Cablevision 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(74)

Net cash provided by operating activities of discontinued operations amounted to $390,732 for the year

ended December 31, 2009. The 2009 cash provided by operating activities resulted primarily from

income of $329,307 before depreciation and amortization, non-cash items of $361,687 and an increase in

accounts payable and other liabilities of $29,191. Partially offsetting these increases were decreases in

cash of $258,695 resulting from the acquisition of and payment of obligations relating to program rights

and an increase in current and other assets of $70,758.

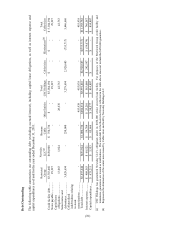

Net Cash Used in Investing Activities

Net cash used in investing activities of discontinued operations for the year ended December 31, 2011

was $4,086 compared to $22,591 for the year ended December 31, 2010. The 2011 investing activities

consisted of capital expenditures of $4,340, partially offset by other net cash receipts of $254.

Net cash used in investing activities of discontinued operations for the year ended December 31, 2010

was $22,591 compared to $75,237 for the year ended December 31, 2009. The 2010 investing activities

consisted of capital expenditures of $23,240, partially offset by other net cash receipts of $649.

Net cash used in investing activities of discontinued operations for the year ended December 31, 2009

was $75,237 and consisted of capital expenditures of $72,780 and other net cash payments of $2,457.

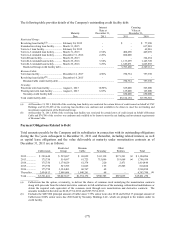

Net Cash Used in Financing Activities

Net cash used in financing activities of discontinued operations for the year ended December 31, 2011

was $2,857 compared to $207,670 for the year ended December 31, 2010. The 2011 financing activities

consisted primarily of net proceeds from credit facility debt of $667,364, partially offset by the repayment

and repurchase of $638,365 of senior notes, additions to deferred financing costs of $23,900 and

payments on capital lease obligations of $2,242.

Net cash used in financing activities of discontinued operations for the year ended December 31, 2010

was $207,670 compared to $192,890 for the year ended December 31, 2009. The 2010 financing

activities consist of the repayment of a note payable to Madison Square Garden of $190,000, net

repayments of credit facility debt of $105,000, additions to deferred financing of $8,069 and payments on

capital lease obligations of $4,215, partially offset by net contributions from Cablevision of $99,614.

Net cash used in financing activities of discontinued operations for the year ended December 31, 2009

was $192,890 and consisted of net bank repayments of $120,000, net distributions to Cablevision of

$66,104, payments on capital lease obligations of $4,256 and additions to deferred financing of $2,530.