Cablevision 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

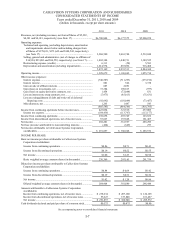

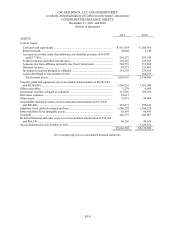

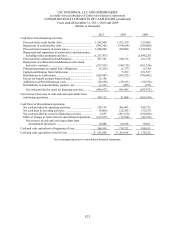

CABLEVISION SYSTEMS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31, 2011, 2010 and 2009

(Dollars in thousands)

I-12

2011 2010 2009

Cash flows from operating activities:

Income from continuing operations ...................................... $ 238,658 $ 207,749 $ 123,832

Adjustments to reconcile income from continuing

operations to net cash provided by operating

activities:

Depreciation and amortization (including

impairments) .............................................................. 1,014,974 887,092 916,408

Non-cash restructuring expense ..................................... - - 2,129

Gain on sale of affiliate interests .................................... (683) (2,051) -

Loss (gain) on investments, net ...................................... (37,384) (109,813) 977

Loss (gain) on equity derivative contracts, net .............. (1,454) 72,044 (631)

Loss on extinguishment of debt and write-off of

deferred financing costs .............................................. 92,692 110,049 73,457

Amortization of deferred financing costs, discounts

on indebtedness and other costs ................................. 46,785 40,739 43,514

Share-based compensation expense related to equity

classified awards ........................................................ 44,877 48,434 47,143

Deferred income taxes ................................................... 157,219 95,682 95,750

Provision for doubtful accounts ..................................... 57,330 63,574 64,307

Change in assets and liabilities, net of effects of

acquisitions and dispositions:

Accounts receivable, trade ................................................. (57,133) (81,909) (42,581)

Other receivables ............................................................... 12,059 (8,330) 18,751

Prepaid expenses and other assets ..................................... (28,241) 9 3,975

Advances/payables to affiliates ......................................... 25,444 (934) (4,673)

Accounts payable .............................................................. (4,509) 65,886 10,489

Accrued liabilities .............................................................. (60,510) 19,577 (59,516)

Deferred revenue ............................................................... 9,500 (3,997) 6,216

Derivative contracts ........................................................... (111,895) (44,183) (52,408)

Net cash provided by operating activities ............................. 1,397,729 1,359,618 1,247,139

Cash flows from investing activities:

Capital expenditures .............................................................. (814,807) (823,245) (737,524)

Payments for acquisitions, net of cash acquired .................... (7,776) (1,356,500) 98

Proceeds from sale of equipment, net of costs of disposal .... 667 2,382 2,184

Contributions to Madison Square Garden ............................. - - (148)

Proceeds from sale of affiliate interests ................................ 750 6,990 -

Decrease in other investments ............................................... 50 133 1,131

Distributions from (contributions to) AMC Networks .......... - (99,614) 66,252

Decrease in restricted cash .................................................... - - 4,875

Additions to other intangible assets ...................................... (10,797) (2,175) (4,141)

Net cash used in investing activities .................................. (831,913) (2,272,029) (667,273)

See accompanying notes to consolidated financial statements.