Cablevision 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-34

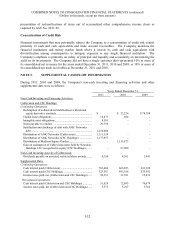

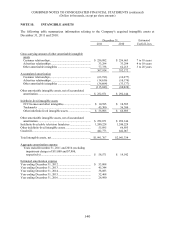

timing of estimated future cash flows attributable to the cable television franchises, identification of

appropriate continuing growth rate assumptions and attributing the appropriate attrition factor for

customer relationships. The projected cash flow assumptions considered contractual relationships,

customer attrition, eventual development of new technologies and market competition. The discount rates

used in the DCF analysis are intended to reflect the risk inherent in the projected future cash flows

generated by the respective intangible assets. This method includes a forecast of direct revenues and

costs associated with the respective intangible assets and charges for economic returns on tangible and

intangible assets utilized in cash flow generation. Net cash flows attributable to the identified intangible

assets are discounted to their present value at a rate commensurate with the perceived risk.

Estimates of fair value were determined using discounted cash flows and comparable market transactions.

These valuations are based on estimates and assumptions including projected future cash flows, discount

rate, determination of appropriate market comparables, average annual revenue per customer, number of

homes passed, operating margin, market penetration as a percentage of homes passed, and determination

of whether a premium or discount should be applied to comparables.

The estimates of expected useful lives take into consideration the effects of contractual relationships,

customer attrition, eventual development of new technologies and market competition.

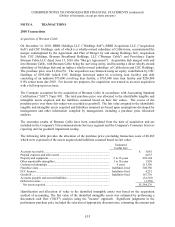

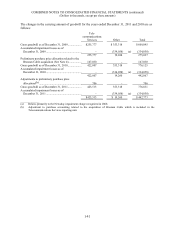

Revenues and loss from continuing operations before income taxes attributable to Bresnan Cable for the

period from December 14, 2010 through December 31, 2010 amounted to approximately $22,135 and

($20,610), respectively, which are included in the accompanying consolidated statement of income for the

year ended December 31, 2010.

Approximately $167,300 of goodwill recorded in connection with the Bresnan Cable acquisition is

deductible for tax purposes.

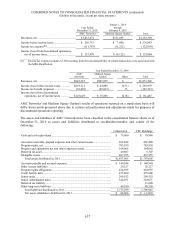

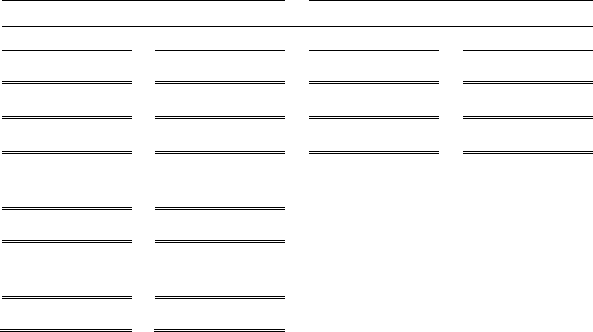

The unaudited pro forma revenues, income from continuing operations, net income, income per share

from continuing operations and net income per share for the years ended December 31, 2010 and 2009, as

if the Bresnan acquisition had occurred on January 1, 2009, are as follows:

Cablevision CSC Holdings

Years Ended December 31,

2010 2009 2010 2009

Revenues...................................................... $6,599,504 $6,316,061 $6,599,504 $6,316,061

Income from continuing operations ............. $ 202,927 $ 100,358 $ 416,256 $ 206,009

Net income ................................................... $ 356,775 $ 261,825 $ 570,104 $ 367,476

Basic income per share from continuing

operations ................................................. $0.69 $0.34

Basic net income per share .......................... $1.22 $0.90

Diluted income per share from continuing

operations ................................................. $0.67 $0.34

Diluted net income per share ....................... $1.18 $0.88