Cablevision 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(79)

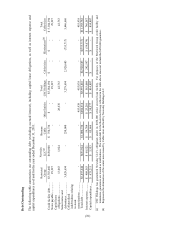

• an extended term A facility agreement (the "Term A-3 extended loan facility") that provided for

the extension of the maturity date for lenders holding approximately $480,000 of loans under

CSC Holdings' existing $650,000 Term A loan facility, at the time of the launch of the

transaction, to March 31, 2015. Lenders under the Term A-3 extended loan facility are entitled

to an extension fee payment of between 2.00% and 2.50% per annum of the outstanding loans

under the Term A-3 extended facility, based upon the cash flow ratio applicable from time to

time.

• an extended incremental term facility agreement (the "Term B-3 extended loan facility") that

provided for the extension of the maturity date for lenders holding approximately $1,678,000

under CSC Holdings' existing $2,200,000 incremental term facility, at the time of the launch of

the transaction, to March 29, 2016. Lenders under the Term B-3 extended loan facility are

entitled to an extension fee payment of 3.00% per annum of the outstanding loans under the

Term B-3 extended loan facility.

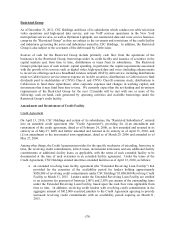

On June 30, 2010, the availability period for $20,000 of revolving credit commitments under CSC

Holdings' Revolving Loan Facility was extended to March 31, 2015 and the maturity date of $4,786 of

loans under CSC Holdings' existing term A facility was extended to March 31, 2015.

In April 2010, the Company utilized $200,000 of its increased revolver commitments to make a $200,000

pre-payment of the unextended term B credit facility. In addition, in December 2010, the Company

utilized $395,000 of its revolver commitments to make a $395,000 equity contribution in Bresnan Cable.

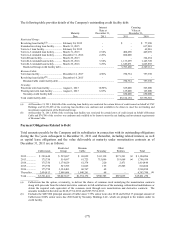

On November 14, 2011, CSC Holdings entered into an extended term A facility Agreement (the "Term

A-4 extended loan facility") pursuant to the terms of the Credit Agreement. The Term A-4 extended loan

facility agreement increases the commitments of certain existing term A lenders and includes

commitments of certain new term A lenders, with the effect being to create the Term A-4 extended loan

facility, providing for $600,000 of extended term A loans with a final maturity date of December 31,

2016. Lenders under the Term A-4 extended loan facility are entitled to an extension fee payment of

between 1.50% and 2.50% per annum of the outstanding extended facility loans under the Term A-4

extended loan facility, based upon the Cash Flow Ratio applicable from time to time; provided that until

June 2012 the extension fee shall remain at 2.00% per annum. In connection with the Term A-4 extended

loan facility, the Company incurred deferred financing costs of $4,490, which are being amortized to

interest expense over the term of the facility. A portion of the proceeds from the Term A-4 extended loan

facility was used to repay the outstanding balances of the Term A-1 loan facility and Term B loan facility.

In connection with the repayments, the Company recorded a write-off of the remaining unamortized

deferred financing costs associated with the Term A-1 loan facility and Term B loan facility of

approximately $470.

Loans under the Restricted Group credit facility are direct obligations of CSC Holdings, guaranteed by

most Restricted Group subsidiaries and secured by the pledge of the stock of most Restricted Group

subsidiaries.

Credit Facility Repayments

The revolver has no required interim repayments. The Term A-3 extended loan facility is subject to

quarterly repayments of approximately $12,142 through March 2012, approximately $18,213 beginning

in June 2012 through March 2013, approximately $24,284 beginning in June 2013 through March 2014

and approximately $54,640 beginning in June 2014 through its maturity date in March 2015. The

principal amount of the Term A-4 extended loan facility will be repaid beginning in March 2013 in

quarterly installments of $7,500 through December 31, 2013, $15,000 through December 31, 2015,