Cisco 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

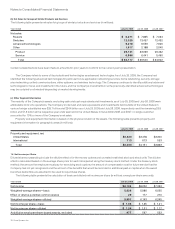

U.S. income taxes and foreign withholding taxes associated with the repatriation of earnings of foreign subsidiaries were not provided

for on a cumulative total of $24.1 billion of undistributed earnings for certain foreign subsidiaries as of the end of fiscal 2009. The Company

intends to reinvest these earnings indefinitely in its foreign subsidiaries. If these earnings were distributed to the United States in the form

of dividends or otherwise, or if the shares of the relevant foreign subsidiaries were sold or otherwise transferred, the Company would be

subject to additional U.S. income taxes (subject to an adjustment for foreign tax credits) and foreign withholding taxes. Determination of the

amount of unrecognized deferred income tax liability related to these earnings is not practicable.

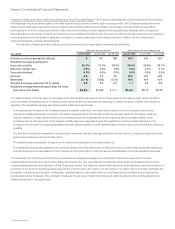

As a result of certain employment and capital investment actions, the Company’s income in certain foreign countries is subject to

reduced tax rates, and in some cases is wholly exempt from taxes. These tax incentives expire in whole or in part at various times through

fiscal 2025. As of the end of the respective fiscal years, the gross income tax benefits attributable to these tax incentives were estimated to

be $1.3 billion ($0.22 per diluted share) in fiscal 2009, $1.6 billion ($0.26 per diluted share) in fiscal 2008, and $1.2 billion ($0.20 per diluted

share) in fiscal 2007. These gross income tax benefits for the respective years were partially offset by accruals of U.S. income taxes on

undistributed earnings.

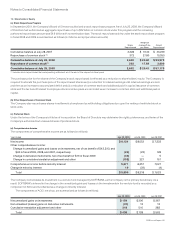

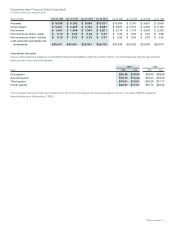

(b) Unrecognized Tax Benefits

On July 29, 2007, the Company adopted FIN 48, which prescribes a comprehensive model for the financial statement recognition,

measurement, classification, and disclosure of uncertain tax positions. In the year of adoption, the Company reduced the liability for net

unrecognized tax benefits by $451 million and accounted for this as a cumulative effect of a change in accounting principle at the

beginning of fiscal 2008.

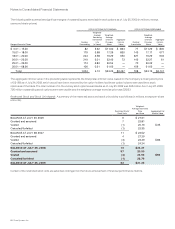

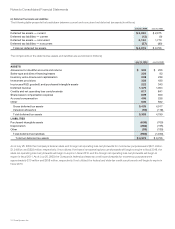

The aggregate changes in the balance of gross unrecognized tax benefits during fiscal 2008 and fiscal 2009 were as follows (in

millions):

Amount

Balance at July 29, 2007 $ 3,331

Additions based on tax positions related to the current year 488

Additions for tax positions of prior years 147

Reductions for tax positions of prior years (466)

Settlements (951)

Lapse of statute of limitations (44)

Balance at July 26, 2008 $ 2,505

Additions based on tax positions related to the current year 190

Additions for tax positions of prior years 307

Reductions for tax positions of prior years (17)

Settlements (109)

Lapse of statute of limitations (60)

Balance at July 25, 2009 $ 2,816

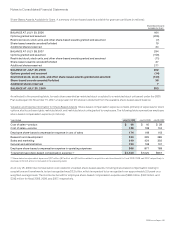

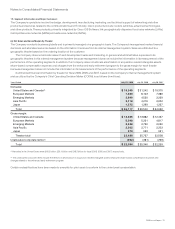

As of July 25, 2009, $2.2 billion of the unrecognized tax benefits would affect the effective tax rate if realized. The Company recognizes

interest and penalties accrued related to unrecognized tax benefits in its provision for income taxes. During fiscal 2009 and 2008, the

Company recognized $163 million and $8 million, respectively, in interest and penalties. The Company had $329 million and $166 million

for the payment of interest and penalties accrued at the end of fiscal 2009 and 2008, respectively. The Company is no longer subject to U.S.

federal income tax audit for returns covering tax years through fiscal year 2001. With limited exceptions, the Company is no longer subject

to state and local or foreign income tax audits for returns covering tax years through fiscal year 1997.

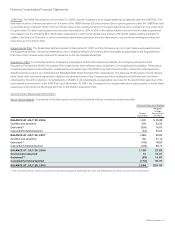

In the fourth quarter of fiscal 2009, as a result of the U.S. Court of Appeals decision in Xilinx, Inc. v. Commissioner, the Company

increased the amount of gross unrecognized tax benefits by approximately $214 million. The Company also increased the amount of

accrued interest by $197 million. The Company believes that adequate amounts have been reserved for any adjustments that may

ultimately result from this decision.

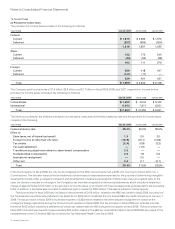

In the first quarter of fiscal 2008, the Company and the IRS agreed to a settlement with respect to certain tax issues related to U.S.

income inclusions arising from the Company’s international operations for fiscal years ended July 27, 2002 through July 29, 2006. As a

result of the settlement, the Company reduced the amount of gross unrecognized tax benefits by approximately $1.0 billion. The Company

also reduced the amount of accrued interest by $39 million. In addition, the IRS has proposed other adjustments that are not covered under

the settlement agreement related to fiscal years ended July 27, 2002 through July 31, 2004. The Company has timely filed a protest with

the IRS Appeals Office on these proposed adjustments. The Company believes that adequate amounts have been reserved for any

adjustments that may ultimately result from these examinations. Although timing of the resolution of audits is highly uncertain, the Company

does not believe it is reasonably possible that the total amount of unrecognized tax benefits as of July 25, 2009 will materially change in the

next 12 months.

2009 Annual Report 73