Berkshire Hathaway 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

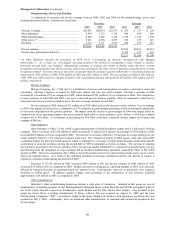

Management’s Discussion (Continued)

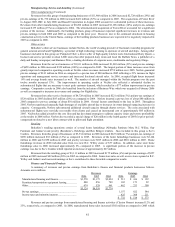

Insurance — Underwriting (Continued)

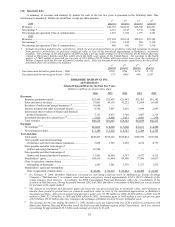

Property/casualty

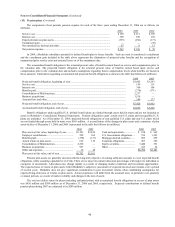

Premiums written declined in 2006 from amounts written in 2005 which declined from amounts written in 2004. The

declines in North America were attributable to significant reductions in finite risk business and to a lesser extent lower casualty

treaty volume. International premiums written in 2006 were essentially unchanged from 2005. In local currencies, international

premiums written increased 2% over 2005 primarily due to increased volume of property business at Faraday offset by a

significant reduction in finite risk business. The overall comparative declines in written premiums in the past three years

reflected continued underwriting discipline by rejecting transactions where pricing is deemed inadequate with respect to the risk.

Approximately half of the comparative declines in the North American premiums earned in 2006 and 2005 versus the

previous year were attributable to policy cancellations and non-renewals exceeding new contracts as well as a slight impact from

rate changes. The remainder of the comparative declines were primarily due to the significant decreases in finite risk business.

In local currencies, 2006 international premiums earned declined 3.5% from 2005, which declined 12.3% compared with 2004.

Similar to North America, the decline in premiums earned in the international segment over the past three years generally

reflects reductions in premium volume due to the non-renewal of unprofitable business and the decrease in finite risk business.

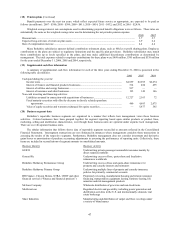

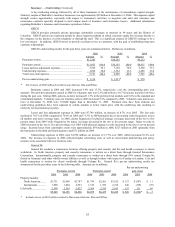

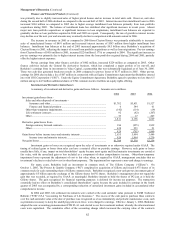

The North American business produced an underwriting gain of $127 million in 2006 compared with an underwriting

loss of $307 million in 2005 and an underwriting gain of $11 million in 2004. Underwriting results in 2006 included $348

million in underwriting gains from property business partially offset by $221 million in underwriting losses from

casualty/workers’ compensation business and includes legal and estimated settlement costs associated with the ongoing

regulatory investigations of the finite risk business. The property business produced underwriting gains of $209 million for the

2006 accident year, and $139 million from favorable run-off of prior year property losses. The current accident year results

benefited from a lack of catastrophe losses. The underwriting losses from casualty/workers’ compensation business in 2006

included (1) $137 million in discount accretion and deferred charge amortization, (2) increases in prior years’ workers’

compensation reserves of $103 million arising from the continuing escalation of medical utilization and cost inflation and (3)

increases in asbestos and environmental reserves of $58 million. These losses were somewhat offset by net decreases in prior

years’ reserves for other casualty coverages.

The 2005 underwriting loss included approximately $480 million in losses from three major hurricanes in 2005

(Katrina, Rita and Wilma). Otherwise, underwriting results for the 2005 accident year generally benefited from re-pricing efforts

and improved coverage terms and conditions put into place over the preceding few years. Underwriting results in 2005 also

included losses attributable to prior accident years consisting of net reserve increases on workers’ compensation of $228 million,

asbestos and environmental mass tort exposures of $102 million and $136 million in discount accretion on workers’

compensation reserves and deferred charge amortization on retroactive reinsurance coverages. Offsetting these prior years’

losses were $419 million in gains from net reserve decreases in other casualty lines and property lines.

The net underwriting gain of $11 million in 2004 consisted of current accident year gains of $166 million partially

offset by $155 million in prior accident years’ losses. The 2004 current accident year results benefited from a one-time reduction

of $70 million in underwriting expenses from the curtailment of certain pension benefits. In 2004, prior accident years’ losses

included reserve increases on casualty and workers’ compensation claims of $729 million and $110 million in discount accretion

and deferred charge amortization offset by $307 million of reserve reductions for prior years’ property losses (primarily in World

Trade Center loss exposures) and $377 million of gains from contract commutations and settlements.

The International property/casualty businesses produced an underwriting gain of $246 million in 2006 compared with

underwriting losses of $138 million and $93 million in 2005 and 2004, respectively. Underwriting results for 2006 benefited

from $360 million of net gains in property and aviation lines of business and the lack of catastrophe losses. Partially offsetting

these gains were $114 million in net losses in casualty business, including costs associated with the finite risk business regulatory

investigations. Underwriting results for both 2005 and 2004 included catastrophe losses from the U.S. hurricanes of $205

million and $110 million, respectively. Additionally, 2005 results included $29 million in losses from windstorm Erwin.

Underwriting results for each of the last three years benefited from favorable results of the aviation and non-catastrophe property

businesses. The International property and casualty underwriting results included gains associated with prior accident years of

$235 million in 2006 compared with gains of $108 million in 2005 and losses of $102 million in 2004. Prior years’ losses in

2004 were primarily in motor excess, workers’ compensation and other casualty lines and increases for operations placed in run-

off.

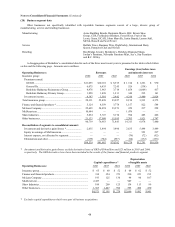

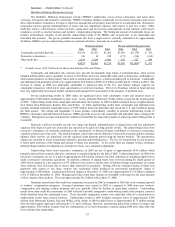

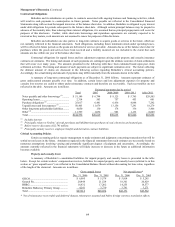

Life/health

Premiums earned in 2006 increased 3.0% over 2005, which increased 13.9% over 2004. Adjusting for the effects of

foreign currency, premiums earned increased 2.3% in 2006 and 14.2% in 2005. The increase in premiums earned in 2006 was

primarily from European life business and in 2005 was primarily due to an increase in both North American and European life

business.

The global life/health operations produced underwriting gains of $153 million in 2006, $111 million in 2005 and

$85 million in 2004. Both the U.S. and international life/health operations were profitable in each of the past three years

primarily due to favorable mortality; however, most of the gains were earned in the international life business. Additionally,

included in the underwriting results for 2006, 2005 and 2004 were $31 million, $66 million and $46 million, respectively, of net

losses attributable to reserve increases on certain U.S. health business in run-off.