Cablevision 2011 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-68

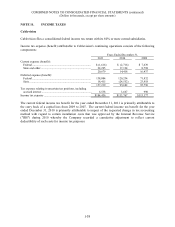

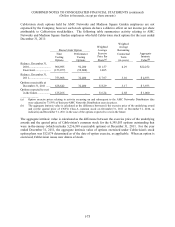

Plan Assumptions for Defined Benefit Plans

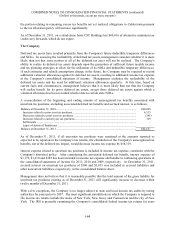

Weighted-average assumptions used to determine net periodic cost (made at the beginning of the year)

and benefit obligations (made at the end of the year) for the Cablevision defined benefit plans are as

follows:

Weighted-Average Assumptions

Net Periodic Benefit Cost for the

Years Ended December 31,

Benefit Obligations at

December 31,

2011 2010 2009 2011 2010

Discount rate ..................

.

5.25% 5.17% 5.58% 4.32% 5.25%

Rate of increase in

future compensation

levels ..........................

.

3.50% 3.50% 4.50% 3.50% 3.50%

Expected rate of return

on plan assets

(Pension Plan only) ....

.

5.04% 4.38% 4.00% N/A N/A

In 2011, 2010 and 2009, the discount rates used by the Company in calculating the net periodic benefit

cost were determined (based on the expected duration of the benefit payments for the pension plans) from

the Buck Consultants' Discount Rate Model (which is developed by examining the yields on selected

highly rated corporate bonds), to select a rate at which the Company believed the pension benefits could

be effectively settled.

In December 2010, the Pension Plan's actuary completed an experience study of the demographic

assumptions used in the actuarial valuation of the Pension Plan. The assumptions reviewed included the

expected rates of termination and retirement, as well as the assumed timing of benefit commencements

and lump sum utilization rates. Based on this analysis, the actuary developed revised demographic

assumptions, which were utilized in calculating the benefit obligations as of December 31, 2010. The use

of the revised assumptions resulted in an increase in the Pension Plan's expected duration of benefit

payments as compared to the previous years. Although overall discount rates decreased in 2010 as

compared to 2009, the increase in the expected duration of benefit payments yielded a higher discount

rate as compared to the discount rate under the Pension Plan's historical expected duration of benefit

payments.

The Company's expected long-term return on plan assets is based on a periodic review and modeling of

the plan's asset allocation structure over a long-term horizon. Expectations of returns for each asset class

are the most important of the assumptions used in the review and modeling and are based on

comprehensive reviews of historical data, forward looking economic outlook, and economic/financial

market theory. The expected long-term rate of returns were selected from within the reasonable range of

rates determined by (a) historical real returns, net of inflation, for the asset classes covered by the

investment policy, and (b) projections of inflation over the long-term period during which benefits are

payable to plan participants.