Cablevision 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(63)

rising rates. The losses on interest rate swap contracts are a result of a shift in the yield curve over the life

of the swap contracts.

Loss on extinguishment of debt and write-off of deferred financing costs amounted to $110,049 and

$73,457 for the years ended December 31, 2010 and 2009, respectively. The 2010 amount represents

premiums paid to repurchase a portion of Cablevision senior notes due April 2012 and related fees

associated with the tender offer and the write-off of unamortized deferred financing costs related to such

repurchases. The 2009 amount represents the premiums paid to repurchase a portion of Cablevision

senior notes due April 2009, CSC Holdings' senior notes due July 2009, and senior debentures due

August 2009 and related fees associated with the tender offers. They also included the write-off of

unamortized deferred financing costs related to such repurchases.

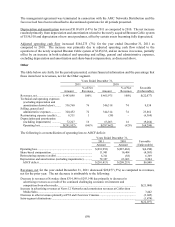

Income tax expense of $113,767 for the year ended December 31, 2010, reflecting an effective tax rate of

35%. In the second quarter of 2010, the Company recorded a nonrecurring tax benefit of $18,951 for an

increase in certain state and city net operating loss carry forwards pursuant to the finalization of an

examination with a state taxing authority. Absent this tax benefit, the effective tax rate for the year ended

December 31, 2010 would have been 41%. The Company recorded tax expense of $5,842 for the impact

of a change in the state rate used to measure deferred taxes principally due to the impact of the MSG

Distribution on February 9, 2010. A decrease in the valuation allowance relating to certain state net

operating loss carry forwards resulted in a tax benefit of $2,428. The Company recorded tax expense of

$1,202, including accrued interest, related to uncertain tax positions.

Income tax expense of $113,177 for the year ended December 31, 2009, reflected an effective tax rate of

48%. To address state income tax planning considerations, during 2009 certain subsidiary corporations

were converted to limited liability companies. In connection with such conversions, the Company

recorded tax expense of $9,095 relating to the elimination of certain state NOLs and credit carry forwards.

Absent this tax expense, the effective tax rate for the year ended December 31, 2009 would have been

44%. The Company recorded tax benefit of $6,764 for the impact of a change in the state rate used to

measure deferred taxes. A decrease in the valuation allowance relating to certain state net operating loss

carry forwards resulted in a tax benefit of $1,427. The Company recorded tax benefit of $105, including

accrued interest, related to uncertain tax positions.

For the years ended December 31, 2010 and 2009, the Company has fully offset federal taxable income

with a net operating loss carry forward. However, the Company is subject to the federal alternative

minimum tax and certain state and local income taxes that are payable quarterly.

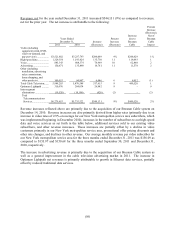

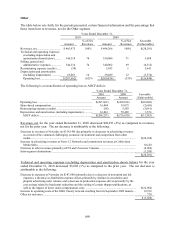

Income (loss) from discontinued operations

Income (loss) from discontinued operations, net of income taxes, for the years ended December 31, 2010

and 2009 reflects the following items:

Years Ended December 31,

2010 2009

Net operating results of Madison Square Garden, including transaction costs,

net of income taxes(a) ......................................................................................... $ (4,122) $ 35,856

Net operating results of AMC Networks, including transaction costs, net of

income taxes ....................................................................................................... 157,970 125,611

$153,848 $161,467

______________

(a) Includes operating results of the Madison Square Garden segment from January 1, 2010 through February 9, 2010,

the date of the MSG Distribution.