Cablevision 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(86)

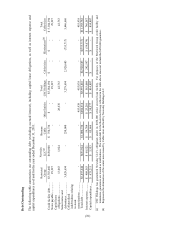

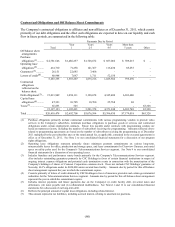

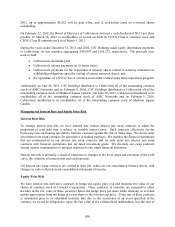

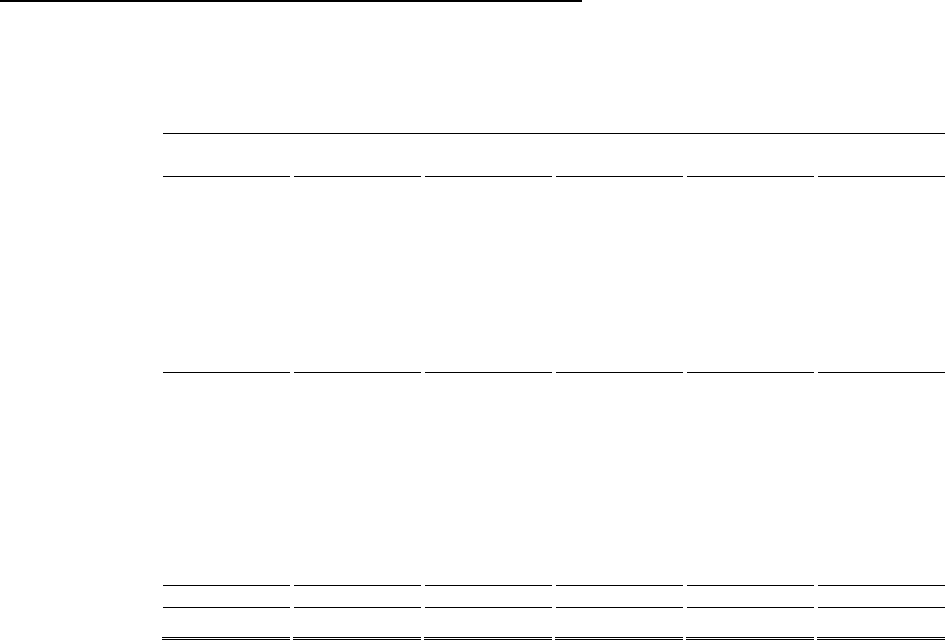

Contractual Obligations and Off Balance Sheet Commitments

The Company's contractual obligations to affiliates and non-affiliates as of December 31, 2011, which consist

primarily of our debt obligations and the effect such obligations are expected to have on our liquidity and cash

flow in future periods, are summarized in the following table:

Payments Due by Period

Total

Year

1

Years

2-3

Years

4-5

More than

5 years

Other

Off balance sheet

arrangements:

Purchase

obligations(1) .......... $ 4,781,546 $1,486,257 $1,728,672 $ 857,002 $ 709,615 $ -

Operating lease

obligations(2) .......... 414,710 71,258 141,367

116,430 85,655 -

Guarantees(3) ........... 26,151 22,685 3,466 - - -

Letters of credit(4) .... 60,948 7,087 1,711 52,150 - -

5,283,355 1,587,287 1,875,216

1,025,582 795,270 -

Contractual

obligations

reflected on the

balance sheet:

Debt obligations(5) ... 15,013,949 1,094,111 3,190,678 4,345,480 6,383,680 -

Capital lease

obligations(6) .......... 47,321 10,785 10,700 25,768 68 -

Taxes(7) .................... 65,853 525 - - - 65,328

15,127,123 1,105,421 3,201,378

4,371,248 6,383,748 65,328

Total ......................... $20,410,478 $2,692,708 $5,076,594 $5,396,830 $7,179,018 $65,328

______________

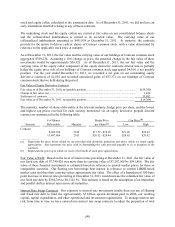

(1) Purchase obligations primarily include contractual commitments with various programming vendors to provide video

services to the Company's subscribers, minimum purchase obligations to purchase goods or services and contractual

obligations under certain employment contracts. Future fees payable under contracts with programming vendors are

based on numerous factors, including the number of subscribers receiving the programming. Amounts reflected above

related to programming agreements are based on the number of subscribers receiving the programming as of December

2011 multiplied by the per subscriber rates or the stated annual fee, as applicable, contained in the executed agreements in

effect as of December 31, 2011. See Note 2 to our consolidated financial statements for a discussion of our program

rights obligations.

(2) Operating lease obligations represent primarily future minimum payment commitments on various long-term,

noncancelable leases for office, production and storage space, and lease commitments for Clearview Cinemas, and rental

space on utility poles used for the Company's Telecommunications Services segment. See Note 9 to our consolidated

financial statements for a discussion of our operating leases.

(3) Includes franchise and performance surety bonds primarily for the Company's Telecommunications Services segment.

Also includes outstanding guarantees primarily by CSC Holdings in favor of certain financial institutions in respect of

ongoing interest expense obligations and potential early termination events in connection with the monetization of the

Company's holdings of shares of Comcast Corporation common stock. Does not include CSC Holdings' guarantee of

Newsday LLC's obligations under its $650,000 senior secured loan facility. Amounts due by period for this off-balance

sheet arrangement represent the year in which the commitment expires.

(4) Consists primarily of letters of credit obtained by CSC Holdings in favor of insurance providers and certain governmental

authorities for the Telecommunications Services segment. Amounts due by period for this off-balance sheet arrangement

represent the year in which the commitment expires.

(5) Includes interest payments and future payments due on the Company's (i) credit facility debt, (ii) senior notes and

debentures, (iii) notes payable and (iv) collateralized indebtedness. See Notes 11 and 12 to our consolidated financial

statements for a discussion of our long-term debt.

(6) Reflects the principal amount of capital lease obligations, including related interest.

(7) This amount represents tax liabilities, including accrued interest, relating to uncertain tax positions.