Cablevision 2011 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-52

2012 Notes have been recorded in loss on extinguishment of debt in the consolidated statement of income

for the year ended December 31, 2009.

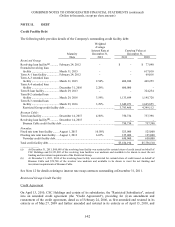

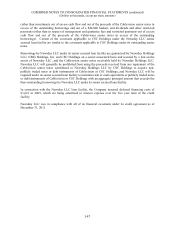

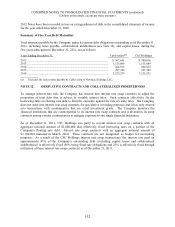

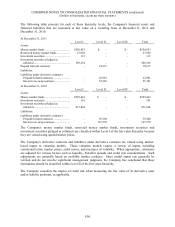

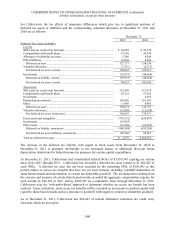

Summary of Five Year Debt Maturities

Total amounts payable by the Company under its various debt obligations outstanding as of December 31,

2011, including notes payable, collateralized indebtedness (see Note 12), and capital leases, during the

five years subsequent to December 31, 2011, are as follows:

Years Ending December 31, Cablevision(a) CSC Holdings

2012 ................................................................................................................. $ 367,641 $ 340,816

2013 ................................................................................................................. 1,133,089 1,133,089

2014 ................................................................................................................. 864,815 864,815

2015 ................................................................................................................. 297,346 297,346

2016 ................................................................................................................. 3,125,235 3,125,235

______________

(a) Excludes the senior notes payable by Cablevision to Newsday Holdings LLC.

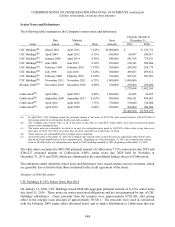

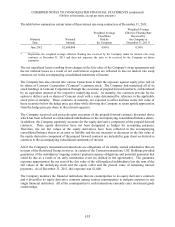

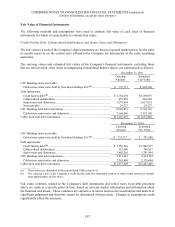

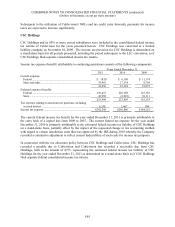

NOTE 12. DERIVATIVE CONTRACTS AND COLLATERALIZED INDEBTEDNESS

To manage interest rate risk, the Company has entered into interest rate swap contracts to adjust the

proportion of total debt that is subject to variable interest rates. Such contracts effectively fix the

borrowing rates on floating rate debt to limit the exposure against the risk of rising rates. The Company

does not enter into interest rate swap contracts for speculative or trading purposes and it has only entered

into transactions with counterparties that are rated investment grade. The Company monitors the

financial institutions that are counterparties to its interest rate swap contracts and it diversifies its swap

contracts among various counterparties to mitigate exposure to any single financial institution.

As of December 31, 2011, CSC Holdings was party to several interest rate swap contracts with an

aggregate notional amount of $2,600,000 that effectively fixed borrowing rates on a portion of the

Company's floating rate debt. Interest rate swap contracts with an aggregate notional amount of

$1,100,000 matured in March 2010. These contracts are not designated as hedges for accounting

purposes. As a result of the CSC Holdings interest rate swap transactions, the interest rate paid on

approximately 81% of the Company's outstanding debt (excluding capital leases and collateralized

indebtedness) is effectively fixed (56% being fixed rate obligations and 25% is effectively fixed through

utilization of these interest rate swap contracts) as of December 31, 2011.