Cablevision 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(82)

recognized a loss on extinguishment of debt of approximately $1,457 and the write-off of the unamortized

deferred financing costs associated with these notes of approximately $45.

Repayment of CSC Holdings 7-5/8% Senior Notes Due 2011

On April 1, 2011, CSC Holdings' 7-5/8% senior notes matured. CSC Holdings repaid the principal

amount of the notes of $325,796, plus accrued interest, with $275,000 of borrowings under its revolving

loan facility and cash-on-hand.

Interest Rate Swaps

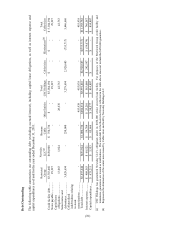

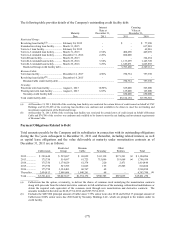

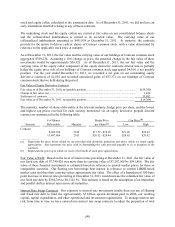

As of December 31, 2011, CSC Holdings was party to several interest rate swap contracts with an

aggregate notional amount of $2,600,000 that effectively fixed borrowing rates on a portion of the

Company's floating rate debt. These contracts are not designated as hedges for accounting purposes. As

a result of the CSC Holdings interest rate swap transactions, the interest rate paid on approximately 81%

of the Company's outstanding debt (excluding capital leases and collateralized indebtedness) is effectively

fixed (56% being fixed rate obligations and 25% is effectively fixed through utilization of these interest

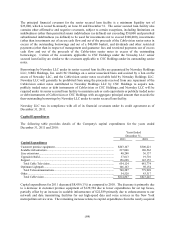

rate swap contracts) as of December 31, 2011. The table below summarizes certain terms of these interest

rate swap contracts as of December 31, 2011:

Maturity

Date

Notional

Amount

Weighted Average

Fixed Rate

Paid by

the Company

Weighted Average

Effective Floating Rate

Received by

the Company at

December 31, 2011*

June 2012 $2,600,000 4.86% 0.54%

______________

* Represents the weighted average effective floating rate received by the Company under its interest rate swap

contracts at December 31, 2011 and does not represent the rates to be received by the Company on future

payments.

Bresnan Cable

Credit Facility Debt

We currently expect that net funding and investment requirements for Bresnan Cable for the next

12 months will be met with one or more of the following: cash on hand, cash generated by operating

activities and borrowings under its credit facility.

Bresnan Cable has an $840,000 senior secured credit facility which is comprised of two components: a

$765,000 term loan facility and a $75,000 revolving loan facility (collectively, the "Bresnan Credit

Agreement"). In connection with the financing of the Bresnan acquisition in December 2010, the full

$765,000 amount of the term loan facility was drawn, net of an original issue discount of approximately

$7,700. The revolving loan facility, which includes a $25,000 sublimit for the issuance of standby letters

of credit and a $5,000 sublimit for swingline loans, was not drawn in connection with the transaction.

Such revolving loan facility is expected to be available to provide for ongoing working capital

requirements and for other general corporate purposes of the Company and its subsidiaries.

Borrowings under the Bresnan Credit Agreement bear interest at a floating rate, which at the option of

Bresnan Cable may be either 2.0% over a floating base rate or 3.0% over an adjusted LIBOR rate, subject

to a LIBOR floor of 1.50%. The Bresnan Credit Agreement requires Bresnan Cable to pay a commitment

fee of 0.75% in respect of the average daily unused commitments under the revolving loan facility.