Cablevision 2011 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-56

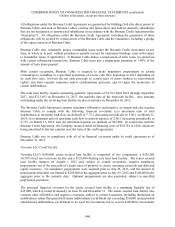

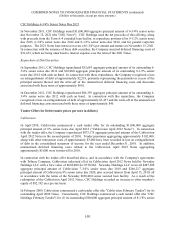

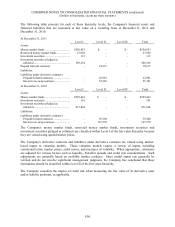

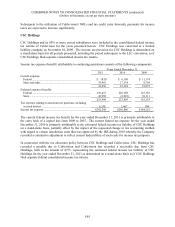

The following table presents for each of these hierarchy levels, the Company's financial assets and

financial liabilities that are measured at fair value on a recurring basis at December 31, 2011 and

December 31, 2010:

At December 31, 2011:

Level I Level II Level III Total

Assets:

Money market funds .................................. $556,853 $ - $ - $556,853

Restricted money market funds .................. 27,920 - - 27,920

Investment securities .................................. 113 - - 113

Investment securities pledged as

collateral .................................................. 509,234 - - 509,234

Prepaid forward contracts - 18,617 - 18,617

Liabilities:

Liabilities under derivative contracts:

Prepaid forward contracts ....................... - 22,981 - 22,981

Interest rate swap contracts ..................... - 55,383 - 55,383

At December 31, 2010:

Level I Level II Level III Total

Assets:

Money market funds .................................. $259,463 $ - $ - $259,463

Investment securities .................................. 101 - - 101

Investment securities pledged as

collateral .................................................. 471,864 - - 471,864

Liabilities:

Liabilities under derivative contracts:

Prepaid forward contracts ....................... - 59,300 - 59,300

Interest rate swap contracts ..................... - 167,278 - 167,278

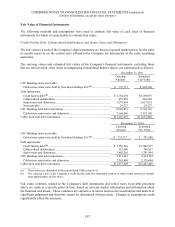

The Company's money market funds, restricted money market funds, investment securities and

investment securities pledged as collateral are classified within Level I of the fair value hierarchy because

they are valued using quoted market prices.

The Company's derivative contracts and liabilities under derivative contracts are valued using market-

based inputs to valuation models. These valuation models require a variety of inputs, including

contractual terms, market prices, yield curves, and measures of volatility. When appropriate, valuations

are adjusted for various factors such as liquidity, bid/offer spreads and credit risk considerations. Such

adjustments are generally based on available market evidence. Since model inputs can generally be

verified and do not involve significant management judgment, the Company has concluded that these

instruments should be classified within Level II of the fair value hierarchy.

The Company considers the impact of credit risk when measuring the fair value of its derivative asset

and/or liability positions, as applicable.