Berkshire Hathaway 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

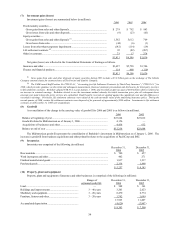

(1) Significant accounting policies and practices (Continued)

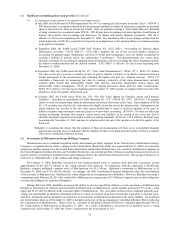

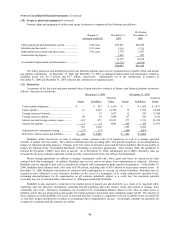

(h) Property, plant and equipment (Continued)

Property, plant and equipment is evaluated for impairment when events or changes in circumstances indicate that the

carrying value of the assets may not be recoverable, or the assets meet the criteria of held for sale. Upon the

occurrence of a triggering event, the asset is reviewed to assess whether the estimated undiscounted cash flows

expected from the use of the asset plus residual value from the ultimate disposal exceeds the carrying value of the

asset. If the carrying value exceeds the estimated recoverable amounts, the asset is written down to the estimated

discounted present value of the expected future cash flows from using the asset. Impairment losses are reflected in

the Consolidated Statements of Earnings, except with respect to impairments of assets of certain domestic regulated

utility and energy subsidiaries where losses are offset by the establishment of a regulatory asset to the extent

recovery in future rates is probable.

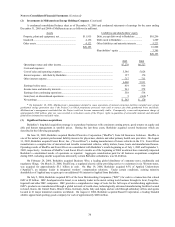

(i) Goodwill

Goodwill represents the difference between purchase cost and the fair value of net assets acquired in business

acquisitions. Goodwill is tested for impairment using a variety of methods at least annually and impairments, if any,

are charged to earnings. Key assumptions used in the testing include, but are not limited to, the use of an

appropriate discount rate and estimated future cash flows. In estimating cash flows, the Company incorporates

current market information as well as historical factors.

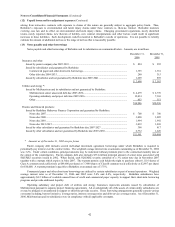

(j) Revenue recognition

Insurance premiums for prospective property/casualty insurance and reinsurance and health reinsurance policies are

earned in proportion to the level of insurance protection provided. In most cases, premiums are recognized as

revenues ratably over the term of the contract with unearned premiums computed on a monthly or daily pro rata

basis. Premiums for retroactive reinsurance property/casualty policies are earned at the inception of the contracts.

Premiums for life reinsurance contracts are earned when due.

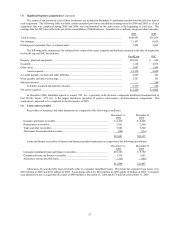

Premiums earned are stated net of amounts ceded to reinsurers. Premiums are estimated with respect to certain

reinsurance contracts written during the period where reports from ceding companies for the period are not

contractually due until after the balance sheet date. For policies containing experience rating provisions, premiums

are based upon estimated loss experience under the contract.

Sales revenues derive from the sales of manufactured products and goods acquired for resale. Revenues from sales are

recognized upon passage of title to the customer, which generally coincides with customer pickup, product delivery

or acceptance, depending on terms of the sales arrangement.

Service revenues derive primarily from pilot training and flight operations and flight management activities. Service

revenues are recognized as the services are performed. Services provided pursuant to a contract are either

recognized over the contract period, or upon completion of the elements specified in the contract, depending on the

terms of the contract.

Interest income from investments in bonds and loans is earned under the constant yield method and includes accrual of

interest due under terms of the bond or loan agreement as well as amortization of acquisition premiums and

accruable discounts. In determining the constant yield for mortgage-backed securities, anticipated counterparty

prepayments are estimated and evaluated periodically. Dividends from equity securities are earned on the ex-

dividend date.

Operating revenue of utilities and energy businesses resulting from the distribution and sale of natural gas and electricity

to customers is recognized when the service is rendered or the energy is delivered. Amounts recognized include

unbilled as well as billed amounts. Rates charged are generally subject to Federal and state regulation or established

under contractual arrangements. When preliminary rates are permitted to be billed prior to final approval by the

applicable regulator, certain revenue collected may be subject to refund and a provision for estimated refunds is

accrued.

Commission revenue from real estate brokerage transactions and related amounts due to agents which are included as

components of operating revenues and expenses of utilities and energy businesses are recognized when a real estate

transaction is closed.

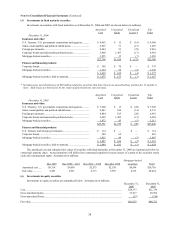

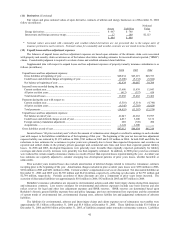

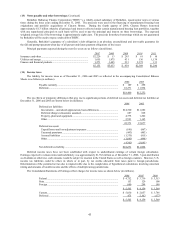

(k) Losses and loss adjustment expenses

Liabilities for unpaid losses and loss adjustment expenses represent estimated claim and claim settlement costs of

property/casualty insurance and reinsurance contracts with respect to losses that have occurred as of the balance

sheet date. The liabilities for losses and loss adjustment expenses are recorded at the estimated ultimate payment

amounts, except that amounts arising from certain workers’ compensation reinsurance business are discounted as

discussed below. Estimated ultimate payment amounts are based upon (1) individual case estimates, (2) reports of

losses from policyholders and (3) estimates of incurred but not reported (“IBNR”) losses.

Provisions for losses and loss adjustment expenses are reported in the accompanying Consolidated Statements of

Earnings after deducting amounts recovered and estimates of amounts recoverable under reinsurance contracts.

Reinsurance contracts do not relieve the ceding company of its obligations to indemnify policyholders with respect

to the underlying insurance and reinsurance contracts.