Cisco 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc.Cisco Systems, Inc.

2009 Annual Report2009 Annual Report

The The

Connected Connected

WorldWorld

Table of contents

-

Page 1

The Connected World Cisco Systems, Inc. 2009 Annual Report -

Page 2

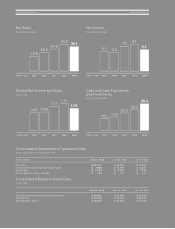

FINANCIAL HIGHLIGHTS / CISCO SYSTEMS, INC Net Sales (DOLLARS IN BILLIONS) Net Income (DOLLARS IN BILLIONS) 39.5 28.5 24.8 34.9 36.1 5.7 5.6 7.3 8.1 6.1 FISCAL YEAR 2005 2006 2007 2008 2009 FISCAL YEAR 2005 2006 2007 2008 2009 Diluted Net Income per Share (IN DOLLARS) Cash and ... -

Page 3

... and Web 2.0 tools, both internally and externally, to maximize productivity and speed decision making; 3) enabling data center virtualization to reach levels of scale and efficiency that were previously unheard of; 4) readying all of our products and solutions for the escalating use of video; and... -

Page 4

... 5%. Balance across product lines and customer segments has historically allowed Cisco's overall financial performance to better withstand downturns in any one particular business segment. Execution / Operational Efficiency that Drives Innovation Cisco recorded near record quarterly revenue of $10... -

Page 5

... TO SHAREHOLDERS / ANNUAL REPORT 2009 In fiscal 2009, product revenue declined by approximately 12% due in large part to reduced enterprise and service provider spending across our geographic theaters. The Public Sector performed better than other customer markets in fiscal 2009. Service revenue... -

Page 6

...-enabled Web 2.0 technologies can have on their businesses and in their lives. We are thrilled to pioneer those applications with our customers and our employees as we strive to make Cisco a company that is "best in the world and best for the world." The 65,000 faces of Cisco inspire me every day... -

Page 7

... Cisco's Board of Directors, has established and maintains a strong ethical climate so that our affairs are conducted to the highest standards of personal and corporate conduct. Management also has established an effective system of internal controls. Cisco's policies and practices reflect corporate... -

Page 8

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was... -

Page 9

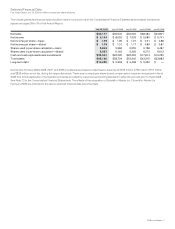

... accounting standard in effect for periods prior to fiscal 2006. See Note 13 to the Consolidated Financial Statements. The effects of the acquisition of Scientific-Atlanta, Inc. ("Scientific-Atlanta") in February 2006 are reflected in the above selected financial data since that date. 2009 Annual... -

Page 10

... a broad range of service offerings, including technical support services and advanced services. Our customer base spans virtually all types of public and private agencies and businesses, comprising enterprise businesses, service providers, commercial customers, and consumers. For fiscal 2009, our... -

Page 11

... will drive productivity and growth in network loads, appear to be evolving even faster than we had anticipated earlier this year. Cisco TelePresence systems are one example of our product offerings that have incorporated video, collaboration, and networked Web 2.0 technologies, as customers evolve... -

Page 12

... of our common stock at an average price of $17.89 per share for an aggregate purchase price of $3.6 billion during fiscal 2009. • Days sales outstanding in accounts receivable (DSO) at the end of fiscal 2009 was 34 days, the same as it was at the end of fiscal 2008. • Our inventory balance was... -

Page 13

...of the customer as determined by credit checks and analysis, as well as the customer's payment history. In instances where final acceptance of the product, system, or solution is specified by the customer, revenue is deferred until all acceptance criteria have been met. When a sale involves multiple... -

Page 14

... Financial Statements. Our products are generally covered by a warranty for periods ranging from 90 days to five years, and for some products we provide a limited lifetime warranty. We accrue for warranty costs as part of our cost of sales based on associated material costs, technical support labor... -

Page 15

... Statement of Financial Accounting Standards ("SFAS") No. 157, "Fair Value Measurements" ("SFAS 157") and its applicable Financial Accounting Standards Board Staff Positions ("FSPs") in determining the fair value of our investment securities. Our fixed income and publicly traded equity securities... -

Page 16

... taxes, foreign operations, research and development (R&D) tax credits, tax audit settlements, nondeductible compensation, international realignments, and transfer pricing adjustments. Our effective tax rate was 20.3%, 21.5%, and 22.5% in fiscal 2009, 2008, and 2007, respectively. 14 Cisco Systems... -

Page 17

... terms and conditions, our business, operating results, and financial condition could be materially and adversely affected. Reclassifications During fiscal 2009, we began to allocate certain costs, which had previously been recorded in general and administrative expenses (related to information... -

Page 18

...revenue increased in each of our geographic theaters and customer markets compared with fiscal 2007 as we benefited from increased IT-related capital spending in our markets. Our sales also benefited from our entry into new markets and the development of adjacent product offerings. 16 Cisco Systems... -

Page 19

...our customer markets, with particular strength in the commercial market. In fiscal 2008, we experienced strong revenue growth in Germany and the United Kingdom, although we experienced slower year-over-year growth in sales in the European Markets overall compared with fiscal 2007. 2009 Annual Report... -

Page 20

Management's Discussion and Analysis of Financial Condition and Results of Operations Emerging Markets Fiscal 2009 Compared with Fiscal 2008 Net product sales in the Emerging Markets theater decreased across all customer market segments in fiscal 2009 compared with fiscal 2008, primarily due to ... -

Page 21

... sales of the Cisco Catalyst 2960, 3560, and 3750 Series Switches. The increase in sales of LAN fixed-configuration switches was a result of the continued adoption by our customers of new technologies throughout their networks from the data center to the wiring closet. Additionally, growth in fiscal... -

Page 22

... due to revenue from IronPort Systems, Inc., which we acquired during the fourth quarter of fiscal 2007, revenue from module and line card sales related to our routers and LAN switches, and revenue from our next-generation adaptive security appliance products. • Sales of application networking... -

Page 23

... we benefited from cost savings in component costs and value engineering and other manufacturing-related costs. Value engineering is the process by which production costs are reduced through component redesign, board configuration, test processes, and transformation processes. 2009 Annual Report 21 -

Page 24

... Markets theaters in fiscal 2009 were primarily a result of lower product pricing, higher sales discounts, and lower shipment volume, partially offset by lower overall manufacturing costs and improved service margins. For the Asia Pacific theater, the lower product pricing and higher sales discounts... -

Page 25

... mix of our product sales; the timing of revenue recognition and revenue deferrals; sales discounts; increases in material or labor costs; excess inventory and obsolescence charges; warranty costs; changes in shipment volume; loss of cost savings due to changes in component pricing; effects of value... -

Page 26

... lower sales and operating results; (iii) lower acquisition-related compensation expenses; and (iv) favorable foreign currency exchange rate effects. During the second half of fiscal 2009, we implemented an enhanced early retirement program, a voluntary program that was offered to eligible employees... -

Page 27

... early retirement program are fully reflected. Fiscal 2008 Compared with Fiscal 2007 In fiscal 2008, our headcount increased by 4,594 employees, reflecting the effects of our investments in sales and R&D as well as increased investments in our service business and acquisitions. 2009 Annual Report... -

Page 28

...in fiscal 2009. See Note 3 to the Consolidated Financial Statements for additional information regarding the acquisitions completed in fiscal 2009, 2008, and 2007, and the associated in-process R&D recorded for those acquisitions. Our methodology for allocating the purchase price for acquisitions to... -

Page 29

...for our purchase acquisitions completed in fiscal 2009 for which in-process R&D was recorded (in millions, except percentages): In-Process R&D Expense Estimated Cost to Complete Technology at Time of Acquisition Risk-Adjusted Discount Rate for In-Process R&D PostPath, Inc. Pure Digital Technologies... -

Page 30

...the termination of various forward sale agreements designated as fair value hedges of publicly traded equity securities. Net gains on publicly traded equity securities include impairment charges of $39 million during fiscal 2009. See Note 7 to the Consolidated Financial Statements for the unrealized... -

Page 31

... will have on our consolidated financial statements. IFRS International Financial Reporting Standards (IFRS) is a comprehensive series of accounting standards published by the International Accounting Standards Board (IASB). In November 2008, the SEC issued for comment a proposed roadmap outlining... -

Page 32

...receivable collections, inventory and supply chain management, deferred revenue, excess tax benefits from share-based compensation, and the timing and amount of tax and other payments. For additional discussion, see "Part I, Item 1A. Risk Factors" in our Annual Report on Form 10-K. 30 Cisco Systems... -

Page 33

...maintain supply chain flexibility to help ensure competitive lead times with the risk of inventory obsolescence because of rapidly changing technology and customer requirements. We believe the amount of our inventory and purchase commitments is appropriate for our revenue levels. 2009 Annual Report... -

Page 34

...Lease receivables include sales-type and directfinancing leases. We also provide certain qualified customers financing for long-term service contracts, which primarily relate to technical support services. Our loan financing arrangements may include not only financing the acquisition of our products... -

Page 35

...certain conditions, either (i) the higher of the Federal Funds rate plus 0.50% or Bank of America's "prime rate" as announced from time to time, or (ii) the London Interbank Offered Rate ("LIBOR") plus a margin that is based on our senior debt credit ratings as published by Standard & Poor's Ratings... -

Page 36

... leases with an initial term in excess of one year. Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of suppliers and use several contract manufacturers to provide manufacturing services for our products. A significant portion of our reported... -

Page 37

... or end-user customers. See the further discussion of these financing guarantees under Financing Receivables and Guarantees above. Stock Repurchase Program In September 2001, our Board of Directors authorized a stock repurchase program. As of July 25, 2009, our Board of Directors had authorized an... -

Page 38

...the fixed-rate debt. Equity Price Risk The fair value of our equity investments in publicly traded companies is subject to market price volatility. We may hold equity securities for strategic purposes or to diversify our overall investment portfolio. Our equity portfolio consists of securities with... -

Page 39

...equity security in the portfolio of plus or minus 10%, 20%, and 30% were selected based on potential near-term changes in those security prices. The hypothetical fair values as of July 25, 2009 and July 26, 2008 are as follows (in millions): VALUATION OF SECURITIES GIVEN AN X% DECREASE IN EACH STOCK... -

Page 40

...investments in foreign subsidiaries Forward contracts-long-term customer financings Forward contracts-investments We do not enter into foreign exchange forward or option contracts for trading purposes. Up to 18 months Up to 3 months Up to 6 months Up to 2 years Up to 2 years 38 Cisco Systems, Inc. -

Page 41

... assets Property and equipment, net Goodwill Purchased intangible assets, net Other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Accounts payable Income taxes payable Accrued compensation Deferred revenue Other current liabilities... -

Page 42

...25, 2009 July 26, 2008 July 28, 2007 NET SALES: Product Service Total net sales COST OF SALES: Product Service Total cost of sales GROSS MARGIN OPERATING EXPENSES: Research and development Sales and marketing General and administrative Amortization of purchased intangible assets In-process research... -

Page 43

... In-process research and development Net losses (gains) on investments Change in operating assets and liabilities, net of effects of acquisitions: Accounts receivable Inventories Lease receivables, net Accounts payable Income taxes payable and receivable Accrued compensation Deferred revenue Other... -

Page 44

... of common stock Tax benefits from employee stock incentive plans, including transfer pricing adjustments Purchase acquisitions Employee share-based compensation expense Share-based compensation expense related to acquisitions and investments BALANCE AT JULY 25, 2009 Supplemental Information 6,059... -

Page 45

... of purchase to be cash equivalents. Cash and cash equivalents are maintained with various financial institutions. (b) Investments The Company's investments include government and government agency securities, corporate debt securities, assetbacked securities, and publicly traded equity securities... -

Page 46

...service contracts, and loans, for certain qualified end-user customers to build, maintain, and upgrade their networks. Lease receivables primarily represent sales-type and direct-financing leases. Leases and loans typically have a three-year term and are usually collateralized by a security interest... -

Page 47

.... Advertising costs were not material for any of the years presented. (o) Share-Based Compensation Expense The Company measures and recognizes the compensation expense for all share-based awards made to employees and directors including employee stock options and employee stock purchases related... -

Page 48

...used for the following, among others Revenue recognition Allowances for receivables and sales returns Inventory valuation and liability for purchase commitments with contract manufacturers and suppliers Warranty costs Share-based compensation expense Fair value measurements and other-than-temporary... -

Page 49

... fiscal 2010. The Company does not expect that the application of SFAS 157, when applied to nonfinancial assets and liabilities, will have a material impact on its results of operations or financial position. SFAS 166 In June 2009, the FASB issued SFAS No. 166, "Accounting for Transfers of Financial... -

Page 50

...acquired Securent, Inc. to allow the Company to offer its enterprise customers policy management software solutions, which are designed to allow enterprises to administer, enforce, and audit access to data, communications, and applications across different types of IT environments. 48 Cisco Systems... -

Page 51

Notes to Consolidated Financial Statements Fiscal 2007 • The Company acquired Arroyo Video Solutions, Inc. to enable carriers to accelerate the creation and distribution of network-delivered entertainment, interactive media, and advertising services across the growing portfolio of televisions, ... -

Page 52

...and purchase accounting adjustments. (b) Purchased Intangible Assets The following tables present details of the intangible assets acquired through business combinations during fiscal 2009 and 2008 (in millions, except years): TECHNOLOGY WeightedAverage Useful Life (in Years) CUSTOMER RELATIONSHIPS... -

Page 53

...26, 2008 July 28, 2007 Amortization of purchased intangible assets: Cost of sales Operating expenses Total $ 211 533 $ 744 $ 233 499 $ 732 $ 156 407 $ 563 During the years ended July 25, 2009 and July 26, 2008, the Company recorded impairment charges of $95 million and $33 million, respectively... -

Page 54

...second half of fiscal 2009, the Company implemented an enhanced early retirement program, a voluntary program that was offered to eligible employees. In connection with the enhanced early retirement program, the Company incurred a charge of $138 million ($28 million in cost of sales and $110 million... -

Page 55

... to Consolidated Financial Statements 6. Financing Receivables and Guarantees (a) Lease Receivables Lease receivables represent sales-type and direct-financing leases resulting from the sale of the Company's and complementary thirdparty products. These lease arrangements typically have terms of up... -

Page 56

... extended to end-user customers related to leases and loans that typically have terms of up to three years. The volume of financing provided by third parties for leases and loans on which the Company has provided guarantees was $1.2 billion for both fiscal 2009 and fiscal 2008. Financing Guarantee... -

Page 57

...): Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Fair Value July 25, 2009 Fixed income securities: Government securities Government agency securities(1) Corporate debt securities Asset-backed securities Total fixed income securities Publicly traded equity securities Total $10... -

Page 58

... fair value has been less than the cost basis and the financial condition and near-term prospects of the issuer, and the Company's intent and ability to hold the publicly traded equity securities for a period of time sufficient to allow for any anticipated recovery in market value. 56 Cisco Systems... -

Page 59

... Significant Unobservable Inputs (Level 3) July 25, 2009 Significant Other Observable Inputs (Level 2) Total Balance Assets: Money market funds Government securities Government agency securities Corporate debt securities Asset-backed securities Publicly traded equity securities Derivative assets... -

Page 60

...2, as they are not actively traded and are valued using pricing models that use observable market inputs. Level 3 assets include asset-backed securities and certain derivative assets, whose values are determined based on discounted cash flow models using inputs that the Company could not corroborate... -

Page 61

... of the Company's loan receivables and financed service contracts also approximate the carrying amount. The fair value of the Company's long-term debt is disclosed in Note 9 and was determined using quoted market prices for those securities. In the fourth quarter of fiscal 2009, the Company adopted... -

Page 62

... this type of credit risk is monitored. Management does not expect material losses as a result of defaults by counterparties. The fair values of the Company's derivative instruments and the line items on the Consolidated Balance Sheet to which they were recorded as of July 25, 2009 are summarized... -

Page 63

... year ended July 25, 2009 of derivative instruments designated as fair value hedges is summarized as follows (in millions): Derivatives Designated as Fair Value Hedging Instruments Line Item in Statements of Operations Gains (Losses) Equity derivatives Interest rate derivatives Total Other income... -

Page 64

... portfolio. The publicly traded equity securities in the Company's portfolio are subject to price risk. To manage its exposure to changes in the fair value of certain equity securities, the Company may enter into equity derivatives that are designated as accounting hedges. The changes in the value... -

Page 65

... all noncancelable operating leases with an initial term in excess of one year as of July 25, 2009 are as follows (in millions): Fiscal Year Amount 2010 2011 2012 2013 2014 Thereafter Total $ 345 249 177 132 103 420 $ 1,426 (b) Purchase Commitments with Contract Manufacturers and Suppliers The... -

Page 66

... issued Payments Fair value of warranty liability acquired Balance at end of fiscal year $ 399 374 (452) - $ 321 $ 340 511 (455) 3 $ 399 The Company accrues for warranty costs as part of its cost of sales based on associated material product costs, labor costs for technical support staff... -

Page 67

Notes to Consolidated Financial Statements 12. Shareholders' Equity (a) Stock Repurchase Program In September 2001, the Company's Board of Directors authorized a stock repurchase program. As of July 25, 2009, the Company's Board of Directors had authorized an aggregate repurchase of up to $62 ... -

Page 68

.... Employees may purchase a limited number of shares of the Company's stock at a discount of up to 15% of the lesser of the market value at the beginning of the offering period or the end of each 6-month purchase period. Prior to July 1, 2009 the offering period was six months. The Purchase Plan... -

Page 69

... longer make equity awards under the 1996 Plan. The maximum number of shares issuable over the term of the 1996 Plan was 2.5 billion shares. Stock options granted under the 1996 Plan have an exercise price of at least 100% of the fair market value of the underlying stock on the grant date and expire... -

Page 70

... the total pretax intrinsic value, based on the Company's closing stock price of $21.88 as of July 24, 2009, which would have been received by the option holders had those option holders exercised their stock options as of that date. The total number of in-the-money stock options exercisable as of... -

Page 71

...stock options, stock purchase rights, restricted stock, and restricted stock units granted to employees. The following table summarizes employee share-based compensation expense (in millions): Years Ended July 25, 2009 July 26, 2008 July 28, 2007 Cost of sales-product Cost of sales-service Employee... -

Page 72

... as follows: EMPLOYEE STOCK OPTIONS Years Ended July 25, 2009 July 26, 2008 July 28, 2007 EMPLOYEE STOCK PURCHASE RIGHTS July 25, 2009 July 26, 2008 July 28, 2007 Number of options granted (in millions) Weighted-average assumptions: Expected volatility Risk-free interest rate Expected dividend... -

Page 73

... market for the Company's employee stock options. (c) Employee 401(k) Plans The Company sponsors the Cisco Systems, Inc. 401(k) Plan (the "Plan") to provide retirement benefits for its employees. As allowed under Section 401(k) of the Internal Revenue Code, the Plan provides for tax-deferred salary... -

Page 74

..., 2009 July 26, 2008 July 28, 2007 Federal statutory rate Effect of: State taxes, net of federal tax benefit Foreign income at other than U.S. rates Tax credits Tax audit settlement Transfer pricing adjustment related to share-based compensation Nondeductible compensation International realignment... -

Page 75

.... As a result of certain employment and capital investment actions, the Company's income in certain foreign countries is subject to reduced tax rates, and in some cases is wholly exempt from taxes. These tax incentives expire in whole or in part at various times through fiscal 2025. As of the end... -

Page 76

...) $ 3,756 July 25, 2009 July 26, 2008 ASSETS Allowance for doubtful accounts and returns Sales-type and direct-financing leases Inventory write-downs and capitalization Investment provisions In-process R&D, goodwill, and purchased intangible assets Deferred revenue Credits and net operating loss... -

Page 77

... Financial Statements 15. Segment Information and Major Customers The Company's operations involve the design, development, manufacturing, marketing, and technical support of networking and other products and services related to the communications and IT industry. Cisco products include routers... -

Page 78

... the treasury stock method, the amount the employee must pay for exercising stock options, the amount of compensation cost for future service that the Company has not yet recognized, and the amount of tax benefits that would be recorded in additional paid-in capital when the award becomes deductible... -

Page 79

...$ 9,554 $ 6,140 $ 2,205 $ 0.36 $ 0.35 $24,679 Stock Market Information Cisco common stock is traded on the NASDAQ Global Select Market under the symbol CSCO. The following table lists the high and low sales prices for each period indicated: 2009 Fiscal High Low High 2008 Low First quarter Second... -

Page 80

...have been declared on Cisco common stock. Shareholder returns over the indicated period are based on historical data and should not be considered indicative of future shareholder returns. Comparison of 5-Year Cumulative Total Return Among Cisco Systems, Inc., the S&P Information Technology Index and... -

Page 81

... and Planning Bob Singleton SVP, Customer Advocacy Asia Pacific, Japan, and Emerging Markets Padmasree Warrior SVP, Chief Technology Officer Tae Yoo SVP, Corporate Affairs Executive Officers Susan L. Bostrom Executive Vice President, Chief Marketing Officer, Global Policy and Worldwide Government... -

Page 82

... San Jose, CA 95134-1706 408 227-CSCO (2726) www.cisco.com/go/investors Cisco's stock trades on the NASDAQ Global Select Market under the ticker symbol CSCO. Forward-Looking Statements Transfer Agent and Registrar Computershare Investor Services P.O. Box 43078 Providence, RI 02940-3078 Email: web... -

Page 83

.... Cisco, the Cisco logo, Catalyst, Cisco IOS, Cisco IronPort, Cisco Nexus, Cisco Systems, Cisco TelePresence, Cisco Uniï¬ed Computing System, Cisco WebEx, Flip Video, IOS, IronPort, Linksys, Networking Academy, WebEx, and Welcome to the Human Network are registered trademarks or trademarks and... -

Page 84

Worldwide Ofï¬ces Americas Headquarters San Jose, California, USA Asia Paciï¬c Headquarters Singapore Europe Headquarters Amsterdam, Netherlands Cisco has more than 200 ofï¬ces worldwide. Addresses, phone numbers, and fax numbers are listed on the Cisco website at www.cisco.com/go/ofï¬ces. ...