Cablevision 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(78)

Restricted Group

As of December 31, 2011, CSC Holdings and those of its subsidiaries which conduct our cable television

video operations and high-speed data service, and our VoIP services operations in the New York

metropolitan service area, as well as Optimum Lightpath, our commercial data and voice service business,

comprise the "Restricted Group" as they are subject to the covenants and restrictions of the credit facility

and indentures governing the notes and debentures issued by CSC Holdings. In addition, the Restricted

Group is also subject to the covenants of the debt issued by Cablevision.

Sources of cash for the Restricted Group include primarily cash flow from the operations of the

businesses in the Restricted Group, borrowings under its credit facility and issuance of securities in the

capital markets and, from time to time, distributions or loans from its subsidiaries. The Restricted

Group's principal uses of cash include: capital spending, in particular, the capital requirements associated

with the growth of its services such as digital video, high-speed data and voice (including enhancements

to its service offerings such as a broadband wireless network (WiFi)); debt service, including distributions

made to Cablevision to service interest expense on its debt securities; distributions to Cablevision to fund

dividends paid to stockholders of CNYG Class A and CNYG Class B common stock; distributions to

Cablevision to fund share repurchases; other corporate expenses and changes in working capital; and

investments that it may fund from time to time. We currently expect that the net funding and investment

requirements of the Restricted Group for the next 12 months will be met with one or more of the

following: cash on hand, cash generated by operating activities and available borrowings under the

Restricted Group's credit facility.

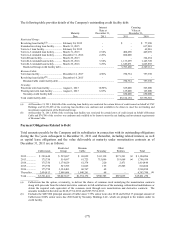

Amendment and Restatement of Credit Facility

Credit Agreement

On April 13, 2010, CSC Holdings and certain of its subsidiaries, the "Restricted Subsidiaries", entered

into an amended credit agreement (the "Credit Agreement"), providing for (i) an amendment and

restatement of the credit agreement, dated as of February 24, 2006, as first amended and restated in its

entirety as of May 27, 2009 and further amended and restated in its entirety as of April 13, 2010, and

(ii) an amendment to the incremental term supplement, dated as of March 29, 2006 and amended as of

May 27, 2009.

Among other things, the Credit Agreement provides for the specific mechanics of extending, from time to

time, the revolving credit commitments, term A loans, incremental term loans and any additional facility

commitments or additional facility loans, as applicable, with the terms of such extended facility to be

documented at the time of such extension in an extended facility agreement. Under the terms of the

Credit Agreement, CSC Holdings entered into three extended facilities as of April 13, 2010, as follows:

• an extended revolving loan facility agreement (the "Extended Revolving Loan Facility") that

provided for the extension of the availability period for lenders holding approximately

$820,000 of revolving credit commitments under CSC Holdings' $1,000,000 Revolving Credit

Facility to March 31, 2015. Lenders under the Extended Revolving Loan Facility are entitled

to an extension fee payment of between 2.00% and 2.50% per annum of the outstanding loans

under the Extended Revolving Loan Facility, based upon the cash flow ratio applicable from

time to time. In addition, revolving credit lenders with revolving credit commitments in the

aggregate amount of $412,000 executed joinders to the Credit Agreement agreeing to provide

increased revolving credit commitments with an availability period expiring on March 31,

2015.