Cisco 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

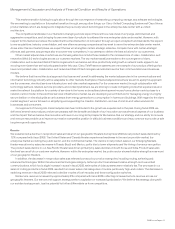

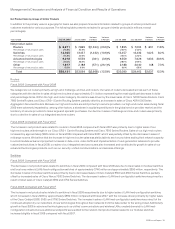

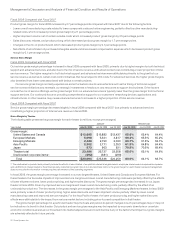

Emerging Markets

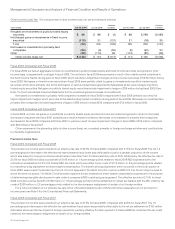

Fiscal 2009 Compared with Fiscal 2008

Net product sales in the Emerging Markets theater decreased across all customer market segments in fiscal 2009 compared with fiscal

2008, primarily due to lower sales to the service provider, commercial and enterprise markets. We also experienced a sales decline in fiscal

2009 across most countries in this theater, with particular weakness in Russia, Brazil, and Mexico. In addition to the impact from lower

shipments, the decline in net product sales in this theater in fiscal 2009 was also due to the timing of revenue recognition for sales involving

financing arrangements. Certain of our customers in the Emerging Markets theater tend to make large and sporadic purchases, and the net

sales related to these transactions may also be affected by the timing of revenue recognition. Further, some customers may continue to

require greater levels of financing arrangements, service, and support in future periods, which may also impact the timing of recognition of

the revenue for this theater.

Fiscal 2008 Compared with Fiscal 2007

Net product sales in the Emerging Markets theater increased in fiscal 2008 due to increased shipments and recognition of previously

deferred revenue. In fiscal 2008, we experienced continued network deployments across our customer markets in this theater, with

particular strength in Brazil and Russia.

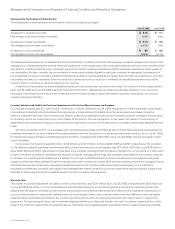

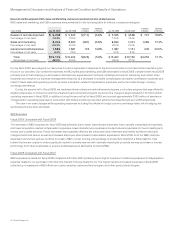

Asia Pacific

Fiscal 2009 Compared with Fiscal 2008

The decrease in net product sales in the Asia Pacific theater in fiscal 2009 compared with fiscal 2008 was reflected across all the customer

market segments. The decrease was driven by lower sales in the enterprise and service provider markets, and to a lesser extent in the

commercial market. The year-over-year decline in net product sales was experienced across most of the major countries in this theater,

particularly in South Korea and India. Net product sales in Australia remained relatively flat and China exhibited only a slight decline in net

product sales in fiscal 2009 compared with fiscal 2008.

Fiscal 2008 Compared with Fiscal 2007

The increase in net product sales in the Asia Pacific theater in fiscal 2008 was primarily attributable to the balanced growth in the

enterprise, service provider, and commercial markets. In particular, China and India experienced strong growth in fiscal 2008.

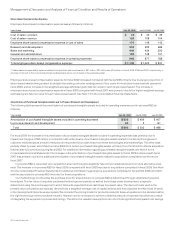

Japan

Fiscal 2009 Compared with Fiscal 2008

Net product sales in the Japan theater decreased in fiscal 2009 compared with fiscal 2008 primarily due to a decline in sales to the service

provider market and a decline in sales to the enterprise market, excluding the public sector. Net product sales to the public sector within

the enterprise market increased in this theater.

Fiscal 2008 Compared with Fiscal 2007

Net product sales in the Japan theater increased in fiscal 2008 primarily due to service providers building out next-generation networks.

18 Cisco Systems, Inc.