Cablevision 2011 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-70

Investments at Estimated Fair Value

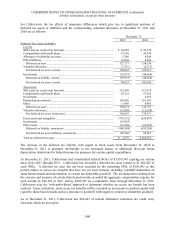

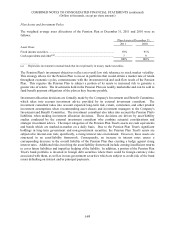

The fair values of the assets of the Pension Plan at December 31, 2011 by asset class are as follows:

______________

(a) Primarily represents investments in mutual funds that invest primarily in money market securities.

(b) Excludes net receivables relating to securities sales that were not settled as of December 31, 2011.

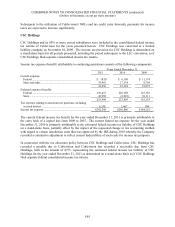

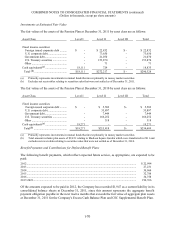

The fair values of the assets of the Pension Plan at December 31, 2010 by asset class are as follows:

______________

(a) Primarily represents investments in mutual funds that invest primarily in money market securities.

(b) Total amount includes plan assets of $9,451 relating to Madison Square Garden which were transferred in 2011 and

excludes net receivables relating to securities sales that were not settled as of December 31, 2010.

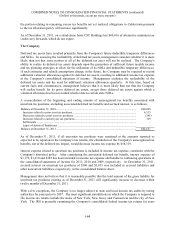

Benefit Payments and Contributions for Defined Benefit Plans

The following benefit payments, which reflect expected future service, as appropriate, are expected to be

paid:

2012 ........................................................................................................................................................ $ 22,994

2013 ........................................................................................................................................................ 27,231

2014 ........................................................................................................................................................ 30,964

2015 ........................................................................................................................................................ 32,788

2016 ........................................................................................................................................................ 34,758

2017-2021 ............................................................................................................................................... 199,766

Of the amounts expected to be paid in 2012, the Company has recorded $1,947 as a current liability in its

consolidated balance sheets at December 31, 2011, since this amount represents the aggregate benefit

payment obligation payable in the next twelve months that exceeds the fair value of aggregate plan assets

at December 31, 2011 for the Company's Excess Cash Balance Plan and CSC Supplemental Benefit Plan.

Asset Class Level I Level II Level III Total

Fixed income securities:

Foreign issued corporate debt .........

.

$ - $ 22,832 $ - $ 22,832

U.S. corporate debt ..........................

.

- 73,650 - 73,650

Government debt ..............................

.

- 21,070 - 21,070

U.S. Treasury securities ...................

.

- 153,870 - 153,870

Other ................................................

.

- 71 - 71

Cash equivalents(a) .............................

.

18,111 724 - 18,835

Total (b) ............................................

.

$18,111 $272,217 $ - $290,328

Asset Class Level I Level II Level III Total

Fixed income securities:

Foreign issued corporate debt .........

.

$ - $ 5,502 $- $ 5,502

U.S. corporate debt ..........................

.

35,897 35,897

Government debt ..............................

.

- 7,449 - 7,449

U.S. Treasury securities ...................

.

- 166,252 - 166,252

Other ................................................

.

- 318 - 318

Cash equivalents(a) .............................

.

19,271 - - 19,271

Total(b) .............................................

.

$19,271 $215,418 $- $234,689