Cisco 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

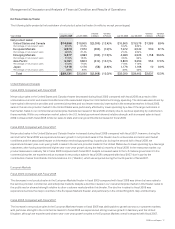

Research and Development (R&D), Sales and Marketing, and General and Administrative (G&A) Expenses

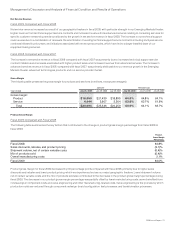

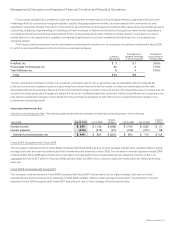

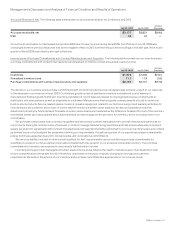

R&D, sales and marketing, and G&A expenses are summarized in the following table (in millions, except percentages):

Years Ended July 25, 2009 July 26, 2008

Variance

in Dollars

Variance

in Percent July 26, 2008 July 28, 2007

Variance

in Dollars

Variance

in Percent

Research and development $ 5,208 $ 5,325 $(117) (2.2)% $ 5,325 $ 4,598 $ 727 15.8%

Percentage of net sales 14.4% 13.5% 13.5% 13.2%

Sales and marketing 8,403 8,690 (287) (3.3)% 8,690 7,401 1,289 17.4%

Percentage of net sales 23.3% 22.0% 22.0% 21.2%

General and administrative 1,565 1,387 178 12.8% 1,387 1,151 236 20.5%

Percentage of net sales 4.3% 3.5% 3.5% 3.3%

Total $15,176 $15,402 $(226) (1.5)% $15,402 $13,150 $2,252 17.1%

Percentage of net sales 42.0% 39.0% 39.0% 37.7%

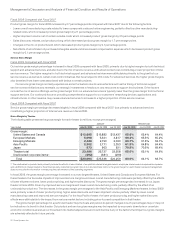

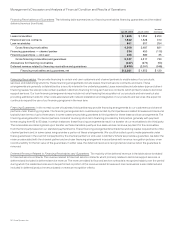

During fiscal 2009, we realigned our resources to reduce expenses in response to the macroeconomic environment while maintaining the

focus on our priorities. Our combined expenses for R&D, sales and marketing, and G&A decreased in fiscal 2009 compared with fiscal 2008

primarily due to the following: (i) a decrease in discretionary expenses such as travel, meetings and events, marketing, and certain other

expenses as a result of our expense management initiatives; (ii) a decrease in variable compensation and sales commission expenses as a

result of lower sales and operating results; (iii) lower acquisition-related compensation expenses; and (iv) favorable foreign currency

exchange rate effects.

During the second half of fiscal 2009, we implemented an enhanced early retirement program, a voluntary program that was offered to

eligible employees. In connection with the enhanced early retirement program, we incurred a charge of approximately $110 million within

operating expenses in fiscal 2009. In addition, during the second half of fiscal 2009, we incurred approximately $100 million of severance

charges within operating expenses in connection with limited workforce reduction actions that impacted just over 2,000 employees.

The year-over-year changes within operating expenses including the effects of foreign currency exchange rates, net of hedging, are

summarized by line item as follows:

R&D Expenses

Fiscal 2009 Compared with Fiscal 2008

The decrease in R&D expenses for fiscal 2009 was primarily due to lower discretionary expenses, lower variable compensation expenses,

and lower acquisition-related compensation expenses. Lower discretionary expenses included reduced expenses for travel, meeting and

events, and outside services. These decreases were partially offset by the enhanced early retirement and limited workforce reduction

charges mentioned above, as well as increased employee share-based compensation expenses in fiscal 2009. All of our R&D costs are

expensed as incurred, and we continue to invest in R&D in order to bring a broad range of products to market in a timely fashion. If we

believe that we are unable to enter a particular market in a timely manner with internally-developed products, we may purchase or license

technology from other businesses or acquire businesses as an alternative to internal R&D.

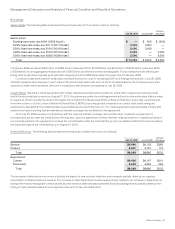

Fiscal 2008 Compared with Fiscal 2007

R&D expenses increased in fiscal 2008 compared with fiscal 2007 primarily due to higher headcount-related expenses and compensation

expense related to our purchase of the minority interest in Nuova Systems, Inc. The higher headcount-related expenses in fiscal 2008

reflected our investment in R&D efforts for routers, switches, advanced technologies, and other product technologies.

24 Cisco Systems, Inc.