Cablevision 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-69

Plan Assets and Investment Policy

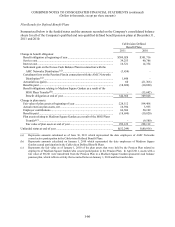

The weighted average asset allocations of the Pension Plan at December 31, 2011 and 2010 were as

follows:

Plan Assets at December 31,

2011 2010

Asset Class:

Fixed income securities ........................................................................................... 93% 91%

Cash equivalents and other(a) .................................................................................. 7 9

100% 100%

______________

(a) Represents investment in mutual funds that invest primarily in money market securities.

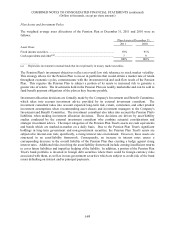

The Pension Plan's investment objectives reflect an overall low risk tolerance to stock market volatility.

This strategy allows for the Pension Plan to invest in portfolios that would obtain a market rate of return

throughout economic cycles, commensurate with the investment risk and cash flow needs of the Pension

Plan. This requires the Pension Plan to subject a portion of its assets to increased risk to generate a

greater rate of return. The investments held in the Pension Plan are readily marketable and can be sold to

fund benefit payment obligations of the plan as they become payable.

Investment allocation decisions are formally made by the Company's Investment and Benefit Committee,

which takes into account investment advice provided by its external investment consultant. The

investment consultant takes into account expected long-term risk, return, correlation, and other prudent

investment assumptions when recommending asset classes and investment managers to the Company's

Investment and Benefit Committee. The investment consultant also takes into account the Pension Plan's

liabilities when making investment allocation decisions. These decisions are driven by asset/liability

studies conducted by the external investment consultant who combine actuarial considerations and

strategic investment advice. The major categories of the Pension Plan Trust's assets are cash equivalents

and bonds which are marked-to-market on a daily basis. Due to the Pension Plan Trust's significant

holdings in long-term government and non-government securities, the Pension Plan Trust's assets are

subjected to interest-rate risk; specifically, a rising interest rate environment. However, these assets are

structured in an asset/liability framework. Consequently, an increase in interest rates causes a

corresponding decrease to the overall liability of the Pension Plan thus creating a hedge against rising

interest rates. Additional risks involving the asset/liability framework include earning insufficient returns

to cover future liabilities and imperfect hedging of the liability. In addition, a portion of the Pension Plan

Trust's bond portfolio is invested in foreign debt securities where there could be foreign currency risks

associated with them, as well as in non-government securities which are subject to credit-risk of the bond

issuer defaulting on interest and/or principal payments.