Cablevision 2011 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-50

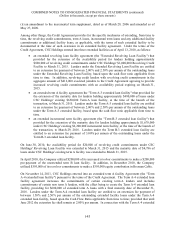

CSC Holdings 6-3/4% Senior Notes Due 2021

In November 2011, CSC Holdings issued $1,000,000 aggregate principal amount of 6-3/4% senior notes

due November 15, 2021 (the "2021 Notes"). CSC Holdings used the net proceeds of this offering, along

with proceeds from the Term A-4 extended loan facility, to repurchase portions of its 8-1/2% senior notes

due 2015, 6-3/4% senior notes due 2012 and 8-1/2% senior notes due 2014, and for general corporate

purposes. The 2021 Notes bear interest at a rate of 6-3/4% per annum and mature on November 15, 2021.

In connection with the issuance of these debt securities, the Company incurred deferred financing costs of

$21,433, which are being amortized to interest expense over the term of the 2021 Notes.

Repurchase of Debt Securities

In September 2011, CSC Holdings repurchased $52,683 aggregate principal amount of its outstanding 6-

3/4% senior notes due 2012 and $10,000 aggregate principal amount of its outstanding 8-1/2% senior

notes due 2014 with cash on hand. In connection with these repurchases, the Company recognized a loss

on extinguishment of debt of approximately $2,218, primarily representing the payments in excess of the

principal amount thereof and the write-off of the unamortized deferred financing costs and discounts

associated with these notes of approximately $810.

In December 2011, CSC Holdings repurchased $86,339 aggregate principal amount of its outstanding 6-

3/4% senior notes due 2012 with cash on hand. In connection with this repurchase, the Company

recognized a loss on extinguishment of debt of approximately $1,457 and the write-off of the unamortized

deferred financing costs associated with these notes of approximately $45.

Tender Offers for Debt (tender prices per note in dollars)

Cablevision

In April 2010, Cablevision commenced a cash tender offer for its outstanding $1,000,000 aggregate

principal amount of 8% senior notes due April 2012 ("Cablevision April 2012 Notes"). In connection

with the tender offer, the Company repurchased $973,175 aggregate principal amount of the Cablevision

April 2012 Notes in the second quarter of 2010. Tender premiums aggregating approximately $102,000,

along with other transaction costs of approximately $3,000 have been recorded in loss on extinguishment

of debt in the consolidated statement of income for the year ended December 31, 2010. In addition,

unamortized deferred financing costs related to the Cablevision April 2012 Notes aggregating

approximately $5,000 were written-off in 2010.

In connection with the tender offer described above, and in accordance with the Company's agreements

with Tribune Company, Cablevision redeemed all of its Cablevision April 2012 Notes held by Newsday

Holdings LLC with a face value of $682,000 for $758,968. Newsday Holdings LLC received $487,500

aggregate principal amount of Cablevision 7-3/4% senior notes due 2018 and $266,217 aggregate

principal amount of Cablevision 8% senior notes due 2020, plus accrued interest from April 15, 2010, all

in accordance with the terms of the Newsday $650,000 senior secured loan facility. As a result of the

redemption of the Cablevision April 2012 Notes, CSC Holdings recorded an increase to other member's

equity of $92,192 on a pre-tax basis.

In February 2009, Cablevision commenced a cash tender offer (the "Cablevision February Tender") for its

outstanding April 2009 Notes. Concurrently, CSC Holdings commenced a cash tender offer (the "CSC

Holdings February Tender") for (1) its outstanding $500,000 aggregate principal amount of 8-1/8% senior