Berkshire Hathaway 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

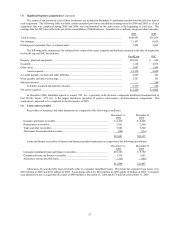

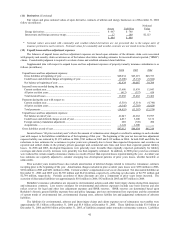

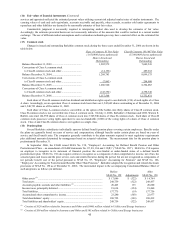

(18) Pension plans (Continued)

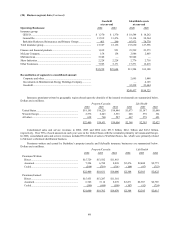

Benefit payments over the next ten years, which reflect expected future service as appropriate, are expected to be paid as

follows (in millions): 2007 - $390; 2008 - $399; 2009 - $411; 2010 - $414; 2011 - $432; and 2012 to 2016 - $2,456.

Weighted average interest rate assumptions used in determining projected benefit obligations were as follows. These rates are

substantially the same as the weighted average rates used in determining the net periodic pension expense.

2006 2005

Discount rate ....................................................................................................................................................... 5.7 5.7

Expected long-term rate of return on plan assets................................................................................................. 6.9 6.4

Rate of compensation increase ............................................................................................................................ 4.4 4.4

Many Berkshire subsidiaries sponsor defined contribution retirement plans, such as 401(k) or profit sharing plans. Employee

contributions to the plans are subject to regulatory limitations and the specific plan provisions. Berkshire subsidiaries may match

these contributions up to levels specified in the plans, and may make additional discretionary contributions as determined by

management. The total expenses related to employer contributions for these plans were $498 million, $395 million and $338 million

for the years ended December 31, 2006, 2005 and 2004, respectively.

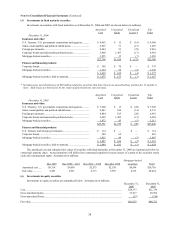

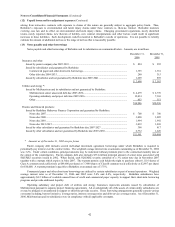

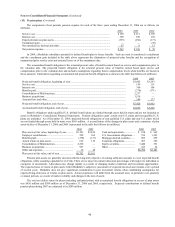

(19) Supplemental cash flow information

A summary of supplemental cash flow information for each of the three years ending December 31, 2006 is presented in the

following table (in millions).

2006 2005 2004

Cash paid during the year for:

Income taxes............................................................................................................................. $4,959 $2,695 $2,674

Interest of finance and financial products businesses................................................................ 514 484 495

Interest of utilities and energy businesses................................................................................. 937 — —

Interest of insurance and other businesses ................................................................................ 195 149 146

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses ........................................... 12,727 2,163 72

Fixed maturity securities sold offset by decrease in directly related repurchase

agreements ......................................................................................................................... 460 4,693 2,075

Value of equity securities and warrants exchanged for equity securities .................................. — 5,877 585

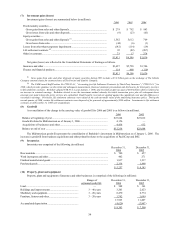

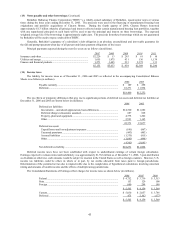

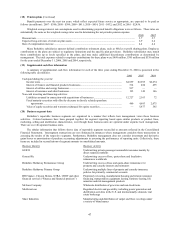

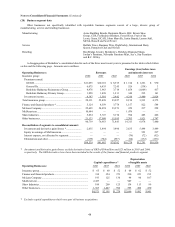

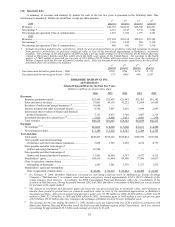

(20) Business segment data

Berkshire’ s reportable business segments are organized in a manner that reflects how management views those business

activities. Certain businesses have been grouped together for segment reporting based upon similar products or product lines,

marketing, selling and distribution characteristics, even though those business units are operated under separate local management.

There are over 40 separate business units.

The tabular information that follows shows data of reportable segments reconciled to amounts reflected in the Consolidated

Financial Statements. Intersegment transactions are not eliminated in instances where management considers those transactions in

assessing the results of the respective segments. Furthermore, Berkshire management does not consider investment and derivative

gains/losses or amortization of purchase accounting adjustments in assessing the performance of reporting units. Collectively, these

items are included in reconciliations of segment amounts to consolidated amounts.

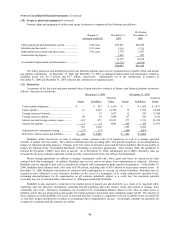

Business Identity Business Activity

GEICO Underwriting private passenger automobile insurance mainly by

direct response methods

General Re Underwriting excess-of-loss, quota-share and facultative

reinsurance worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance for

property and casualty insurers and reinsurers

Berkshire Hathaway Primary Group Underwriting multiple lines of property and casualty insurance

policies for primarily commercial accounts

BH Finance, Clayton Homes, XTRA, CORT and other

financial services (“Finance and financial products”)

Proprietary investing, manufactured housing and related consumer

financing, transportation equipment leasing, furniture leasing, life

annuities and risk management products

McLane Company Wholesale distribution of groceries and non-food items

MidAmerican Regulated electric and gas utility, including power generation and

distribution activities in the U.S. and internationally; domestic real

estate brokerage

Shaw Industries Manufacturing and distribution of carpet and floor coverings under

a variety of brand names