Cablevision 2011 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-54

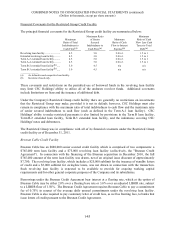

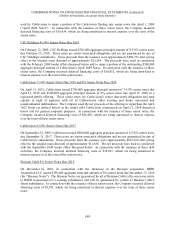

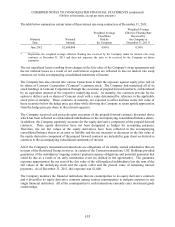

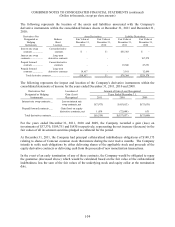

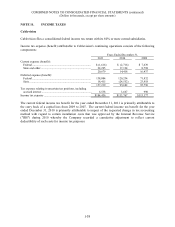

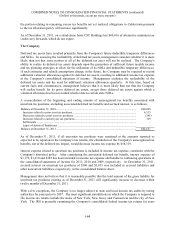

The following represents the location of the assets and liabilities associated with the Company's

derivative instruments within the consolidated balance sheets at December 31, 2011 and December 31,

2010:

Derivatives Not Asset Derivatives Liability Derivatives

Designated as

Hedging

Instruments

Balance

Sheet

Location

Fair Value at

December 31,

2011

Fair Value at

December 31,

2010

Fair Value at

December 31,

2011

Fair Value at

December 31,

2010

Interest rate swap

contracts ................

Current derivative

contracts $ - $ - $55,383 $ -

Interest rate swap

contracts .....................

Long-term

derivative contracts - - - 167,278

Prepaid forward

contracts ................

Current derivative

contracts - - 19,840 47,251

Prepaid forward

contracts ................

Long-term

derivative contracts 18,617 - 3,141 12,049

Total derivative contracts..............................

.

$18,617 $ - $78,364 $226,578

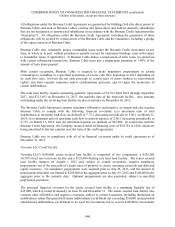

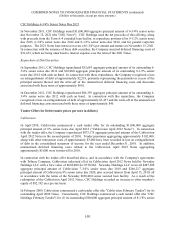

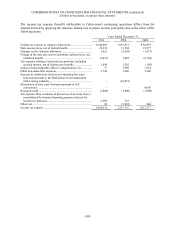

The following represents the impact and location of the Company's derivative instruments within the

consolidated statements of income for the years ended December 31, 2011, 2010 and 2009:

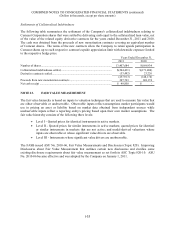

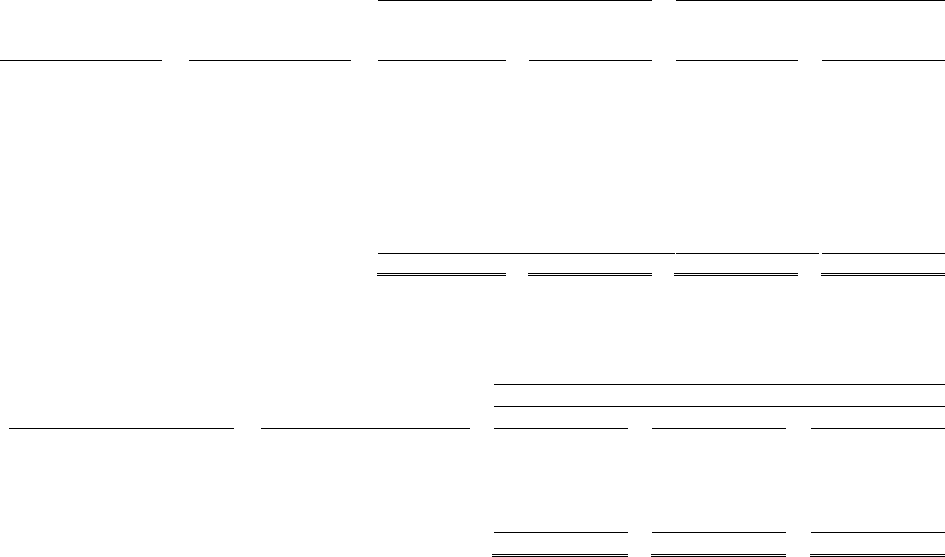

Derivatives Not Location of Amount of Gain (Loss) Recognized

Designated as Hedging Gain (Loss) Years Ended December 31,

Instruments Recognized 2011 2010 2009

Interest rate swap contracts .... Loss on interest rate

swap contracts, net $(7,973) $ (85,013) $(75,631)

Prepaid forward contracts ...... Gain (loss) on equity

derivative contracts, net 1,454 (72,044) 631

Total derivative contracts .....................................................

.

$(6,519) $(157,057) $(75,000)

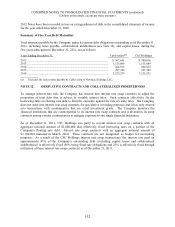

For the years ended December 31, 2011, 2010 and 2009, the Company recorded a gain (loss) on

investments of $37,370, $109,751 and $(430) respectively, representing the net increase (decrease) in the

fair values of all investment securities pledged as collateral for the period.

At December 31, 2011, the Company had principal collateralized indebtedness obligations of $148,175

relating to shares of Comcast common stock that mature during the next twelve months. The Company

intends to settle such obligations by either delivering shares of the applicable stock and proceeds of the

equity derivative contracts or delivering cash from the proceeds of new monetization transactions.

In the event of an early termination of any of these contracts, the Company would be obligated to repay

the guarantee (discussed above) which would be calculated based on the fair value of the collateralized

indebtedness less the sum of the fair values of the underlying stock and equity collar at the termination

date.