Cablevision 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-38

NOTE 8. PROPERTY, PLANT AND EQUIPMENT

Costs incurred in the construction of the Company's cable television system, including line extensions to,

and upgrade of, the Company's hybrid fiber-coaxial infrastructure and headend facilities are capitalized.

These costs consist of materials, subcontractor labor, direct consulting fees, and internal labor and related

costs associated with the construction activities. The internal costs that are capitalized consist of salaries

and benefits of the Company's employees and the portion of facility costs, including rent, taxes, insurance

and utilities, that supports the construction activities. These costs are depreciated over the estimated life

of the plant (10 to 25 years), and headend facilities (4 to 25 years). Costs of operating the plant and the

technical facilities, including repairs and maintenance, are expensed as incurred.

Costs incurred to connect businesses or residences that have not been previously connected to the

infrastructure or digital platform are also capitalized. These costs include materials, subcontractor labor,

internal labor to connect, provision and provide on-site and remote technical assistance and other related

costs associated with the connection activities. In addition, on-site and remote technical assistance during

the provisioning process for new digital product offerings are capitalized. The departmental activities

supporting the connection process are tracked through specific metrics, and the portion of departmental

costs that is capitalized is determined through a time weighted activity allocation of costs incurred based

on time studies used to estimate the average time spent on each activity. New connections are amortized

over the estimated useful lives of 5 years or 12 years for residence wiring and feeder cable to the home,

respectively. The portion of departmental costs related to reconnection, programming service up- and

down- grade, repair and maintenance, and disconnection activities are expensed as incurred.

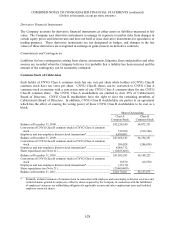

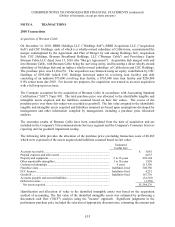

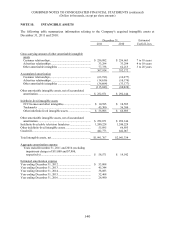

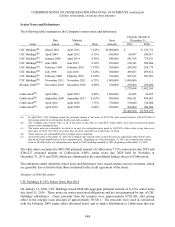

Property, plant and equipment (including equipment under capital leases) consist of the following assets,

which are depreciated or amortized on a straight-line basis over the estimated useful lives shown below:

December 31, Estimated

2011 2010 Useful Lives

Customer equipment ..............................................................

.

$ 2,371,584 $ 2,293,637 2 to 5 years

Headends and related equipment ...........................................

.

1,194,608 1,024,480 3 to 25 years

Central office equipment .......................................................

.

695,424 655,953 3 to 10 years

Infrastructure .........................................................................

.

5,682,079 5,558,949 3 to 25 years

Equipment and software ........................................................

.

1,373,891 1,255,762 2 to 10 years

Construction in progress (including materials and supplies) .

.

109,617 68,138

Furniture and fixtures ............................................................

.

156,944 160,221 3 to 12 years

Transportation equipment ......................................................

.

210,238 196,485 3 to 20 years

Buildings and building improvements ...................................

.

264,543 246,393 10 to 40 years

Leasehold improvements .......................................................

.

404,071 438,554 Term of lease

Land .......................................................................................

.

27,927 27,902

12,490,926 11,926,474

Less accumulated depreciation and amortization ..................

.

(9,221,694) (8,564,884)

$ 3,269,232 $ 3,361,590

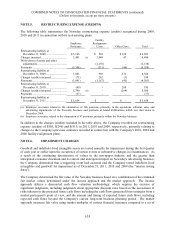

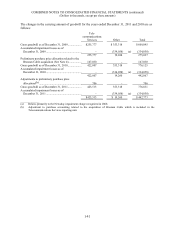

Depreciation expense on property, plant and equipment (including capital leases) for the years ended

December 31, 2011, 2010 and 2009 amounted to $945,403, $859,750 and $897,539 (including

impairments of $2,506, $1,803 and $1,436 in 2011, 2010 and 2009), respectively. In addition, the

Company acquired $78,073 and $54,414 of property and equipment that was accrued but unpaid at

December 31, 2011 and 2010, respectively.