Cisco 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Valuation of Employee Stock Options and Employee Stock Purchase Rights The Company estimates the value of employee stock options

and employee stock purchase rights on the date of grant using a lattice-binomial option-pricing model. The Company’s employee stock

options have vesting provisions and various restrictions including restrictions on transfer and hedging, among others, and are often

exercised prior to their contractual maturity. Lattice-binomial models are more capable of incorporating the features of the Company’s

employee stock options than closed-form models such as the Black-Scholes model. The use of a lattice-binomial model requires extensive

actual employee exercise behavior data and a number of complex assumptions including expected volatility, risk-free interest rate,

expected dividends, kurtosis, and skewness.

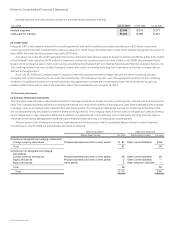

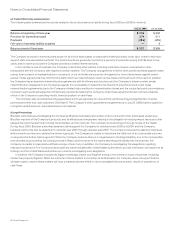

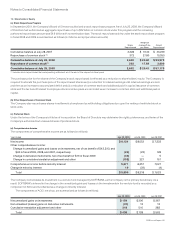

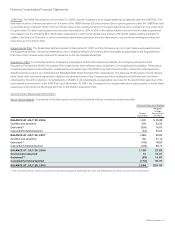

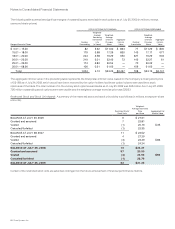

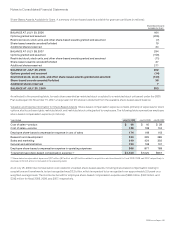

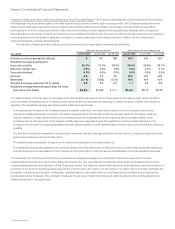

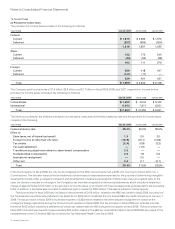

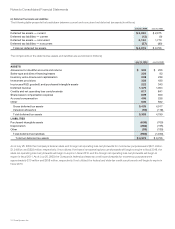

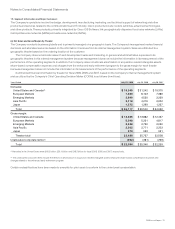

The valuation of employee stock options and employee stock purchase rights is summarized as follows:

EMPLOYEE STOCK OPTIONS EMPLOYEE STOCK PURCHASE RIGHTS

Years Ended July 25, 2009 July 26, 2008 July 28, 2007 July 25, 2009 July 26, 2008 July 28, 2007

Number of options granted (in millions) 9151 183 N/A N/A N/A

Weighted-average assumptions:

Expected volatility 36.0% 31.0% 26.0% 36.4% 32.6% 26.1%

Risk-free interest rate 3.0% 4.3% 4.6% 0.6% 2.7% 5.1%

Expected dividend 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Kurtosis 4.5 4.6 4.5 N/A N/A N/A

Skewness (0.19) (0.80) (0.79) N/A N/A N/A

Weighted-average expected life (in years) 5.9 6.3 6.7 1.1 0.5 0.5

Weighted-average estimated grant date fair value

(per option /per share) $6.60 $ 9.60 $ 7.11 $5.46 $6.12 $6.46

The determination of the fair value of employee stock options and employee stock purchase rights on the date of grant using the lattice-

binomial model is impacted by the Company’s stock price as well as assumptions regarding a number of highly complex and subjective

variables. The weighted-average assumptions were determined as follows:

• For employee stock options, the Company used the implied volatility for two-year traded options on the Company’s stock as the

expected volatility assumption required in the lattice-binomial model. For employee stock purchase rights, the Company used the

implied volatility for traded options (with lives corresponding to the expected life of the employee stock purchase rights) on the

Company’s stock. The selection of the implied volatility approach was based upon the availability of actively traded options on the

Company’s stock and the Company’s assessment that implied volatility is more representative of future stock price trends than historical

volatility.

• The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of the Company’s employee stock

options and employee stock purchase rights.

• The dividend yield assumption is based on the history and expectation of dividend payouts.

• The estimated kurtosis and skewness are technical measures of the distribution of stock price returns, which affect expected employee

exercise behaviors, and are based on the Company’s stock price return history as well as consideration of various academic analyses.

The expected life of employee stock options represents the weighted-average period the stock options are expected to remain

outstanding and is a derived output of the lattice-binomial model. The expected life of employee stock options is impacted by all of the

underlying assumptions and calibration of the Company’s model. The lattice-binomial model assumes that employees’ exercise behavior is

a function of the option’s remaining vested life and the extent to which the option is in-the-money. The lattice-binomial model estimates the

probability of exercise as a function of these two variables based on the entire history of exercises and cancellations on all past option

grants made by the Company. The Company measures the fair value of restricted stock and restricted stock units as if the awards were

vested and issued on the grant date.

70 Cisco Systems, Inc.