Cablevision 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(67)

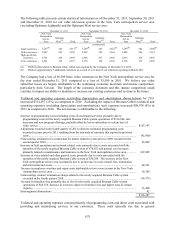

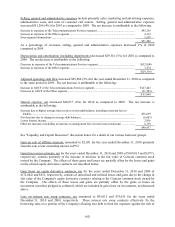

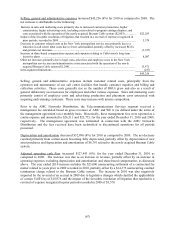

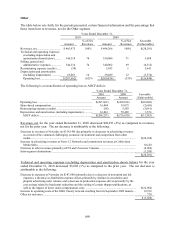

Selling, general and administrative expenses increased $45,256 (4%) for 2010 as compared to 2009. The

net increase is attributable to the following:

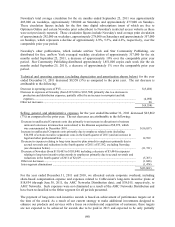

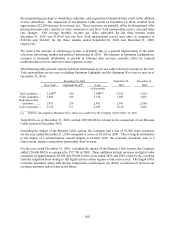

Selling, general and administrative expenses include customer related costs, principally from the

operation and maintenance of our call center facilities that handle customer inquiries and billing and

collection activities. These costs generally rise as the number of RGUs grow and also as a result of

general inflationary cost increases for employees and other various expenses. Sales and marketing costs

primarily consist of employee costs and advertising production and placement costs associated with

acquiring and retaining customers. These costs may increase with intense competition.

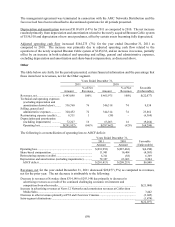

Prior to the AMC Networks Distribution, the Telecommunications Services segment received a

management fee calculated based on gross revenues of AMC and WE tv (as defined under the terms of

the management agreement) on a monthly basis. Historically, these management fees were reported as a

contra-expense and amounted to $26,511 and $23,773, for the year ended December 31, 2010 and 2009,

respectively. The management agreement was terminated in connection with the AMC Networks

Distribution and the fees received have been reclassified to discontinued operations for all periods

presented.

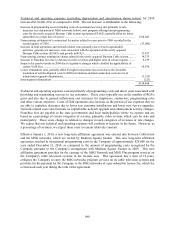

Depreciation and amortization decreased $32,890 (4%) for 2010 as compared to 2009. The net decrease

resulted primarily from certain assets becoming fully depreciated, partially offset by depreciation of new

asset purchases and depreciation and amortization of $6,791 related to the newly acquired Bresnan Cable

system.

Adjusted operating cash flow increased $127,443 (6%) for the year ended December 31, 2010 as

compared to 2009. The increase was due to an increase in revenue, partially offset by an increase in

operating expenses excluding depreciation and amortization and share-based compensation, as discussed

above. The year ended 2010 increase includes the $23,000 nonrecurring settlement of a contractual fee

matter related to years prior to 2009 recorded in 2010, partially offset by a $14,375 nonrecurring contract

termination charge related to the Bresnan Cable system. The increase in 2010 was also negatively

impacted by the reversal of an accrual in 2009 due to legislative changes which clarified the applicability

of certain VoIP fees of $18,976 and the impact of the favorable resolution of litigation that resulted in a

reversal of expense recognized in prior periods recorded in 2009 of $5,579.

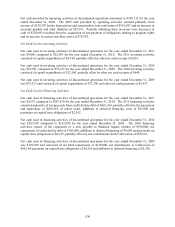

Increase in sales and marketing costs primarily due to increased customer promotions, higher

commissions, higher advertising costs, including costs related to program carriage disputes, and

costs associated with the operation of the newly acquired Bresnan Cable system ($2,003) ............... $22,283

Impact of the favorable resolution of litigation, that resulted in a reversal of expense recognized in

prior periods, recorded in 2009 ........................................................................................................... 5,579

Decrease in customer related costs in the New York metropolitan service area primarily due to a

reduction in call center labor costs due to fewer calls handled, partially offset by increased RGUs

and general cost increases .................................................................................................................. (3,937)

Increase in share-based compensation expense and expenses relating to Cablevision's long-term

incentive plans .................................................................................................................................... 8,087

Other net increases primarily due to legal costs, other fees and employee costs in the New York

metropolitan service area and administrative costs associated with the operation of the newly

acquired Bresnan Cable system ($2,244) ............................................................................................ 13,471

Intra-segment eliminations .................................................................................................................... (227)

$45,256