Cablevision 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(91)

debt that is subject to variable and fixed interest rates. Such contracts effectively fix the borrowing rates

on floating rate debt to limit the exposure against the risk of rising rates and/or effectively convert fixed

rate borrowings to variable rates to permit the Company to realize lower interest expense in a declining

interest rate environment. We do not enter into interest rate swap contracts for speculative or trading

purposes. The Company monitors the financial institutions that are counterparties to our interest rate

swap contracts and we only enter into interest rate swap contracts with financial institutions that are rated

investment grade. We diversify our swap contracts among various counterparties to mitigate exposure to

any single financial institution. All such contracts are carried at their fair values on our consolidated

balance sheets, with changes in fair value reflected in our consolidated statements of income.

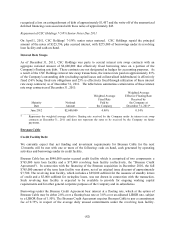

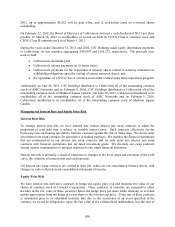

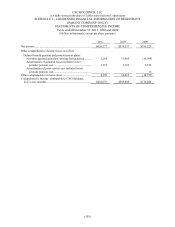

As of December 31, 2011, CSC Holdings was party to several interest rate swap contracts with an

aggregate notional amount of $2,600,000 that effectively fixed borrowing rates on a portion of the

Company's floating rate debt. As of December 31, 2011, our outstanding interest rate swap contracts had

a fair value and carrying value of $55,383, a net liability position, as reflected under liabilities under

derivative contracts in our consolidated balance sheet. Assuming an immediate and parallel shift in

interest rates across the yield curve, a 50 basis point decrease in interest rates prevailing at December 31,

2011 would increase our liability under these derivative contracts by approximately $3,313 to a liability

of $58,696.

For the year ended December 31, 2011, we recorded a net loss on interest swap contracts of $7,973, as

detailed in the table below:

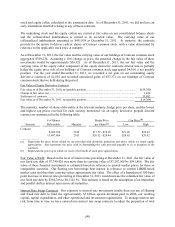

Fair Value of Interest Rate Swap Contracts

Fair value as of December 31, 2010, a net liability position ................................................................. $(167,278)

Cash payments, net ................................................................................................................................ 119,868

Change in fair value, net ........................................................................................................................ (7,973)

Fair value as of December 31, 2011, a net liability position ................................................................. $ (55,383)

Item 8. Financial Statements and Supplementary Data.

For information required by Item 8, refer to the Index to Financial Statements on page 117.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure.

None.

Item 9A. Controls and Procedures

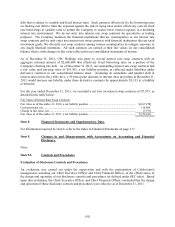

Evaluation of Disclosure Controls and Procedures

An evaluation was carried out under the supervision and with the participation of Cablevision's

management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of

the design and operation of our disclosure controls and procedures (as defined under SEC rules). Based

upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the design

and operation of these disclosure controls and procedures were effective as of December 31, 2011.