Cablevision 2011 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

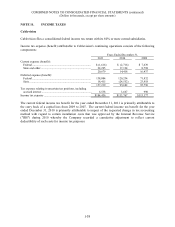

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-55

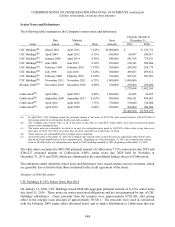

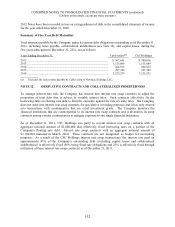

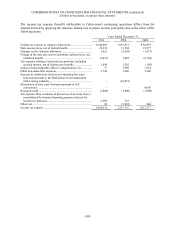

Settlements of Collateralized Indebtedness

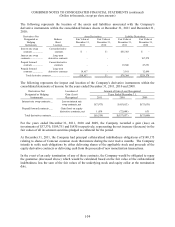

The following table summarizes the settlement of the Company's collateralized indebtedness relating to

Comcast Corporation shares that were settled by delivering cash equal to the collateralized loan value, net

of the value of the related equity derivative contracts for the years ended December 31, 2011 and 2010.

The cash was obtained from the proceeds of new monetization contracts covering an equivalent number

of Comcast shares. The terms of the new contracts allow the Company to retain upside participation in

Comcast shares up to each respective contract's upside appreciation limit with downside exposure limited

to the respective hedge price.

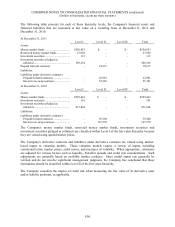

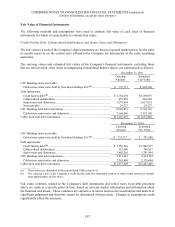

NOTE 13. FAIR VALUE MEASUREMENT

The fair value hierarchy is based on inputs to valuation techniques that are used to measure fair value that

are either observable or unobservable. Observable inputs reflect assumptions market participants would

use in pricing an asset or liability based on market data obtained from independent sources while

unobservable inputs reflect a reporting entity's pricing based upon their own market assumptions. The

fair value hierarchy consists of the following three levels:

• Level I - Quoted prices for identical instruments in active markets.

• Level II - Quoted prices for similar instruments in active markets; quoted prices for identical

or similar instruments in markets that are not active; and model-derived valuations whose

inputs are observable or whose significant value drivers are observable.

• Level III - Instruments whose significant value drivers are unobservable.

The FASB issued ASU No. 2010-06, Fair Value Measurements and Disclosures (Topic 820): Improving

Disclosures about Fair Value Measurement that outlines certain new disclosures and clarifies some

existing disclosure requirements about fair value measurement as set forth in ASC Topic 820-10. ASU

No. 2010-06 became effective and was adopted by the Company on January 1, 2011.

Years Ended December 31,

2011 2010

N

umber of shares ..................................................................................................

.

13,407,684 8,069,934

Collateralized indebtedness settled .......................................................................

.

$(204,431) $(171,400)

Derivative contracts settled...................................................................................

.

(53,482) 23,226

(257,913) (148,174)

Proceeds from new monetization contracts ..........................................................

.

307,763 148,174

N

et cash receip

t

....................................................................................................

.

$ 49,850 $ -