments. The Company measured fair value using financial

metrics, comparison to other private and public companies, and analysis of the financial condition and near-term prospects of the issuer,

including recent financing activities and their capital structure as well as other economic variables. These investments were classified as

58 Cisco Systems, Inc.