Cablevision 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

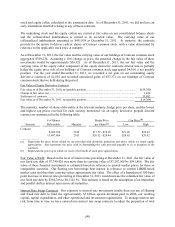

(84)

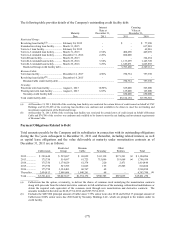

The principal financial covenant for the senior secured loan facility is a minimum liquidity test of

$25,000, which is tested bi-annually on June 30 and December 31. The senior secured loan facility also

contains other affirmative and negative covenants, subject to certain exceptions, including limitations on

indebtedness (other than permitted senior indebtedness (as defined) not exceeding $50,000 and permitted

subordinated indebtedness (as defined) to be used for investments not to exceed $100,000), investments

(other than investments out of excess cash flow and out of the proceeds of the Cablevision senior notes in

excess of the outstanding borrowings and out of a $40,000 basket), and dividends and other restricted

payments (other than in respect of management and guarantee fees and restricted payments out of excess

cash flow and out of the proceeds of the Cablevision senior notes in excess of the outstanding

borrowings). Certain of the covenants applicable to CSC Holdings under the Newsday LLC senior

secured loan facility are similar to the covenants applicable to CSC Holdings under its outstanding senior

notes.

Borrowings by Newsday LLC under its senior secured loan facility are guaranteed by Newsday Holdings

LLC, NMG Holdings, Inc. and CSC Holdings on a senior unsecured basis and secured by a lien on the

assets of Newsday LLC, and the Cablevision senior notes receivable held by Newsday Holdings LLC.

Newsday LLC will generally be prohibited from using the proceeds received from any repayment of the

Cablevision senior notes contributed to Newsday Holdings LLC by CSC Holdings to acquire non-

publicly traded notes or debt instruments of Cablevision or CSC Holdings, and Newsday LLC will be

required under its senior secured loan facility to maintain cash or cash equivalents or publicly traded notes

or debt instruments of Cablevision or CSC Holdings with an aggregate principal amount that exceeds the

then-outstanding borrowings by Newsday LLC under its senior secured loan facility.

Newsday LLC was in compliance with all of its financial covenants under its credit agreement as of

December 31, 2011.

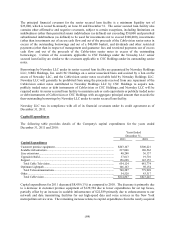

Capital Expenditures

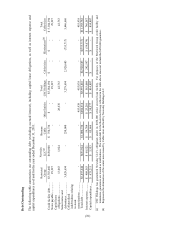

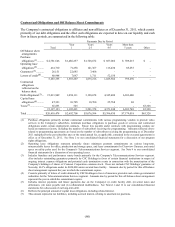

The following table provides details of the Company's capital expenditures for the years ended

December 31, 2011 and 2010:

Years Ended

December 31,

2011 2010

Capital Expenditures

Customer premise equipment .................................................................................

.

$203,107 $300,221

Scalable infrastructure ............................................................................................

.

217,066 180,562

Line extensions .......................................................................................................

.

40,240 36,137

Upgrade/rebuild ......................................................................................................

.

37,013 19,701

Support ...................................................................................................................

.

156,698 145,153

Total Cable Television ........................................................................................

.

654,124 681,774

Optimum Lightpath ................................................................................................

.

106,163 98,154

Total Telecommunications ..................................................................................

.

760,287 779,928

Other .......................................................................................................................

.

54,520 43,317

Total Cablevision ................................................................................................

.

$814,807 $823,245

Capital expenditures for 2011 decreased $8,438 (1%) as compared to 2010. The decrease is primarily due

to a decrease in customer premise equipment of $129,594 due to lower expenditures for set top boxes,

partially offset by an increase in scalable infrastructure of $22,589 primarily due to enhancements to our

network and data transmitting facilities for our high-speed data and voice services in the New York

metropolitan service area. The remaining increase relates to capital expenditures from the newly acquired