Berkshire Hathaway 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.What we are looking for is described on page 25. If you have an acquisition candidate that fits,

call me – day or night. And then watch me shatter a stained glass window.

* * * * * * * * * * * *

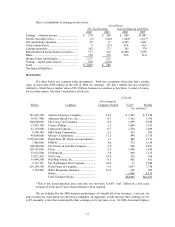

Now, let’ s examine the four major operating sectors of Berkshire. Lumping their financial figures

together impedes analysis. So we’ ll look at them as four separate businesses, starting with the all–

important insurance group.

Insurance

Next month marks the 40th anniversary of our entrance into the insurance business. It was on

March 9, 1967, that Berkshire purchased National Indemnity and its companion company, National Fire &

Marine, from Jack Ringwalt for $8.6 million.

Jack was a long-time friend of mine and an excellent, but somewhat eccentric, businessman. For

about ten minutes every year he would get the urge to sell his company. But those moods – perhaps

brought on by a tiff with regulators or an unfavorable jury verdict – quickly vanished.

In the mid-1960s, I asked investment banker Charlie Heider, a mutual friend of mine and Jack’ s,

to alert me the next time Jack was “in heat.” When Charlie’ s call came, I sped to meet Jack. We made a

deal in a few minutes, with me waiving an audit, “due diligence” or anything else that would give Jack an

opportunity to reconsider. We just shook hands, and that was that.

When we were due to close the purchase at Charlie’ s office, Jack was late. Finally arriving, he

explained that he had been driving around looking for a parking meter with some unexpired time. That was

a magic moment for me. I knew then that Jack was going to be my kind of manager.

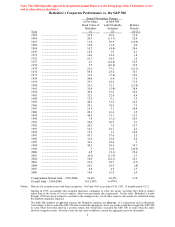

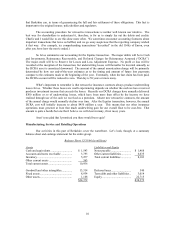

When Berkshire purchased Jack’ s two insurers, they had “float” of $17 million. We’ ve regularly

offered a long explanation of float in earlier reports, which you can read on our website. Simply put, float

is money we hold that is not ours but which we get to invest.

At the end of 2006, our float had grown to $50.9 billion, and we have since written a huge

retroactive reinsurance contract with Equitas – which I will describe in the next section – that boosts float

by another $7 billion. Much of the gain we’ ve made has come through our acquisition of other insurers,

but we’ ve also had outstanding internal growth, particularly at Ajit Jain’ s amazing reinsurance operation.

Naturally, I had no notion in 1967 that our float would develop as it has. There’ s much to be said for just

putting one foot in front of the other every day.

The float from retroactive reinsurance contracts, of which we have many, automatically drifts

down over time. Therefore, it will be difficult for us to increase float in the future unless we make new

acquisitions in the insurance field. Whatever its size, however, the all-important cost of Berkshire’ s float

over time is likely to be significantly below that of the industry, perhaps even falling to less than zero.

Note the words “over time.” There will be bad years periodically. You can be sure of that.

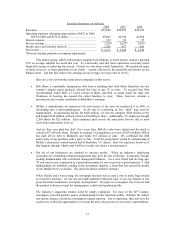

In 2006, though, everything went right in insurance – really right. Our managers – Tony Nicely

(GEICO), Ajit Jain (B-H Reinsurance), Joe Brandon and Tad Montross (General Re), Don Wurster

(National Indemnity Primary), Tom Nerney (U.S. Liability), Tim Kenesey (Medical Protective), Rod

Eldred (Homestate Companies and Cypress), Sid Ferenc and Steve Menzies (Applied Underwriters), John

Kizer (Central States) and Don Towle (Kansas Bankers Surety) – simply shot the lights out. When I recite

their names, I feel as if I’ m at Cooperstown, reading from the Hall of Fame roster. Of course, the overall

insurance industry also had a terrific year in 2006. But our managers delivered results generally superior to

those of their competitors.

7