Cablevision 2011 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-67

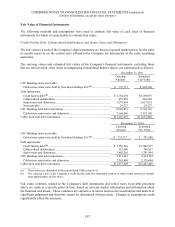

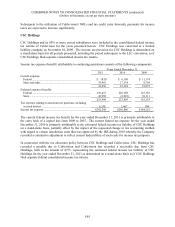

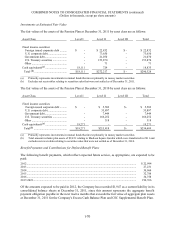

Other pre-tax changes in plan assets and benefit obligations recognized in other comprehensive loss for

the years ended December 31, 2011 and 2010 are as follows:

Cablevision Defined

Benefit Plans

2011 2010

Actuarial gain ......................................................................................................... $(5,517) $(19,186)

Recognized actuarial loss ....................................................................................... (1,988) (5,831)

Transfer of unrecognized actuarial loss to Madison Square Garden as a result

of the MSG Plans Transfer .................................................................................. - (3,712)

Transfer of unrecognized prior service cost to Madison Square Garden as a

result of the MSG Plans Transfer ........................................................................ - (155)

$(7,505) $(28,884)

Approximately $401 in accumulated other comprehensive loss is expected to be recognized as a

component of net periodic benefit cost during the next fiscal year relating to the defined benefit plans.

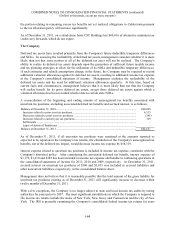

The Company's net funded status relating to its defined benefit plans at December 31, 2011 is as follows:

Cablevision Defined Benefit Plans ........................................................................................................ $(52,244)

Less: Current portion ............................................................................................................................. 1,947

Long-term defined benefit plan obligations ........................................................................................... $(50,297)

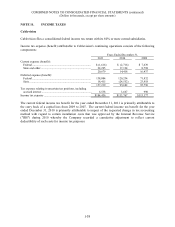

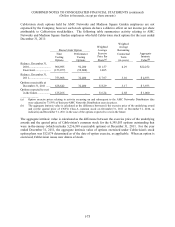

Components of the net periodic benefit cost (credit), recorded primarily in selling, general and

administrative expenses, for the Cablevision defined benefit plans for the years ended December 31,

2011, 2010 and 2009, are as follows:

Cablevision Defined Benefit Plans

2011* 2010* 2009*

Service cost ............................................................................... $ 39,253 $40,786 $40,862

Interest cost ............................................................................... 16,321 14,354 13,359

Expected return on plan assets, net ........................................... (10,816) (6,116) (3,707)

Recognized prior service cost ................................................... - - 26

Recognized actuarial loss ......................................................... 1,583 5,831 5,265

Settlement loss ......................................................................... - - 55

Net periodic benefit cost ........................................................... $ 46,341 $54,855 $55,860

______________

* Includes net periodic benefit costs of approximately $2,332 and $4,988 for the years ended December 31, 2011, and

2010, respectively, relating to AMC Networks employees, and approximately $9,965 for the year ended

December 31, 2009 relating to Madison Square Garden and AMC Networks employees, that are reflected as a

component of discontinued operations in the Company's consolidated financial statements.