Berkshire Hathaway 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

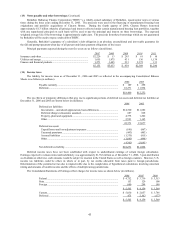

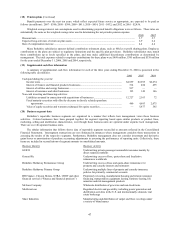

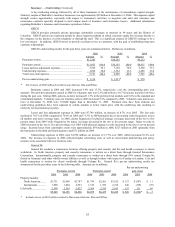

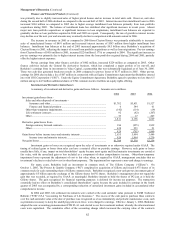

(22) Quarterly data

A summary of revenues and earnings by quarter for each of the last two years is presented in the following table. This

information is unaudited. Dollars are in millions, except per share amounts.

1

s

t2nd 3rd 4th

2006 Quarter Quarter Quarter Quarter

Revenues.............................................................................................................. $22,763 $24,185 $25,360 $26,231

N

et earnings *...................................................................................................... 2,313 2,347 2,772 3,583

N

et earnings per equivalent Class A common share............................................ 1,501 1,522 1,797 2,323

2005

Revenues.............................................................................................................. $17,634 $18,128 $20,533 $25,368

N

et earnings *...................................................................................................... 1,363 1,449 586 5,130

N

et earnings per equivalent Class A common share............................................ 886 941 381 3,330

* Includes investment and derivative gains/losses, which, for any given period have no predictive value and variations in amount

from period to period have no practical analytical value in view of the unrealized appreciation in Berkshire’s investment

portfolio. Net earnings in the third quarter of 2005 include a pre-tax underwriting loss of $3.0 billion ($1.95 billion after-tax)

related to Hurricanes Katrina and Rita which struck the Gulf coast region of the United States. Net earnings in the fourth

quarter of 2005 include a non-cash pre-tax gain of $5.0 billion ($3.25 billion after-tax) which arose from the exchange of

Gillette common stock for Procter & Gamble common stock. After-tax investment and derivative gains/losses for the periods

presented above are as follows (in millions):

1

s

t

2

nd

3

rd

4

th

Quarter Quarter Quarter Quarter

I

nvestment and derivative gains/losses – 2006 ................................................... $526 $294 $174 $ 715

I

nvestment and derivative gains/losses – 2005 ................................................... (77) (160) 480 3,287

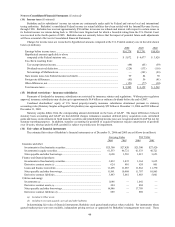

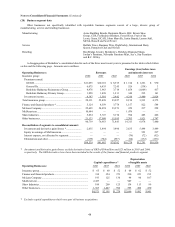

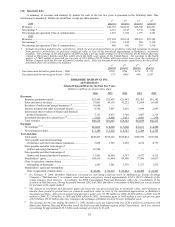

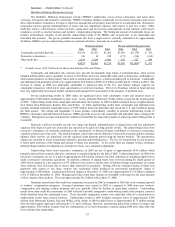

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Selected Financial Data for the Past Five Years

(dollars in millions except per share data)

2006 2005 2004 2003 2002

Revenues:

Insurance premiums earned.................................................... $23,964 $21,997 $21,085 $21,493 $19,182

Sales and service revenues ..................................................... 51,803 46,138 43,222 32,098 16,958

Revenues of utilities and energy businesses (1) ....................... 10,644 — — — —

Interest, dividend and other investment income ..................... 4,382 3,487 2,816 3,098 2,943

Interest and other revenues of finance and financial

products businesses .............................................................

5,111

4,633

3,788

3,087

2,314

Investment and derivative gains/losses (2)............................... 2,635 5,408 3,471 4,083 838

Total revenues ........................................................................ $98,539 $81,663 $74,382 $63,859 $42,235

Earnings:

Net earnings (2) (3).................................................................... $11,015 $ 8,528 $ 7,308 $ 8,151 $ 4,286

Net earnings per share ............................................................ $ 7,144 $ 5,538 $ 4,753 $ 5,309 $ 2,795

Year-end data:

Total assets ............................................................................. $248,437 $198,325 $188,874 $180,559 $169,544

Notes payable and other borrowings

of insurance and other non-finance businesses.................... 3,698 3,583 3,450 4,182 4,775

Notes payable and other borrowings of

utilities and energy businesses (1) ........................................ 16,946 — — — —

Notes payable and other borrowings of

finance and financial products businesses........................... 11,961 10,868 5,387 4,937 4,513

Shareholders’ equity............................................................... 108,419 91,484 85,900 77,596 64,037

Class A equivalent common shares

outstanding, in thousands .................................................... 1,543 1,541 1,539 1,537 1,535

Shareholders’ equity per outstanding

Class A equivalent common share ...................................... $ 70,281 $ 59,377 $ 55,824 $ 50,498 $ 41,727

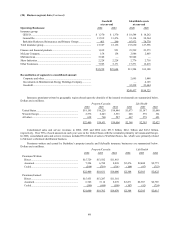

(1) On February 9, 2006, Berkshire Hathaway converted its non-voting preferred stock of MidAmerican Energy Holdings

Company (“MidAmerican”) to common stock and upon conversion, owned approximately 83.4% (80.5% diluted) of the

voting common stock interests. Accordingly, the 2006 Consolidated Financial Statements reflect the consolidation of the

accounts of MidAmerican. During the period between 2002 and 2005, Berkshire’s investment in MidAmerican was accounted

for pursuant to the equity method.

(2) The amount of investment and derivative gains and losses for any given period has no predictive value, and variations in

amount from period to period have no practical analytical value in view of the unrealized appreciation in Berkshire's

investment portfolio. After-tax investment and derivative gains were $1,709 million in 2006, $3,530 million in 2005, $2,259

million in 2004, $2,729 million in 2003 and $566 million in 2002. Investment gains in 2005 include a non-cash pre-tax gain

of $5.0 billion ($3.25 billion after-tax) relating to the exchange of Gillette stock for Procter & Gamble stock.

(3) Net earnings for the year ending December 31, 2005 includes a pre-tax underwriting loss of $3.4 billion in connection with

Hurricanes Katrina, Rita and Wilma that struck the Gulf coast and Southeast regions of the United States. Such loss reduced

net earnings by approximately $2.2 billion and earnings per share by $1,446.