Cablevision 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(69)

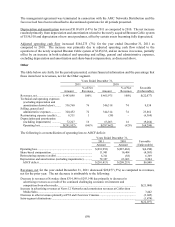

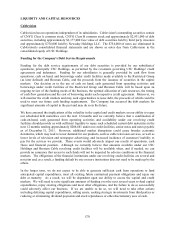

Selling, general, and administrative expenses increased $4,312 for the year ended December 31, 2010 as

compared to the prior year. The net increase is attributable to the following:

Decrease in unallocated Corporate costs due primarily to a net increase in allocations to business

units of $10,664 and lower costs related to former employees of $11,168 .......................................

.

$(21,832)

Charges to Madison Square Garden in 2010 for transition services .....................................................

.

(6,096)

Increase in costs at MSG Varsity, Cablevision Media Sales and News 12 Networks ..........................

.

19,591

Transaction costs related to the Bresnan Cable acquisition ..................................................................

.

8,924

Other net increases ................................................................................................................................

.

4,970

Intra-segment eliminations ...................................................................................................................

.

(1,245)

$ 4,312

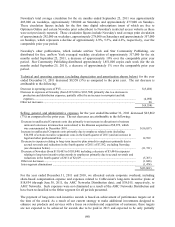

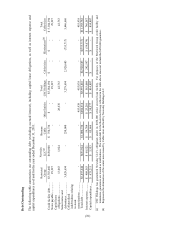

For the year ended December 31, 2010 and 2009, we allocated certain corporate overhead, including

share-based compensation expense and expenses related to Cablevision's long-term incentive plans, of

$38,015 and $34,275, respectively, to AMC Networks. Such expenses will not be eliminated as a result

of the AMC Networks Distribution and have been reclassified to the Other segment for all periods

presented.

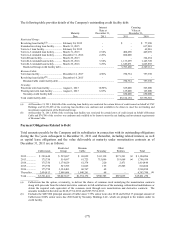

Depreciation and amortization (including impairments) for the year ended December 31, 2010 increased

$3,574 (6%) as compared to the prior year. The net increase is primarily due to an impairment charge

recorded at Newsday of $7,800 in 2010 relating to the estimated fair value of Newsday's indefinite-lived

intangible trademark, as compared to $2,000 in the prior year, and depreciation of new asset purchases,

partially offset by a decrease in depreciation due to certain assets becoming fully depreciated and a

decrease in depreciation expense of $4,025 related to two Newsday printing presses that were phased out

of service in mid-year 2009.

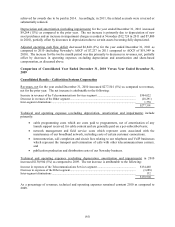

Restructuring expense for the year ended December 31, 2009 amounted to $5,583. This is comprised of

$3,590 in severance and other related costs associated with the elimination of 98 staff positions and

$3,174 related to a lease modification termination penalty and other lease and contract exit costs at

Newsday. Offsetting these expenses are restructuring credits of $1,181 related to adjustments in

severance and facility realignment provisions recorded in prior restructuring plans.

Adjusted operating cash flow deficit increased $31,583 (18%) for the year ended December 31, 2010 as

compared to 2009 (including AOCF of Newsday of $19,349 and $21,775 in 2010 and 2009, respectively).

The increase was due primarily to a decrease in revenues, net, partially offset by a decrease in operating

expenses excluding depreciation and amortization and share-based compensation, as discussed above.