Cisco 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

The Company enters into foreign exchange forward and option contracts to reduce the short-term effects of foreign currency

fluctuations on assets and liabilities such as foreign currency receivables including long-term customer financings, investments, and

payables and these derivatives are not designated as hedging instruments. Gains and losses on the contracts are included in other income

(loss), net, and offset foreign exchange gains and losses from the remeasurement of intercompany balances or other current assets,

investments, or liabilities denominated in currencies other than the functional currency of the reporting entity.

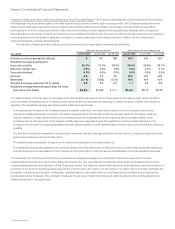

The Company hedges certain net investments in its foreign subsidiaries with forward contracts which generally have maturities of up

to six months. The Company recognized a gain of $8 million in OCI for the effective portion of its net investment hedges for the year ended

July 25, 2009. The Company’s net investment hedges are not included in the preceding tables.

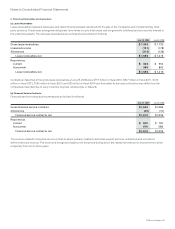

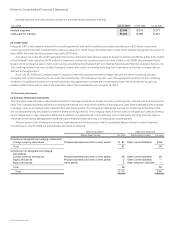

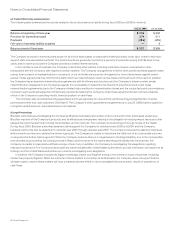

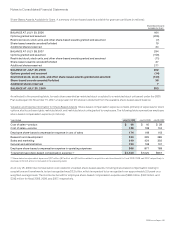

The notional amounts of the Company’s foreign currency derivatives as of July 25, 2009 are summarized as follows (in millions):

Notional Amounts

Derivatives designated as cash flow hedging instruments $ 2,965

Derivatives designated as net investment hedging instruments 103

Derivatives not designated as hedging instruments 4,423

Total $ 7,491

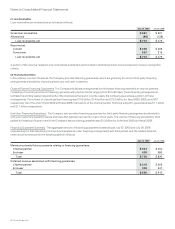

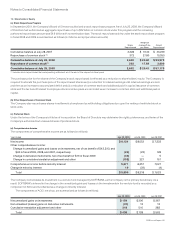

(c) Interest Rate Risk

Interest Rate Derivatives, Investments The Company’s primary objective for holding fixed income securities is to achieve an appropriate

investment return consistent with preserving principal and managing risk. To realize these objectives, the Company may utilize interest rate

swaps or other derivatives designated as fair value or cash flow hedges. As of July 25, 2009, the Company did not have any outstanding

interest rate derivatives related to its fixed income securities.

Interest Rate Derivatives, Long-Term Debt During the third quarter of fiscal 2009, in connection with the issuance of the 2019 and 2039

Notes, the Company entered into interest rate derivatives to hedge against interest rate movements prior to the pricing of the notes. These

derivative instruments were settled in connection with the issuance of the 2019 and 2039 Notes. The effective portion of the hedge was

recorded to AOCI, net of tax, and will be amortized to interest expense over the respective lives of the 2019 and 2039 Notes.

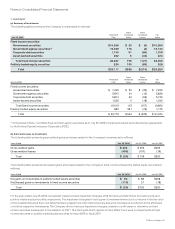

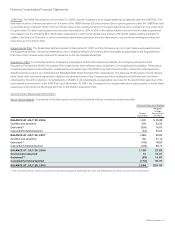

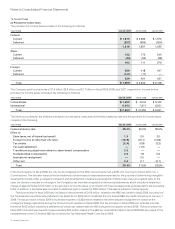

(d) Equity Price Risk

The Company may hold equity securities for strategic purposes or to diversify its overall investment portfolio. The publicly traded equity

securities in the Company’s portfolio are subject to price risk. To manage its exposure to changes in the fair value of certain equity

securities, the Company may enter into equity derivatives that are designated as accounting hedges. The changes in the value of the

hedging instruments are included in other income (loss), net, and offset the change in the fair value of the underlying hedged investment. In

addition, the Company periodically manages the risk of its investment portfolio by entering into equity derivatives that are not designated

as accounting hedges. The changes in the fair value of these derivatives were also included in other income (loss), net. As of July 25, 2009,

there were no equity derivatives outstanding related to its investment portfolio.

The Company is also exposed to variability in compensation charges related to certain deferred compensation obligations to

employees. Although not designated as accounting hedges, the Company utilizes equity derivatives to economically hedge this exposure.

As of July 25, 2009, the notional amount of the derivative instruments used to hedge such liabilities was $91 million.

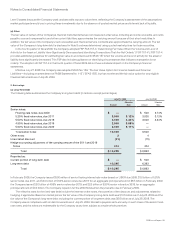

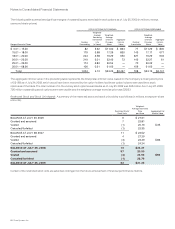

(e) Credit-Risk-Related Contingent Features

Certain of the Company’s derivative instruments contain credit-risk-related contingent features, such as provisions that allow a

counterparty to terminate a transaction if the Company’s debt rating falls below investment grade. These provisions did not affect the

Company’s financial position as of July 25, 2009.

62 Cisco Systems, Inc.