Cisco 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

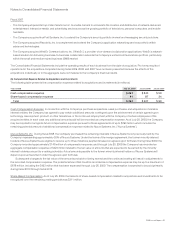

Level 3 assets because the Company used unobservable inputs to value them, reflecting the Company’s assessment of the assumptions

market participants would use in pricing these investments due to the absence of quoted market prices and inherent lack of liquidity.

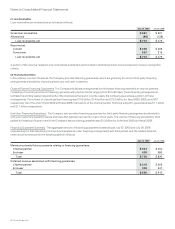

(d) Other

The fair value of certain of the Company’s financial instruments that are not measured at fair value, including accounts receivable, accounts

payable, accrued compensation, and other current liabilities, approximates the carrying amount because of their short maturities. In

addition, the fair value of the Company’s loan receivables and financed service contracts also approximate the carrying amount. The fair

value of the Company’s long-term debt is disclosed in Note 9 and was determined using quoted market prices for those securities.

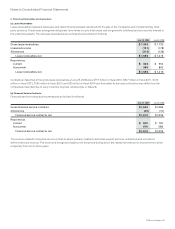

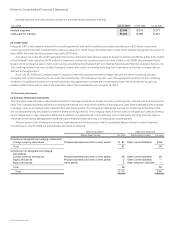

In the fourth quarter of fiscal 2009, the Company adopted FSP FAS 157-4, “Determining Fair Value When the Volume and Level of

Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly” (“FSP 157-4”). FSP 157-4

provides additional guidelines for estimating fair value in accordance with SFAS 157 when the volume and level of activity for the asset or

liability have significantly decreased. This FSP also includes guidance on identifying circumstances that indicate a transaction is not

orderly. The adoption of FSP 157-4 in the fourth quarter of fiscal 2009 did not have a material impact on the Company’s financial

statements.

Effective July 27, 2008, the Company also adopted SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities—Including an amendment of FASB Statement No. 115” (“SFAS 159”), but has not elected the fair value option for any eligible

financial instruments as of July 25, 2009.

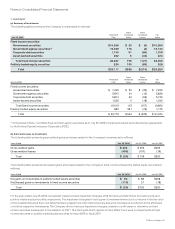

9. Borrowings

(a) Long-Term Debt

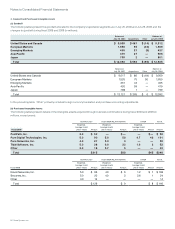

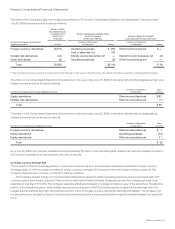

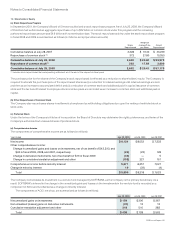

The following table summarizes the Company’s long-term debt (in millions, except percentages):

July 25, 2009 July 26, 2008

Amount

Effective

Rate Amount

Effective

Rate

Senior notes:

Floating-rate notes, due 2009 $— $ 500 2.74%

5.25% fixed-rate notes, due 2011 3,000 3.12% 3,000 3.12%

5.50% fixed-rate notes, due 2016 3,000 4.34% 3,000 4.34%

4.95% fixed-rate notes, due 2019 2,000 5.08% —

5.90% fixed-rate notes, due 2039 2,000 6.11% —

Total senior notes 10,000 6,500

Other notes 24

Unaccreted discount (21) (15)

Hedge accounting adjustment of the carrying amount of the 2011 and 2016

Notes 314 404

Total $ 10,295 $ 6,893

Reported as:

Current portion of long-term debt $— $ 500

Long-term debt 10,295 6,393

Total $ 10,295 $ 6,893

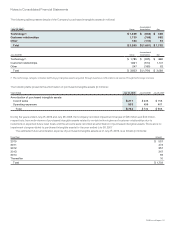

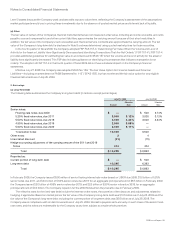

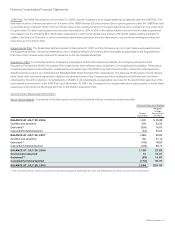

In February 2006, the Company issued $500 million of senior floating interest rate notes based on LIBOR due 2009, $3.0 billion of 5.25%

senior notes due 2011, and $3.0 billion of 5.50% senior notes due 2016, for an aggregate principal amount of $6.5 billion. In February 2009,

the Company issued $2.0 billion of 4.95% senior notes due 2019, and $2.0 billion of 5.90% senior notes due 2039, for an aggregate

principal amount of $4.0 billion. The Company repaid in full the 2009 Notes when they became due in February 2009.

The effective rates for the fixed-rate debt include the interest on the notes, the accretion of the discount, and adjustments related to

hedging, if applicable. Based on market prices, the fair value of the Company’s long-term debt was $10.5 billion as of July 25, 2009 and the

fair value of the Company’s long-term debt, including the current portion of long-term debt, was $6.6 billion as of July 26, 2008. The

Company was in compliance with all debt covenants as of July 25, 2009. Interest is payable semi-annually on each class of the senior fixed-

rate notes, and the notes are redeemable by the Company at any time, subject to a make-whole premium.

2009 Annual Report 59