Cablevision 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-44

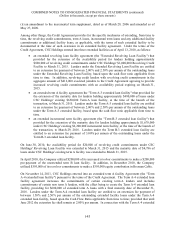

loan facility, the Company incurred deferred financing costs of $4,490, which are being amortized to

interest expense over the term of the facility. A portion of the proceeds from the Term A-4 extended loan

facility was used to repay the outstanding balances of the Term A-1 loan facility and Term B loan facility.

In connection with the repayments, the Company recorded a write-off of the remaining unamortized

deferred financing costs associated with the Term A-1 loan facility and Term B loan facility of

approximately $470.

The Restricted Group credit facility requires the Restricted Group to pay a commitment fee of 0.50% in

respect of the average daily unused commitments under the revolving loan facilities.

Loans under the Restricted Group credit facility are direct obligations of CSC Holdings, guaranteed by

most Restricted Group subsidiaries and secured by the pledge of the stock of most Restricted Group

subsidiaries.

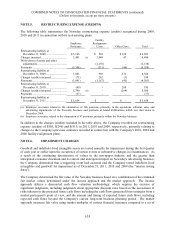

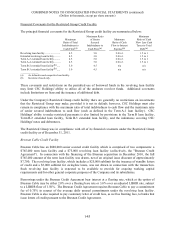

Credit Facility Repayments

The revolver has no required interim repayments. The Term A-3 extended loan facility is subject to

quarterly repayments of approximately $12,142 through March 2012, approximately $18,213 beginning

in June 2012 through March 2013, approximately $24,284 beginning in June 2013 through March 2014

and approximately $54,640 beginning in June 2014 through its maturity date in March 2015. The

principal amount of the Term A-4 extended loan facility will be repaid beginning in March 2013 in

quarterly installments of $7,500 through December 31, 2013, $15,000 through December 31, 2015,

$30,000 through September 30, 2016, and a final principal repayment of $360,000 on December 31,

2016. The Term B-2 extended loan facility is subject to quarterly repayments of approximately $3,007

through December 2015 and a final payment of approximately $1,085,585 upon maturity in March 2016.

The Term B-3 extended loan facility is subject to quarterly repayments of approximately $4,196 through

December 2015 and a final payment of approximately $1,581,933 upon maturity in March 2016. The

borrowings under the Restricted Group credit facility may be repaid without penalty at any time.

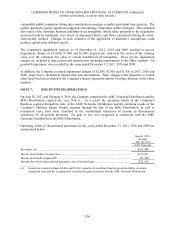

AMC Networks Distribution

In connection with the AMC Networks Distribution, AMC Networks issued senior notes and senior

secured term loans under its new senior secured credit facility to the Company as partial consideration for

the transfer of certain businesses to AMC Networks. The Company exchanged the AMC Networks

senior notes and senior secured term loans in satisfaction and discharge of $1,250,000 outstanding

indebtedness under its Restricted Group revolving loan and extended revolving loan facilities.