Cablevision 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-45

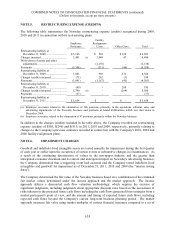

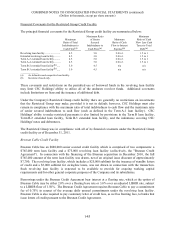

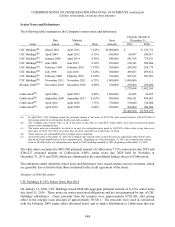

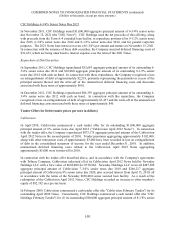

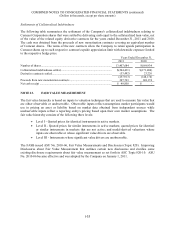

Financial Covenants for the Restricted Group Credit Facility

The principal financial covenants for the Restricted Group credit facility are summarized below:

Maximum

Ratio of Total

Indebtedness to

Cash Flow(a)

Maximum Ratio

of Senior

Secured

Indebtedness to

Cash Flow(a)

Minimum

Ratio of Cash

Flow to Interest

Expense(a)

Minimum

Ratio of Cash

Flow Less Cash

Taxes to Total

Debt(a)

Revolving loan facility ........................

.

4.5 3.0 2.0 to 1 1.5 to 1

Extended revolving loan facility .........

.

4.5 3.0 2.0 to 1 1.5 to 1

Term A-3 extended loan facility .........

.

4.5 3.0 2.0 to 1 1.5 to 1

Term A-4 extended loan facility .........

.

4.5 3.0 2.0 to 1 1.5 to 1

Term B-2 extended loan facility(b) .....

.

5.0 4.5 n/a n/a

Term B-3 extended loan facility(b) .....

.

5.0 4.5 n/a n/a

______________

(a) As defined in each respective loan facility.

(b) Incurrence based only.

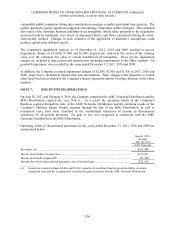

These covenants and restrictions on the permitted use of borrowed funds in the revolving loan facility

may limit CSC Holdings' ability to utilize all of the undrawn revolver funds. Additional covenants

include limitations on liens and the issuance of additional debt.

Under the Company's Restricted Group credit facility there are generally no restrictions on investments

that the Restricted Group may make, provided it is not in default; however, CSC Holdings must also

remain in compliance with the maximum ratio of total indebtedness to cash flow and the maximum ratio

of senior secured indebtedness to cash flow (each as defined in the Term A-1 loan facility). CSC

Holdings' ability to make restricted payments is also limited by provisions in the Term B loan facility,

Term B-2 extended loan facility, Term B-3 extended loan facility, and the indentures covering CSC

Holdings' notes and debentures.

The Restricted Group was in compliance with all of its financial covenants under the Restricted Group

credit facility as of December 31, 2011.

Bresnan Cable Credit Facility

Bresnan Cable has an $840,000 senior secured credit facility which is comprised of two components: a

$765,000 term loan facility and a $75,000 revolving loan facility (collectively, the "Bresnan Credit

Agreement"). In connection with the financing of the Bresnan acquisition in December 2010, the full

$765,000 amount of the term loan facility was drawn, net of an original issue discount of approximately

$7,700. The revolving loan facility, which includes a $25,000 sublimit for the issuance of standby letters

of credit and a $5,000 sublimit for swingline loans, was not drawn in connection with the transaction.

Such revolving loan facility is expected to be available to provide for ongoing working capital

requirements and for other general corporate purposes of the Company and its subsidiaries.

Borrowings under the Bresnan Credit Agreement bear interest at a floating rate, which at the option of

Bresnan Cable may be either 2.0% over a floating base rate or 3.0% over an adjusted LIBOR rate, subject

to a LIBOR floor of 1.50%. The Bresnan Credit Agreement requires Bresnan Cable to pay a commitment

fee of 0.75% in respect of the average daily unused commitments under the revolving loan facility.

Bresnan Cable is also required to pay customary letter of credit fees, as well as fronting fees, to banks that

issue letters of credit pursuant to the Bresnan Credit Agreement.