Cablevision 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(90)

stock and equity collar, calculated at the termination date. As of December 31, 2011, we did not have an

early termination shortfall relating to any of these contracts.

The underlying stock and the equity collars are carried at fair value on our consolidated balance sheets

and the collateralized indebtedness is carried at its accreted value. The carrying value of our

collateralized indebtedness amounted to $455,938 at December 31, 2011. At maturity, the contracts

provide for the option to deliver cash or shares of Comcast common stock, with a value determined by

reference to the applicable stock price at maturity.

As of December 31, 2011, the fair value and the carrying value of our holdings of Comcast common stock

aggregated $509,234. Assuming a 10% change in price, the potential change in the fair value of these

investments would be approximately $50,923. As of December 31, 2011, the net fair value and the

carrying value of the equity collar component of the equity derivative contracts entered into to partially

hedge the equity price risk of our holdings of Comcast common stock aggregated $4,364, a net payable

position. For the year ended December 31, 2011, we recorded a net gain on our outstanding equity

derivative contracts of $1,454 and recorded unrealized gains of $37,371 on our holdings of Comcast

common stock that we held during the period.

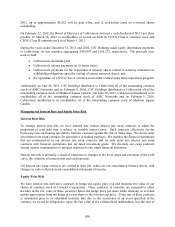

Fair Value of Equity Derivative Contracts

Fair value as of December 31, 2010, net payable position .................................................................... $(59,300)

Change in fair value, net ........................................................................................................................ 1,454

Settlement of contracts .......................................................................................................................... 53,482

Fair value as of December 31, 2011, net payable position .................................................................... $ (4,364)

The maturity, number of shares deliverable at the relevant maturity, hedge price per share, and the lowest

and highest cap prices received for each security monetized via an equity derivative prepaid forward

contract are summarized in the following table:

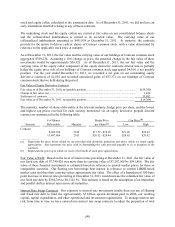

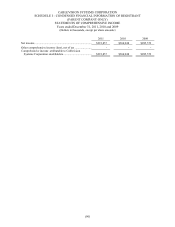

# of Shares Hedge Price Cap Price(b)

Security Deliverable Maturity per Share(a) Low High

Comcast

8,069,934 2012 $17.57 - $18.85 $21.09 $22.62

13,407,684 2013 $20.52 - $24.94 $24.63 $29.92

______________

(a) Represents the price below which we are provided with downside protection and above which we retain upside

appreciation. Also represents the price used in determining the cash proceeds payable to us at inception of the

contracts.

(b) Represents the price up to which we receive the benefit of stock price appreciation.

Fair Value of Debt: Based on the level of interest rates prevailing at December 31, 2011, the fair value of

our fixed rate debt of $7,749,426 was more than its carrying value of $7,207,560 by $541,866. The fair

value of these financial instruments is estimated based on reference to quoted market prices for these or

comparable securities. Our floating rate borrowings bear interest in reference to current LIBOR-based

market rates and thus their carrying values approximate fair value. The effect of a hypothetical 100 basis

point decrease in interest rates prevailing at December 31, 2011 would increase the estimated fair value of

our fixed rate debt by $364,768 to $8,114,194. This estimate is based on the assumption of an immediate

and parallel shift in interest rates across all maturities.

Interest Rate Swap Contracts: Our exposure to interest rate movements results from our use of floating

and fixed rate debt to fund the approximately $3 billion special dividend paid in 2006, our working

capital, capital expenditures, and other operational and investment requirements. To manage interest rate

risk, from time to time we have entered into interest rate swap contracts to adjust the proportion of total