Cablevision 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(54)

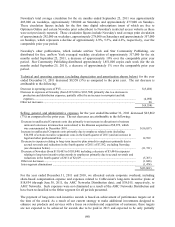

Gain (loss) on equity derivative contracts, net for the years ended December 31, 2011 and 2010 of $1,454

and $(72,044), respectively, consists of unrealized and realized gains and losses due to the change in fair

value of the Company's equity derivative contracts relating to the Comcast common stock owned by the

Company. The effects of these gains and losses are partially offset by the losses or gains on investment

securities pledged as collateral, which are included in gain (loss) on investments, net discussed above.

Loss on interest rate swap contracts, net amounted to $7,973 and $85,013 for the years ended

December 31, 2011 and 2010, respectively. These interest rate swap contracts effectively fix the

borrowing rates on a portion of the Company's floating rate debt to limit the exposure against the risk of

rising rates. The losses on interest rate swap contracts are a result of a shift in the yield curve over the life

of the swap contracts.

Loss on extinguishment of debt and write-off of deferred financing costs amounted to $92,692 and

$110,049 for the years ended December 31, 2011 and 2010, respectively. The 2011 amount represents

amounts paid in excess of the aggregate principal amount to repurchase CSC Holdings senior notes due

April 2012, April 2014 and June 2015 and related fees associated with the tender offers and the write-off

of unamortized deferred financing costs and discounts related to such repurchases. The 2010 amount

represents premiums paid to repurchase a portion of Cablevision senior notes due April 2012 and related

fees associated with the tender offer and the write-off of unamortized deferred financing costs related to

such repurchases.

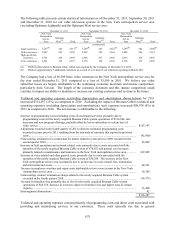

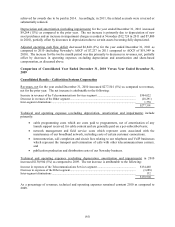

Income tax expense of $184,436 for the year ended December 31, 2011, reflected an effective tax rate of

44%. The Company recorded a tax benefit of $1,015 due to the impact of a change in the state rate used

to measure deferred taxes. An increase in the valuation allowance relating to certain state net operating

loss carry forwards resulted in tax expense of $1,822. The Company recorded tax expense of $1,699,

including accrued interest, related to uncertain tax positions. In addition, the exclusion of the pretax loss

of an entity that is not consolidated for income tax purposes resulted in additional tax expense of $2,509.

The Company recorded income tax expense of $113,767 for the year ended December 31, 2010,

reflecting an effective tax rate of 35%. In the second quarter of 2010, the Company recorded a

nonrecurring tax benefit of $18,951 for an increase in certain state and city net operating loss carry

forwards pursuant to the finalization of an examination with a state taxing authority. Absent this tax

benefit, the effective tax rate for the year ended December 31, 2010 would have been 41%. The

Company recorded tax expense of $5,842 for the impact of a change in the state rate used to measure

deferred taxes principally due to the impact of the MSG Distribution on February 9, 2010. A decrease in

the valuation allowance relating to certain state net operating loss carry forwards resulted in a tax benefit

of $2,428. The Company recorded tax expense of $1,202, including accrued interest, related to uncertain

tax positions.

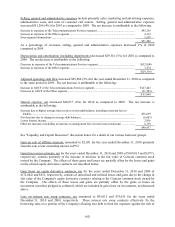

For the year ended December 31, 2010, the Company has fully offset federal taxable income with a net

operating loss carry forward. However, the Company is subject to the federal alternative minimum tax

and certain state and local income taxes that are payable quarterly.