Cablevision 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(43)

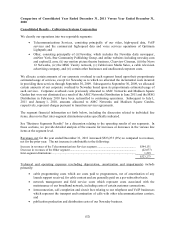

area and the U.S. Virgin Islands in the Optimum West service area) long distance, regional and local

calling, together with certain features for which the incumbent providers charge extra, are offered at one

low price. Due to our high penetration in the New York metropolitan service area (44.7% of serviceable

passings at December 31, 2011) and the impact of intense competition, our ability to maintain or increase

our existing customers and revenue in the future may continue to be negatively impacted.

The Telecommunications Services segment advertising and other revenues accounted for 2% of our

consolidated revenues, net of inter-segment eliminations, for the year ended December 31, 2011.

Optimum Lightpath, which operates in our New York metropolitan service area accounted for 4% of our

consolidated revenues, net of inter-segment eliminations, for the year ended December 31, 2011.

Optimum Lightpath operates in the most competitive business telecommunications market in the country

and competes against the very largest telecommunications companies - incumbent local exchange carriers

such as Verizon and AT&T, other competitive local exchange companies and long distance companies.

To the extent that dominant market leaders decide to reduce their prices, future success of our Optimum

Lightpath business may be negatively impacted. The trend in business communications has been shifting

from a wired voice medium to a wireless data medium. This trend could also negatively impact the future

growth of Optimum Lightpath if it were to accelerate.

Other

Our Other segment, which accounted for 6% of our consolidated revenues, net of inter-segment

eliminations, for the year ended December 31, 2011, includes the operations of (i) Newsday, which

includes the Newsday daily newspaper, amNew York, Star Community Publishing Group, and online

websites including newsday.com and exploreLI.com, (ii) our motion picture theatre business, Clearview

Cinemas, (iii) the News 12 Networks, our regional news programming services, (iv) the MSG Varsity

network, our network dedicated entirely to showcasing high school sports and activities, (v) our cable

television advertising company, Cablevision Media Sales Corporation ("Cablevision Media Sales"),

previously known as Rainbow Advertising Sales Corporation, and (vi) certain other businesses and

unallocated corporate costs.

Newsday

Newsday's revenue is derived primarily from the sale of advertising and the sale of newspapers

("circulation revenue"). For the year ended December 31, 2011, advertising revenues accounted for 71%

and circulation revenues accounted for approximately 28% of the total revenues of Newsday. Newsday's

circulation revenue is derived primarily from home delivery subscriptions of the Newsday newspaper, and

single copy sales of Newsday through local retail outlets.

Local economic conditions affect the levels of retail and classified newspaper advertising

revenue. General economic conditions, changes in consumer spending, auto sales, housing sales,

unemployment rates, job creation, readership and circulation levels and rates all impact demand for

advertising. For the year ended December 31, 2011, Newsday experienced a decline of $20,750 (9%) in

advertising revenues as compared to 2010. Circulation revenue for the year ended December 31, 2011

increased $958 (1%) over the same period in the prior year due primarily to the impact of home delivery

price increases.

Newsday and the newspaper industry generally have experienced significant declines in advertising and

circulation revenue as circulation and readership levels continue to be adversely affected by competition

from new media news formats and less reliance on newspapers by some consumers, particularly younger

consumers, as a source of news and classifieds. A prolonged decline in circulation levels would also have

a material adverse effect on the rate and volume of advertising revenues.