Cablevision 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-25

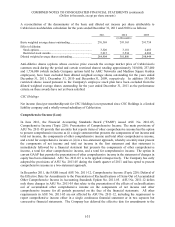

2010 and 2009, the amount of franchise fees included as a component of net revenue aggregated

$147,498, $134,730, and $127,716, respectively.

Technical and Operating Expenses

Costs of revenue related to sales of services are classified as "technical and operating" expenses in the

accompanying statements of income.

Programming Costs

Programming expenses for the Company's cable television business included in the Telecommunications

Services segment relate to fees paid to programming distributors to license the programming distributed

to subscribers. This programming is acquired generally under multi-year distribution agreements, with

rates usually based on the number of subscribers that receive the programming. There have been periods

when an existing affiliation agreement has expired and the parties have not finalized negotiations of either

a renewal of that agreement or a new agreement for certain periods of time. In substantially all these

instances, the Company continues to carry and pay for these services until execution of definitive

replacement agreements or renewals. The amount of programming expense recorded during this interim

period is based on the Company's estimates of the ultimate contractual agreement expected to be reached,

which is based on several factors, including previous contractual rates, customary rate increases and the

current status of negotiations. Such estimates are adjusted as negotiations progress until new

programming terms are finalized.

In addition, the Company's cable television business has received, or may receive, incentives from

programming distributors for carriage of the distributors' programming. The Company generally

recognizes these incentives as a reduction of programming costs in technical and operating expense,

generally over the term of the programming agreement.

Advertising Expenses

Advertising costs are charged to expense when incurred and are recorded to selling, general and

administrative expenses in the accompanying statements of income. Advertising costs amounted to

$177,694, $164,314 and $157,777 for the years ended December 31, 2011, 2010 and 2009, respectively.

Share-Based Compensation

Share-based compensation expense recognized during the period is based on the fair value of the portion

of share-based payment awards that are ultimately expected to vest.

For options and performance based option awards, Cablevision recognizes compensation expense based

on the estimated grant date fair value using the Black-Scholes valuation model using a straight-line

amortization method. For restricted shares and restricted stock units, Cablevision recognizes

compensation expense using a straight-line amortization method, based on the grant date price of CNYG

Class A common stock over the vesting period, except for restricted stock units granted to non-employee

directors which vest 100% and are expensed at the date of grant. For stock appreciation rights,

Cablevision recognizes compensation expense based on the estimated fair value at each reporting period

using the Black-Scholes valuation model.

For CSC Holdings, share-based compensation expense is recognized in its statements of income for the

years ended December 31, 2011, 2010 and 2009 based on allocations from Cablevision.