Berkshire Hathaway 2006 Annual Report Download - page 10

Download and view the complete annual report

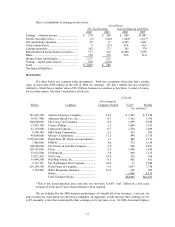

Please find page 10 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Eventually, the names came to include many thousands of people from around the world, who

joined expecting to pick up some extra change without effort or serious risk. True, prospective names were

always solemnly told that they would have unlimited and everlasting liability for the consequences of their

syndicate’ s underwriting – “down to the last cufflink,” as the quaint description went. But that warning

came to be viewed as perfunctory. Three hundred years of retained cufflinks acted as a powerful sedative

to the names poised to sign up.

Then came asbestos. When its prospective costs were added to the tidal wave of environmental

and product claims that surfaced in the 1980s, Lloyd’ s began to implode. Policies written decades earlier –

and largely forgotten about – were developing huge losses. No one could intelligently estimate their total,

but it was certain to be many tens of billions of dollars. The specter of unending and unlimited losses

terrified existing names and scared away prospects. Many names opted for bankruptcy; some even chose

suicide.

From these shambles, there came a desperate effort to resuscitate Lloyd’ s. In 1996, the powers

that be at the institution allotted £11.1 billion to a new company, Equitas, and made it responsible for

paying all claims on policies written before 1993. In effect, this plan pooled the misery of the many

syndicates in trouble. Of course, the money allotted could prove to be insufficient – and if that happened,

the names remained liable for the shortfall.

But the new plan, by concentrating all of the liabilities in one place, had the advantage of

eliminating much of the costly intramural squabbling that went on among syndicates. Moreover, the

pooling allowed claims evaluation, negotiation and litigation to be handled more intelligently than had been

the case previously. Equitas embraced Ben Franklin’ s thinking: “We must all hang together, or assuredly

we shall hang separately.”

From the start, many people predicted Equitas would eventually fail. But as Ajit and I reviewed

the facts in the spring of 2006 – 13 years after the last exposed policy had been written and after the

payment of £11.3 billion in claims – we concluded that the patient was likely to survive. And so we

decided to offer a huge reinsurance policy to Equitas.

Because plenty of imponderables continue to exist, Berkshire could not provide Equitas, and its

27,972 names, unlimited protection. But we said – and I’ m simplifying – that if Equitas would give us

$7.12 billion in cash and securities (this is the float I spoke about), we would pay all of its future claims and

expenses up to $13.9 billion. That amount was $5.7 billion above what Equitas had recently guessed its

ultimate liabilities to be. Thus the names received a huge – and almost certainly sufficient – amount of

future protection against unpleasant surprises. Indeed the protection is so large that Equitas plans a cash

payment to its thousands of names, an event few of them had ever dreamed possible.

And how will Berkshire fare? That depends on how much “known” claims will end up costing us,

how many yet-to-be-presented claims will surface and what they will cost, how soon claim payments will

be made and how much we earn on the cash we receive before it must be paid out. Ajit and I think the odds

are in our favor. And should we be wrong, Berkshire can handle it.

Scott Moser, the CEO of Equitas, summarized the transaction neatly: “Names wanted to sleep

easy at night, and we think we’ ve just bought them the world’ s best mattress.”

* * * * * * * * * * *

Warning: It’ s time to eat your broccoli – I am now going to talk about accounting matters. I owe

this to those Berkshire shareholders who love reading about debits and credits. I hope both of you find this

discussion helpful. All others can skip this section; there will be no quiz.

Berkshire has done many retroactive transactions – in both number and amount a multiple of such

policies entered into by any other insurer. We are the reinsurer of choice for these coverages because the

obligations that are transferred to us – for example, lifetime indemnity and medical payments to be made to

injured workers – may not be fully satisfied for 50 years or more. No other company can offer the certainty

9