Cablevision 2011 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-81

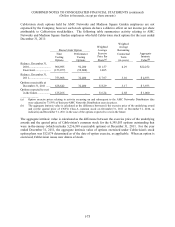

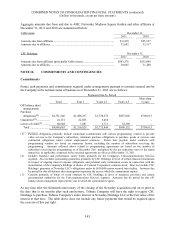

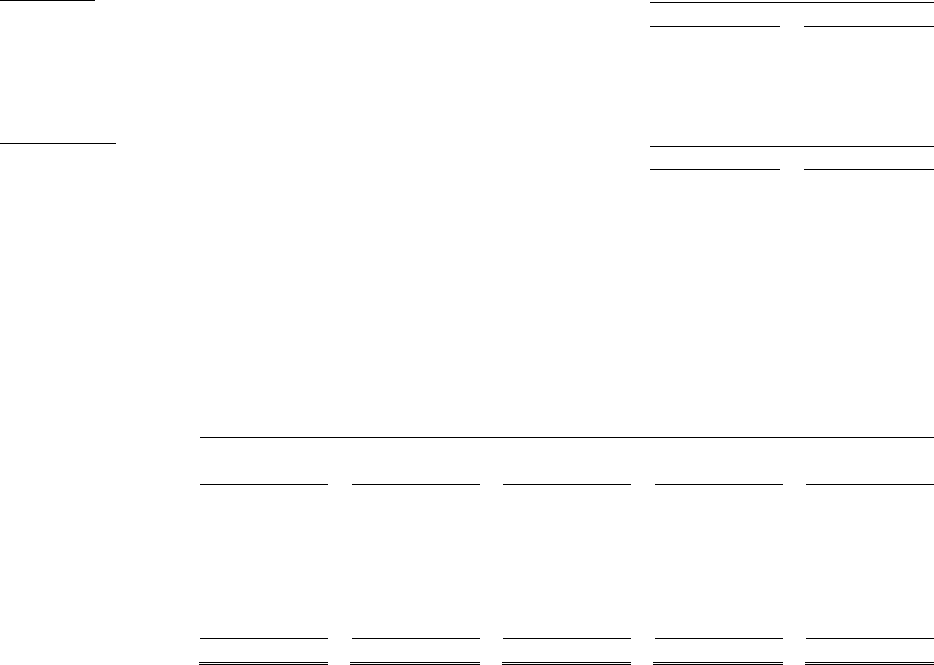

Aggregate amounts due from and due to AMC Networks, Madison Square Garden and other affiliates at

December 31, 2011 and 2010 are summarized below:

Cablevision December 31,

2011 2010

Amounts due from affiliates .................................................................................... $ 6,818 $25,127

Amounts due to affiliates ........................................................................................ 32,682 31,517

CSC Holdings December 31,

2011 2010

Amounts due from affiliates (principally Cablevision) ........................................... $503,576 $515,698

Amounts due to affiliates ........................................................................................ 30,065 31,200

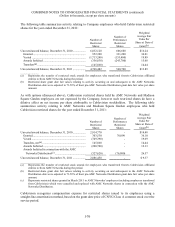

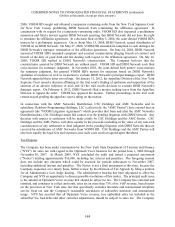

NOTE 18. COMMITMENTS AND CONTINGENCIES

Commitments

Future cash payments and commitments required under arrangements pursuant to contracts entered into by

the Company in the normal course of business as of December 31, 2011 are as follows:

Payments Due by Period

Total Year 1 Years 2-3 Years 4-5

More than

5 years

Off balance sheet

arrangements:

Purchase

obligations(1) .............

.

$4,781,546 $1,486,257 $1,728,672 $857,002 $709,615

Guarantees(2) .................

.

26,151 22,685 3,466 - -

Letters of credit(3) .........

.

60,948 7,087 1,711 52,150 -

Total ...........................

.

$4,868,645 $1,516,029 $1,733,849 $909,152 $709,615

______________

(1) Purchase obligations primarily include contractual commitments with various programming vendors to provide

video services to the Company's subscribers, minimum purchase obligations to purchase goods or services and

contractual obligations under certain employment contracts. Future fees payable under contracts with

programming vendors are based on numerous factors, including the number of subscribers receiving the

programming. Amounts reflected above related to programming agreements are based on the number of

subscribers receiving the programming as of December 2011 multiplied by the per subscriber rates or the stated

annual fee, as applicable, contained in the executed agreements in effect as of December 31, 2011.

(2) Includes franchise and performance surety bonds primarily for the Company's Telecommunications Services

segment. Also includes outstanding guarantees primarily by CSC Holdings in favor of certain financial institutions

in respect of ongoing interest expense obligations and potential early termination events in connection with the

monetization of the Company's holdings of shares of Comcast Corporation common stock. Does not include CSC

Holdings' guarantee of Newsday LLC's obligations under its $650,000 senior secured loan facility. Amounts due

by period for this off-balance sheet arrangement represent the year in which the commitment expires.

(3) Consists primarily of letters of credit obtained by CSC Holdings in favor of insurance providers and certain

governmental authorities for the Telecommunications Services segment. Amounts due by period for this off-

balance sheet arrangement represent the year in which the commitment expires.

At any time after the thirteenth anniversary of the closing of the Newsday acquisition and on or prior to

the date that is six months after such anniversary, Tribune Company will have the right to require CSC

Holdings to purchase Tribune Company's entire interest in Newsday Holdings LLC at the fair value of the

interest at that time. The table above does not include any future payments that would be required upon

the exercise of this put right.